Cards

PagBank Card or Access Card: which one is better?

If you are looking for a card with no proof of income and that also does not consult credit protection agencies, such as SPC and SERASA, then you are looking for the PagBank card or the Acesso card. To know a little more about them, read this post and check it out!

Advertisement

PagBank x Access: find out which one to choose

If you are looking for a card with international coverage, no proof of income, a customer benefit program and several other benefits, the Pagbank card or the Acesso card may be the alternative you are looking for.

That's why, today, we're going to show you everything about these two cards so that you can choose the option that best suits your needs. Follow!

How to apply for Pagbank card

If you liked the functionalities and advantages of the Pagbank prepaid card, find out right now how to apply without bureaucracy.

How to Apply for a Credit Card

Requesting your Access credit card is very easy and simple. See how it works!

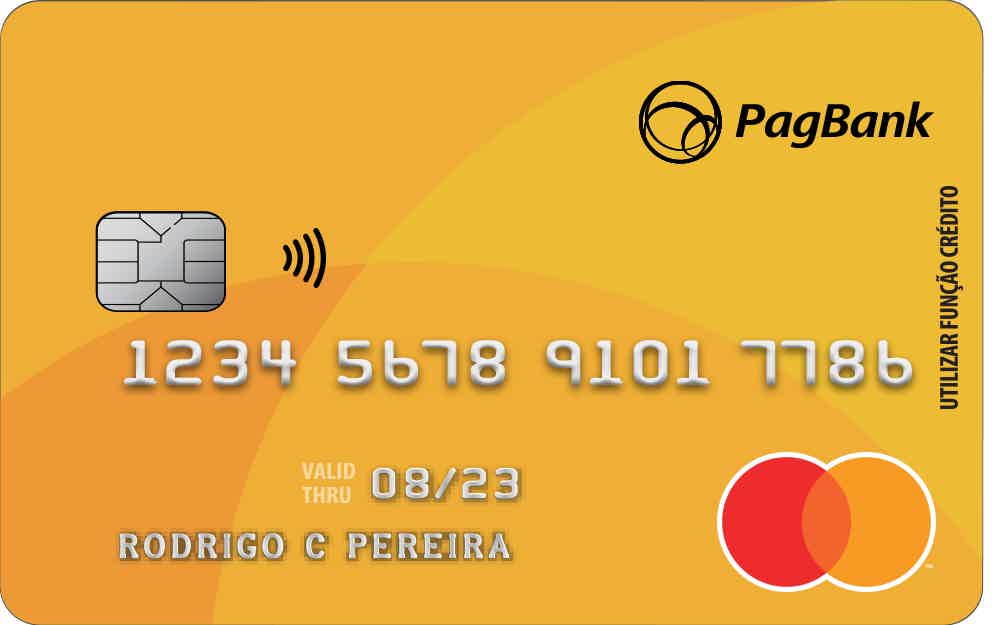

| Pagbank | Access | |

| Minimum Income | not required | not required |

| Annuity | Exempt | 12x of R$ 5.95 |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Spending only from the balance available on the card Card recharge through account balance, bank slip, deposit or online debit Digital and streaming services Exclusive discounts and perks | Exemption from annuity when there is no balance Mastercard Surprise |

PagBank card

So, the PagBank card is a card that works in prepaid mode, but as if it were a credit card.

This is because, when inserting it into the card machines, you will choose the credit mode, but it will immediately discount it as if it were a debit.

And, in addition, for you to be able to use the card, you need to have an available balance, that is, to use it frequently, you need to recharge it.

In addition, it is a totally free international card with the Mastercard brand, which is why it has several advantages for customers, such as access to the Mastercard Surpreenda program.

Thus, to request the card, just install the application, open an account at PagBank and make the request.

Therefore, the Pagbank card is a financial product that has several advantages for customers, including the possibility of having control of finances through the application.

Access Card

Well, the Acesso card is a prepaid financial product that needs to be recharged to be used, that is, you use it in the credit function, but it works as if it were a debit card.

So, to use the card to make purchases, you need to have an available balance, otherwise you won't be able to use it.

And, in addition, the card has a Mastercard brand and is international, that is, you can shop in national and international stores, as well as having access to all the advantages of the brand.

In addition, you have the Access card application, which is available for Android and iOS. Through it, it is possible to access the function to charge the cell phone and the transport ticket, as well as you can follow all the movements of your card.

What are the advantages of the PagBank card?

Therefore, the PagBank card has several advantages for users, such as international coverage, which you can use to make purchases in national or foreign stores.

And, in addition, you do not need to provide proof of income or pay annuity. And you can also take advantage of the Mastercard Surprise Program. Therefore, the Pagbank card has several advantages for its customers.

What are the advantages of the Access card?

Well then, the Acesso card has several advantages, such as the absence of proof of income and consultation with credit protection agencies, being a great alternative for negatives.

And, in addition, despite charging a management fee of R$5.95 per month, this amount is not deducted from your account if it is zero.

In addition, the card has international coverage, that is, you can shop in national or foreign stores, having access to a wide variety of establishments.

It also has a Mastercard brand that offers access to all the benefits of the brand, such as the Mastercard Surpreenda program. As well as you can receive and transfer money to any bank.

What are the disadvantages of the PagBank card?

So, one of the biggest disadvantages of the PagBank card is the charge for withdrawals made by the bank in the amount of R$7.50. As well as the impossibility of paying for purchases in installments due to the fact that it works as a prepaid card.

And, in addition, you need to have a balance to use the card, that is, if you need to make a quick purchase or pay a bill and you don't have a balance, the card will not be useful to you at an important moment. So, before opting for this card, look at the disadvantages it presents.

What are the disadvantages of the Access card?

Well, despite having several advantages, the Acesso card also has some disadvantages, for example, the impossibility of paying for purchases in installments.

And, in addition, to use the Acesso card, as well as the Pagbank card, you need to have a balance to be able to make purchases.

Furthermore, you also need to pay a card management fee to use the services. Therefore, before opting for the Access card, see if these disadvantages can be a hindrance.

PagBank Card or Access Card: which one to choose?

So, the PagBank card or the Acesso card, as you can see, have a unique proposal for negatives, because the two cards do not consult with credit protection agencies, such as SPC or SERASA. So if you're negative looking for a card option, they can be a great alternative.

But if you still have doubts, check out another card comparison in the recommended content below.

Saraiva card or Pan card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Havan Card or Neon Card: which is better?

Find out about credit options that appeal to different audiences. So, read this post choose between Havan card or Neon card.

Keep Reading

What is the entry fee for Casa Verde e Amarela?

Do you know the entry fee for Casa Verde e Amarela? Find out here how the down payment and the reduction in interest rates work.

Keep Reading

Mercado Pago Card or BMG Card: which one to choose?

Either the Mercado Pago card or the BMG card, both have international coverage and exclusive benefit programs. Check it out here!

Keep ReadingYou may also like

CGD cards: what are they and how to choose the best one?

CGD cards offer several benefits, such as a points program, brand benefits, personal accident insurance, shopping insurance, travel assistance and more. For more information about card options, just continue reading the article.

Keep Reading

Porto Seguro Card or Itaucard Blue Card: which one is better?

If you are looking for cards to organize your financial life or to count on in times of emergency, the Porto Seguro card or Azul Itaucard are great options. Want to know more about them and their main features? So, read the post!

Keep Reading

Discover the Hipercard Internacional credit card

Meet Hipercard Internacional, which requires a minimum income of only R$800 reais and gives you several discounts on supermarket purchases. Read in full below!

Keep Reading