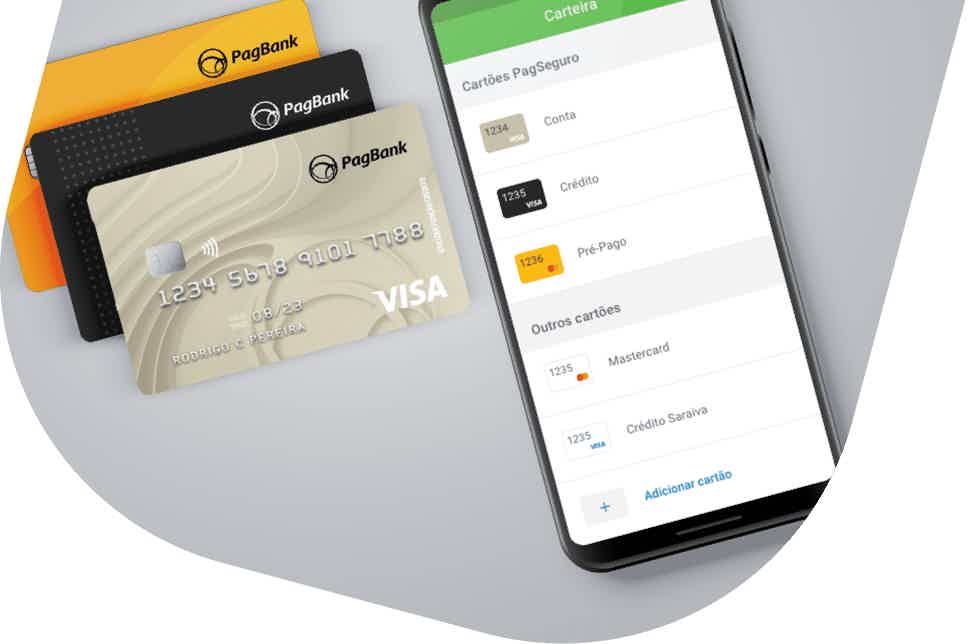

Cards

How to apply for PagBank card

Apply for your credit card with no annual fee and with a limit of 100% of your salary or up to R$ 100,000 if you have an application in the CDB. See now how to acquire your PagBank card and have your financial independence.

Advertisement

PagBank: apply for your credit card online

First, applying for the PagBank card is a great option for those starting out in financial life. Being a simple option for you to create your financial autonomy. That's because it is international with a Visa flag. That way, you can do your day-to-day shopping, as well as consume products and services abroad.

Also, do you want to know how to apply for your PagBank card? So, read on and check it out!

Order online

To apply online, just enter the official PagBank website and open an account. After that, you need to wait for the offer made available by the institution to apply. So, it is possible to speed up this process, if you port your salary to the account or make an investment in the CDB. After receiving the offer, just access the app and request the card.

Request via phone

If you prefer, you can also find out about PagBank products by phone at the numbers below, but the request process can only be done via the website or the app.

- 4003 1775 (capitals and metropolitan areas);

- 0800 882 1100 (other locations, except mobile).

Request by app

To purchase your PagBank card through the app, just download the PagBank app and open your account. Then, you must wait for the offer and go through the request process according to the step-by-step instructions given by the application itself.

Santander SX card or PagBank card: which one to choose?

Are you still in doubt if the PagBank card is right for you? So, check now the differences between PagBank and the Santander SX card. Also, compare them and choose the best option!

| Santander SX | PagBank | |

| Annuity | 12x of R$33.25 Exempt if you spend R$ 100 per month or if you join the PIX system | Exempt |

| minimum income | R$ 1,045.00 for non-account holders R$ 500.00 for account holders | not informed |

| Flag | Visa or Mastercard | Visa |

| Roof | International | International |

| Benefits | Benefits of the flag; Discounts with Esfera partners. | Vai de Visa Program; High credit limit. |

How to apply for the Santander SX card

Find out how to apply for your Santander SX card online and enjoy its advantages, such as discounts with partners, exclusive installments and much more!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the OpaPay Mastercard credit card

Do you want to know how to apply for your OpaPay Mastercard credit card and be able to benefit from it once and for all? Find out right now!

Keep Reading

Loan for negative employee debit account

Get a loan even if you are negative. Discover in this article the loan for salaried negatives and get out of debt!

Keep Reading

How to find the best mason jobs

See the best mason vacancies and find out how to apply for different vacancies and be quickly approved in a selection process.

Keep ReadingYou may also like

Discover the benefits of the Sicredi Black card

Do you love to travel? Then learn how to accumulate up to 2.2 points for every dollar spent on purchases and use them on airline tickets, as well as hotel rates.

Keep Reading

How to apply for the Santander Business Credit Card

Applying for the Santander Business Credit Card is the first step to optimizing your business finances. Discover how to obtain financial flexibility and exclusive benefits for your business.

Keep Reading

Discover the Bankinter Gold card

The Bankinter Gold card has a credit limit of up to €30,000 for purchases, payments to the state and transfers. See more information about this card here and find out if it's right for you.

Keep Reading