Cards

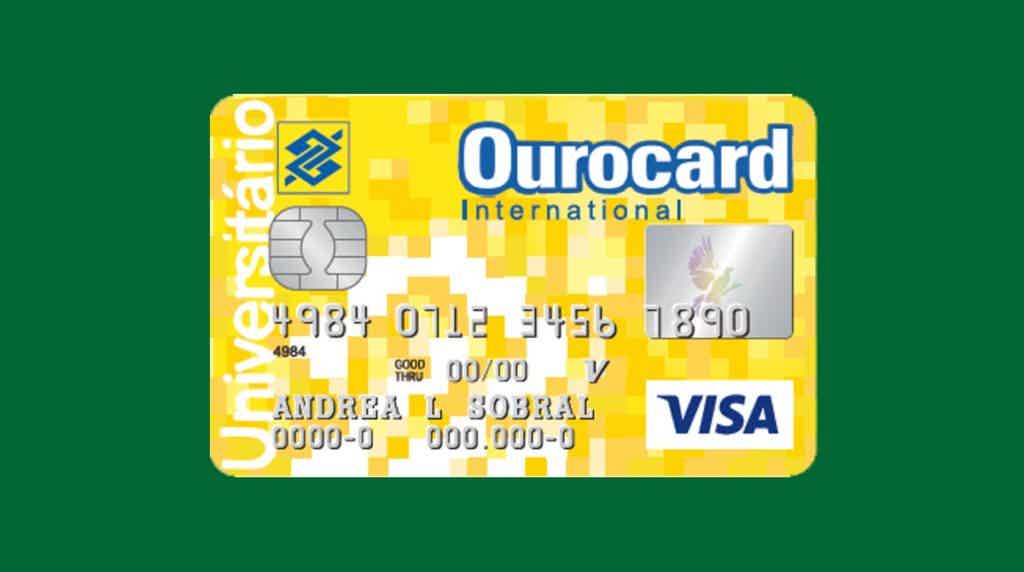

Ourocard Universitário Card or Superdigital Card: which one to choose?

Choose between the Ourocard Universitário card or the Superdigital card to shop around the world and enjoy special discounts at partner stores. Check out!

Advertisement

Ourocard Universitário x Superdigital: find out which one to choose

If you can't decide between the Ourocard Universitário card or the Superdigital card, we can help you!

Today, we are going to compare these two financial products and show you the pros and cons of each. Thus, you can choose which is the best option for your financial life with all the information at hand.

So, while the Ourocard Universitário card seeks to cater to the student public, the Superdigital card is perfect for those who want to have greater control over expenses and finances.

Therefore, read on to learn more about each card and make the best decision according to your needs. So let's go?

How to apply for a Ourocard Universitário card

The Ourocard Universitário card is an alternative for undergraduate students. It waives proof of income and offers free annuity. See how to order!

How to apply for the Superdigital credit card

If you are looking for a card with a digital account that accepts negative payments, the Superdigital card may be ideal. See how to order yours!

| Ourocard Universitário | Superdigital | |

| minimum income | not required | not required |

| Annuity | No annuity | No annuity |

| Flag | Visa | MasterCard |

| Roof | International | International |

| Benefits | Pre-approved limit of R$ 1,500.00, Goes from Visa | Mastercard Surpreenda, Santander Esfera |

Ourocard University Card

Well, thinking about making life easier for students and offering them more financial freedom, Banco do Brasil created the Ourocard Universitário card.

So, if you are enrolled in a higher level course and are between 16 and 28 years old, the card can be a great option.

Thus, the financial product has national and international coverage so that you can make purchases all over the world in a very practical and uncomplicated way. In addition, it has the Visa flag, one of the most recognized in the market.

Another feature of the card is that you do everything through the app. In this way, it is possible to order the product and control your finances directly through the app, which is available for both Android and iOS systems. That way, everyday life gets a lot easier, don't you think?

Furthermore, Banco do Brasil understands that many students still do not have the opportunity to work while they are in higher education. Therefore, you do not need to prove income and the annual fee for the card is free. Therefore, this is a great opportunity to become the protagonist of your financial life.

Superdigital Card

The Superdigital card is a great choice for those who want to have more control over their finances. That's because it works in prepaid mode and you need to top up before using it. Thus, it is only possible to spend the amount available in the balance and not have to worry about having the account in the red.

In addition, it is issued by Banco Santander, one of the best known institutions in the market. So, you know you are hiring a reliable and quality product to enjoy all its benefits.

Another feature of the card is that it has international coverage for you to make purchases in Brazil and abroad, both in physical stores and online. Furthermore, its Mastercard brand is one of the most accepted worldwide, with thousands of accredited stores.

In addition, you have two types of card: physical and virtual. This way, your shopping becomes much easier and you don't miss out on any offers! In addition, you can withdraw money from ATMs in the Banco24Horas network.

What are the advantages of the Ourocard Universitário card?

Undoubtedly, the Ourocard Universitário card arrived to bring more autonomy to higher education students.

Thus, it already comes with a pre-approved limit of R$ 1,500.00 for you to use however you prefer. But don't forget to do financial planning to avoid unnecessary spending and even debt.

In addition, your flag allows you to participate in the Vai de Visa program. This way, you can take advantage of special offers on products and services from partner establishments, such as Marisa, Decolar, Domino's and many others!

In addition, the card is a modern product, which seeks to facilitate the daily lives of its users. So, you can make purchases using contactless payment technology. So, you must bring your Ourocard wristband or card to the machine and the transaction is complete. Very practical, isn't it? That way you don't have to enter the password and the payment is much more secure.

Finally, Banco do Brasil knows that a student's life is very tiring. So you can take advantage of exclusive offers and promotions on sporting, cultural and entertainment events sponsored by the bank. That way, you can have fun when you're off and even pay less for it!

What are the advantages of the Superdigital card?

Well, as the card is issued by Santander, you have access to an exclusive program: Santander Esfera. With it, you accumulate points and exchange them for special discounts on products, services and even trips!

In addition, you can participate in another incredible rewards program offered by the brand, Mastercard Surpreenda. Thus, with each purchase made with your card, you receive 1 point to exchange for exclusive offers at partner stores, such as Outback, Asics, Arezzo and much more.

Another positive point of the financial product is that you can apply even if you have a dirty name. This is because credit protection bodies are not consulted. So this is quite an opportunity, isn't it?

In addition, you control the movement of your digital account through the application. Thus, it is much easier to check the statement, make payments and transfers and several other functions.

What are the disadvantages of the Ourocard Universitário card?

So, as the card is aimed at a specific audience, one of the negative points is that not everyone can apply for one and enjoy the benefits.

Thus, you must be of the required age and be studying at a higher level. Furthermore, if you lose this condition, the bank can modify your card type.

Another disadvantage is that the Ourocard wristband for approximation payments costs R$ 40.00. So, although it is a very practical way of shopping, you should analyze whether the value is worth it. However, the product is optional and you can use the technology normally with just your card.

What are the disadvantages of the Superdigital card?

So, although the prepaid function is a good way to control expenses, it can end up being a negative point, since purchases have to be made in cash. Thus, it is not the best option for those who want to make purchases in installments.

In addition, the card also charges some fees for certain operations. For example, you pay R$ 5.90 for transfers to other banks and R$ 6.40 for domestic withdrawals on the Banco24Horas network. Therefore, be aware of all the conditions of the card so that you do not have any surprises when using it.

Ourocard Universitário card or Superdigital card: which one to choose?

Now that you know better about the two financial products, it's easier to make a decision, isn't it? So, Ourocard Universitário card or Superdigital card?

Thus, both have international coverage, but each has its own flag. In addition, they bring several benefits to their customers. Therefore, review the pros and cons of cards to choose the best option for your needs.

And if you're still in doubt about which decision to make, don't worry! That's why we made an exclusive comparison so you can find out more about two cards full of advantages that are available on the market. So check out our recommended content below and learn more!

Hipercard card or Pernambucanas card?

Hipercard card or Pernambucanas card: do you know which one is the best option? They offer exclusive discounts and can serve different audiences. Compare here!

Trending Topics

Lanistar Card or Santander SX Card: which is better?

Know which to choose between Lanistar card or Santander SX card. Here we will show you the main differences and advantages. Read and check!

Keep Reading

How to apply for a Di Santinni card

Find out about the advantages of the Di Santinni card. They include exclusive discounts, promotions and conditions. Want to order yours? Check out the process here!

Keep Reading

Beware of payroll loan scam

Getting the loan is an excellent option for those who need money. But, there are many scams in time. So know how not to fall

Keep ReadingYou may also like

How to apply for a loan with a property guarantee Creditas

The Creditas secured loan is a great option for those who want credit with lower fees and a higher limit. To learn more about and see how to do the simulation, just continue reading the article!

Keep Reading

Digio Card or Caixa SIM Card: which one is better?

It's never been so easy to have your financial life under control, you know? Nowadays, we have several tools to help us organize our money and also cards that make your purchases and transactions much safer. The Digio card and the Caixa SIM card are two ideal options for looking for this organization and more convenience, wherever you are. So, learn more about it here!

Keep Reading

How to apply for the C6 Acqua card

Check now how to get the C6 Acqua card and start adopting a lifestyle that is more concerned with the planet through a biodegradable payment method. Learn more right now.

Keep Reading