Cards

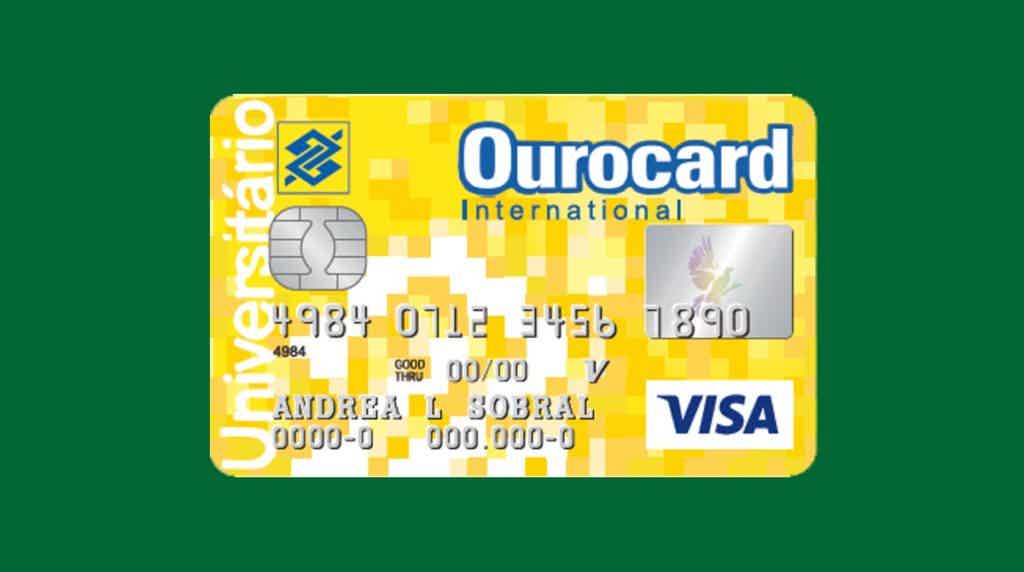

Ourocard Universitário Card or Magalu Card: which one to choose?

Either the Ourocard Universitário card or the Magalu card, both have ZERO annuity, Visa brand and international coverage. However, they have different advantages and disadvantages. So, read this post and compare.

Advertisement

Ourocard Universitário x Magalu: find out which one to choose

Are you in doubt between the Ourocard Universitário card or the Magalu card? So, no need to worry anymore! Today, we're going to tell you more about these two amazing financial products.

Thus, both cards have international coverage and the Visa flag so you can make purchases in Brazil and around the world in an uncomplicated and easy way.

However, the Magalu card offers several exclusive offers in its stores, while the Ourocard Universitário already comes with a pre-approved limit of R$ 1,500.00.

So, if you want to know even more about these two financial products, check out the exclusive table we've prepared with the main features of each one.

And keep reading to learn about their pros and cons, as well as find out which one best fits your financial needs. Let's go?

How to apply for a Ourocard Universitário card

The Ourocard Universitário card is an alternative for undergraduate students. It waives proof of income and offers free annuity. See how to order!

How to apply for the Magalu Card

Learn how to apply for the Magalu card, the Magazine Luiza network card, ideal for shopping on Magalu websites and in the app with various discounts! Check out!

| Ourocard Universitário | Magalu | |

| minimum income | not required | R$ 800.00 |

| Annuity | No annuity | No annuity |

| Flag | Visa | Visa |

| Roof | International | International |

| Benefits | Pre-approved limit of R$ 1,500.00, without proof of income | Exclusive discounts and offers on Magalu, cashback program |

Ourocard University Card

So, Banco do Brasil launched the Ourocard Universitário card to serve higher education students who are looking for financial freedom.

Thus, if you are between 16 and 28 years old and are studying at a higher level, the card may be a good option for your financial life. However, if you are under 18 years of age, you will need your legal guardian's authorization to apply for the card.

In addition, the card has international coverage and the Visa flag, one of the most recognized worldwide. This way, you can shop domestically and abroad and also enjoy the benefits of the brand, such as the Vai de Visa program, which offers special discounts at partner services and stores.

In addition, the card offers another very interesting feature, designed especially for its audience. So, as many students still don't work because of their studies, you don't need to prove income or pay an annuity fee! This is a great opportunity to become the protagonist of your financial life, isn't it?

Magalu card

Well, the Magazine Luiza chain of stores launched the Magalu card to make life easier for its customers and offer various benefits and exclusive discounts.

So, the card can be the ideal option for those who want to shop in Brazil and abroad, as it has international coverage. In addition, you can still use it both in physical stores and online so you don't miss any offers!

Another feature of the card is its Visa flag, which is accepted in thousands of establishments around the world, in addition to offering the Vai de Visa program to its users.

In addition, the card is modern and brings many facilities. Thus, you control your finances through the app and do all the operations with just a few taps. This way, you can follow the invoice and check the card limit, in addition to making transfers and payments quickly and easily.

What are the advantages of the Ourocard Universitário card?

So, one of the advantages of the card is that it already comes with a pre-approved limit of R$ 1,500.00 for you to use according to your needs.

In addition, you get exclusive discounts and take advantage of promotions at entertainment, sports and cultural events sponsored by Banco do Brasil. So, in addition to studying, you can also relax and have fun paying less for it!

Another positive point is that you don't need to have a Banco do Brasil account to apply for your card. Thus, you can enjoy a quality product, but without worrying about opening an account, if you are an account holder at another institution.

In addition, the card is modern and practical. Thus, you finalize your debit or credit purchases with the approach payment technology using your Ourocard card or wristband.

What are the advantages of the Magalu card?

Well, one of the positive points of the card is that it offers an exclusive cashback program for Magazine Luiza customers. Thus, when making purchases through the app, website or physical store, you get 2% of the value back. So, after shopping, the money is available in your MagaluPay digital wallet within 20 days. Amazing, isn't it?

In addition, you can take advantage of several discounts at Magazine Luiza that are exclusive to those who make purchases using the Magalu card. And you can also pay for purchases in up to 24 installments in stores and on the website.

Another advantage of the card is that it does not charge an annual fee. That way, you save a little money and don't have to worry about this type of fee.

In addition, it offers approximation payment technology. So, to make your purchases, you must bring the card to the machine and the transaction is complete. A much simpler and safer way, as you don't need to use the password in physical stores.

So, now that you know better the benefits of each card, how about knowing its negative points too? Thus, it is possible to make the best decision for your financial life with all the necessary information.

What are the disadvantages of the Ourocard Universitário card?

So, the Ourocard Universitário card has a specific audience and you need to comply with the conditions established by the bank. Therefore, you must be between 16 and 28 years old and enrolled in a higher level course to apply for your card.

Furthermore, if you cease to be part of this group, Banco do Brasil may change the modality of your card.

Another disadvantage is that there is a fee of R$ 40.00 when purchasing the Ourocard wristband to make contactless payments. But it is worth noting that the wristband is optional and you can use the technology using only your card.

What are the disadvantages of the Magalu card?

Well, one of the negative points is that many benefits offered by the card are directed to Magazine Luiza customers. So, if you don't shop at the store often, you won't take advantage of many of its exclusive discounts.

In addition, you must prove a minimum income of R$ 800.00 to apply for the card. So, if you do not fit this condition, the card may not be approved.

Ourocard Universitário Card or Magalu Card: which one to choose?

Now that you know the pros and cons of each card, do you know which one is the best choice for you? Ourocard Universitário card or Magalu card?

So, the two options are quite interesting, as they do not charge annuity and offer several facilities for your day to day life, such as payment by approximation.

However, the Ourocard Universitário card is focused on higher education students, while Magalu offers several promotions for those who are frequent customers of its stores.

Therefore, take your time to analyze each card to make the best decision for your current financial needs. Also, check all contracting conditions before ordering your financial product so you don't have any surprises.

But if you've come this far and you're still not sure which one to choose, don't worry! So, read our recommended content below to learn about two more amazing card options available on the market.

PagBank Card or Neon Card?

Be it the Pagbank card or the Neon card, both seek to offer quality services and have the Mastercard brand! Check out!

Trending Topics

Agibank 2022 personal loan review

In this review about the Agibank personal loan, learn about the service's characteristics, advantages, disadvantages and learn how to apply for yours.

Keep Reading

Inter Consigned Loan or C6 Consig Loan: which is better?

Do you know which one to choose between the Inter payroll loan and the C6 loan? In today's article we'll show you how to do this, check it out!

Keep Reading

How to open Nubank account

See how to open a Nubank account and guarantee advantages such as annuity exemption, unlimited transfers and automatic income!

Keep ReadingYou may also like

Real estate funds: how do they work?

Do you know what real estate funds are and how they work? Check out in this post all about this type of investment to find out if it's worth investing.

Keep Reading

How to apply for Millennium BCP car credit

Millennium BCP car credit is a great option for those who want to buy new cars with an extended payment period. To find out how to apply for credit and enjoy its benefits, just continue reading the article.

Keep Reading

How to use cashback from Nubank Ultravioleta?

Did you know that the Nubank Ultravioleta card entitles you to cashback on all purchases? So, check here all the details on how to use this benefit and, also, see how this money can yield in your Nuconta.

Keep Reading