Cards

Nubank Ultraviolet Card or Superdigital Card: which is better?

Decide between the Nubank Ultraviolet card or the Superdigital card. Both are different but have great benefits. Learn more here!

Advertisement

Nubank Ultraviolet x Superdigital: find out which one to choose

But, after all, why decide between the Nubank Ultraviolet card or the Superdigital card?

While the Nubank Ultravioleta card is focused on people with a clean name who want more security, convenience and savings on travel, the other option is for those with negative credit.

This means that the Superdigital card is prepaid and does not require a credit analysis or proof of income, that is, it gives back the opportunity to purchase in credit mode for people with a dirty name.

Therefore, the comparison between them will bring important answers for those who need to pay Netflix, Spotify and iFood, for example.

If you are curious, stay with us and follow this detailed comparison to choose the best credit card for you and, who knows, your family!

How to apply for the Nubank Ultravioleta card

A credit card made of metal that offers cashback with yields in CDI, a high limit and many other advantages. Check here how to apply.

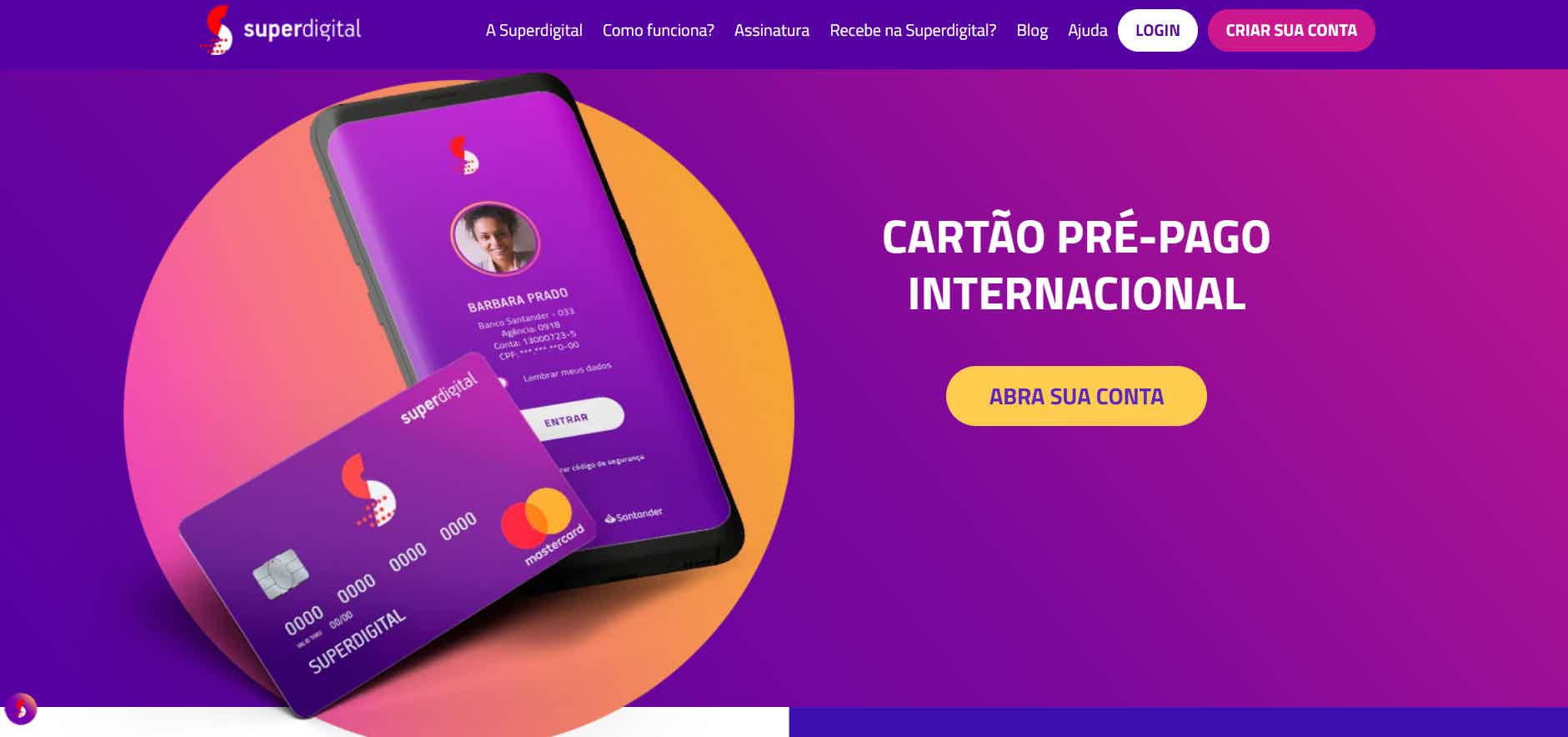

How to apply for the Superdigital credit card

You don't need to have a clean name to access this card with immediate approval, no annuity or any monthly fee. Check here how to apply.

| Nubank Ultraviolet Card | Superdigital Card | |

| Minimum Income | not required | not required |

| Annuity | Exempt | Exempt |

| Flag | Mastercard Black | MasterCard |

| Roof | International | International |

| Benefits | With a card made of metal and without numbers, the customer gains in security Each purchase generates cashback of 1% The returned money earns in the digital account Count on benefits for travel at airports and at chosen destinations | Pay for streaming services and international purchases Don't worry about any fees such as membership and annual fees Get up to 10 free additional cards Fast and hassle-free approval |

Nubank Ultraviolet Card

How about having a Nubank credit card with benefits that will bring you more security when traveling, but at the same time, comfort with access to VIP lounges at airports?

Eventually, it will be necessary to wait for flights in these places and using your card you will be able to have food, chargers, sockets and of course, a lot of comfort in these places.

In addition, this option has cashback on each purchase that yields 200% of the CDI annually if the returned amount remains in the account.

However, to take advantage of the benefits of the Nubank Ultravioleta card, the customer must pay a monthly fee of R$49.00 and also have access to the Mastercard Black brand.

This means that comprehensive health insurance is available in case of emergencies, which is very useful for family trips, isn't it? So, ask online and wait on an interest list!

Superdigital Card

Undoubtedly, negative customers end up facing many obstacles in order to be able to shop online or pay for subscriptions to Netflix or Globoplay, for example.

For this reason, prepaid cards provide credit without bureaucracy or rigorous document analysis, unlike the first option presented in our comparison.

So, the Superdigital card does not make queries at the SPC/Serasa, it offers a digital card with a free account and immediate approval, with an order placed over the internet.

Thus, you will be able to make purchases on the internet or on any international website through a frequent top-up, which becomes your credit limit, with no chance of paying in installments.

In addition, have up to ten additional free cards to create emergency reserves or offer children and teenagers to receive money for purchases, for example.

What are the advantages of the Nubank Ultraviolet card?

While the traditional Nubank card is more basic, this one offers cashback and many advantages for travelers, so check it out in detail below.

- Get access to Masterassist Black medical insurance for travel emergencies;

- Wait in VIP lounges, with free Wi-Fi and all airport food;

- The card is metal;

- The free monthly fee can be earned by spending a minimum of R$ 5,000 on the invoice.

What are the advantages of the Superdigital card?

In short, Superdigital customers never worry about monthly bills or fees that were not foreseen, so see some more benefits below.

- Have a free international credit card account;

- Don't worry about annuity or any fee, such as joining;

- Did you need credit? Try a loan through an agreement with the SIM network;

- Without charging anything extra, Superdigital offers transfers and payments;

- Pay Netflix or Globoplay subscriptions, as well as rental cars or apps.

What are the disadvantages of the Nubank Ultraviolet card?

Undeniably, the Nubank Ultraviolet card is less accessible than the traditional versions, of course, therefore, it requires a more rigorous credit analysis and the customer waits longer.

This means that when making the request, the customer is forwarded to an interest list, where the general financial history and with Nubank is seen in detail.

Finally, there is a monthly fee of R$49.00 to be paid, if the customer has a high monthly income and a credit limit that exceeds R$ 5 thousand, he can get rid of the fee, which also makes the card a little more directed to a specific audience.

What are the disadvantages of the Superdigital card?

Certainly, not having the chance to pay for purchases in installments is a disadvantage of prepaid cards, as they only work with a recharge to be made each time they are used.

Although it is a free card, many transactions on the Banco24h network are charged, such as the withdrawal, which costs R$6.40 each time the customer needs to withdraw deposited money.

Finally, even the issuance of balance and statement is paid, costing R$2.50 each time there is a printout.

Nubank Ultraviolet Card or Superdigital Card: which one to choose?

So, were you able to decide between the Nubank Ultraviolet card or the Superdigital card?

Just to exemplify, Nubank customers are more likely to be approved, as they have a financial history with the digital bank and constant transactions.

On the other hand, if you are negative, you will not be able to try unless you are already a Nubank customer before the negative, so it is worth taking a risk and waiting on the interest list.

Although negatives cannot have a credit card, the Superdigital card is a case that can be used for important and frequent payments, such as streaming services.

So that anyone can access it, it does not charge fees and does not consult with the SPC/Serasa, therefore, it is very useful for anyone over 16 years old.

Without further ado, don't worry if the information gathered here didn't lead to a decision, as below we have another interesting comparison. Just click and continue with us.

Atacadão card or Marisa card

More international brand credit card options that offer daily discounts in their stores, in addition to interest-free installments.

Trending Topics

How to enroll in Uninter courses

Learn in this article how to enroll in Uninter courses and find out if they ask for special requirements to be accessed by the public.

Keep Reading

Apps or websites: which is safer for financial transactions?

Apps or websites, which is more secure? You need to know how to guarantee the security of your transactions regardless of the access mode. Learn more here!

Keep Reading

How to apply for a cash loan

See how to apply for a Caixa loan without bureaucracy, safely and conveniently. In addition, it offers four types of credit with up to 48 months to pay.

Keep ReadingYou may also like

How to apply for the TudoAzul card

With the TudoAzul card, you have a 50% discount in cinemas and theaters, as well as participating in the TudoAzul points program. Find out how to apply below!

Keep Reading

Is it worth investing in Azul shares?

Are you thinking of investing in Azul? We tell you here in this post if this is a worthwhile investment or not. Continue reading to find out.

Keep Reading

PIS/PASEP 2022: those who did not receive the benefit can file an appeal

Those who fulfilled the requirements demanded by the Ministry of work in 2020 and still were not entitled to pay the Abono Salarial this year can file an administrative appeal for non-payment. Learn more below!

Keep Reading