Cards

Nubank Ultraviolet Card or Santander SX Card: which is better?

Find the ideal card for your profile by choosing between the Nubank Ultravioleta card or the Santander SX card, both have the possibility of waiving the annuity, a high limit and access for different audiences, so check it out!

Advertisement

Nubank Ultravioleta x Santander SX: find out which one to choose!

But, after all, why choose between the Nubank Ultravioleta card or the Santander SX card?

In short, the Nubank Ultraviolet card is ideal for those who like to save money and have more comfort when traveling, in addition to an advanced version of the roxinho card with many more advantages.

On the other hand, the Santander SX card requires a minimum income and does not charge any annuity or monthly fee, subject to minimum expenses on the bill, and requested via the internet.

This means that we are going to compare both, so that you can decide which one is ideal for your financial situation, namely that you can make purchases using credit at any national or international store.

How to apply for the Nubank Ultravioleta card

A card with a low monthly fee, numerous travel-related benefits and cashback that earns money straight into your account!

How to apply for the Santander SX card

An ideal card for people looking for a practical option for a financial product with a high limit, possibility of free annuity and much more!

| Nubank Ultraviolet Card | Santander SX Card | |

| Minimum Income | not required | R$ 500.00 for account holders R$ 1,045.00 for non-account holders |

| Annuity | Exempt | 12x of R$ 33.25 |

| Flag | Mastercard Black | Visa Gold/Mastercard Gold |

| Roof | International | International |

| Benefits | With cashback, get cash back on every purchase Get access to health insurance and warranty on purchases Pay no monthly fee with minimum spending | With Santander Pass, you pay with proximity without the card Don't pay annuity with minimum spending Withdraw money from your credit card and only pay when the invoice arrives |

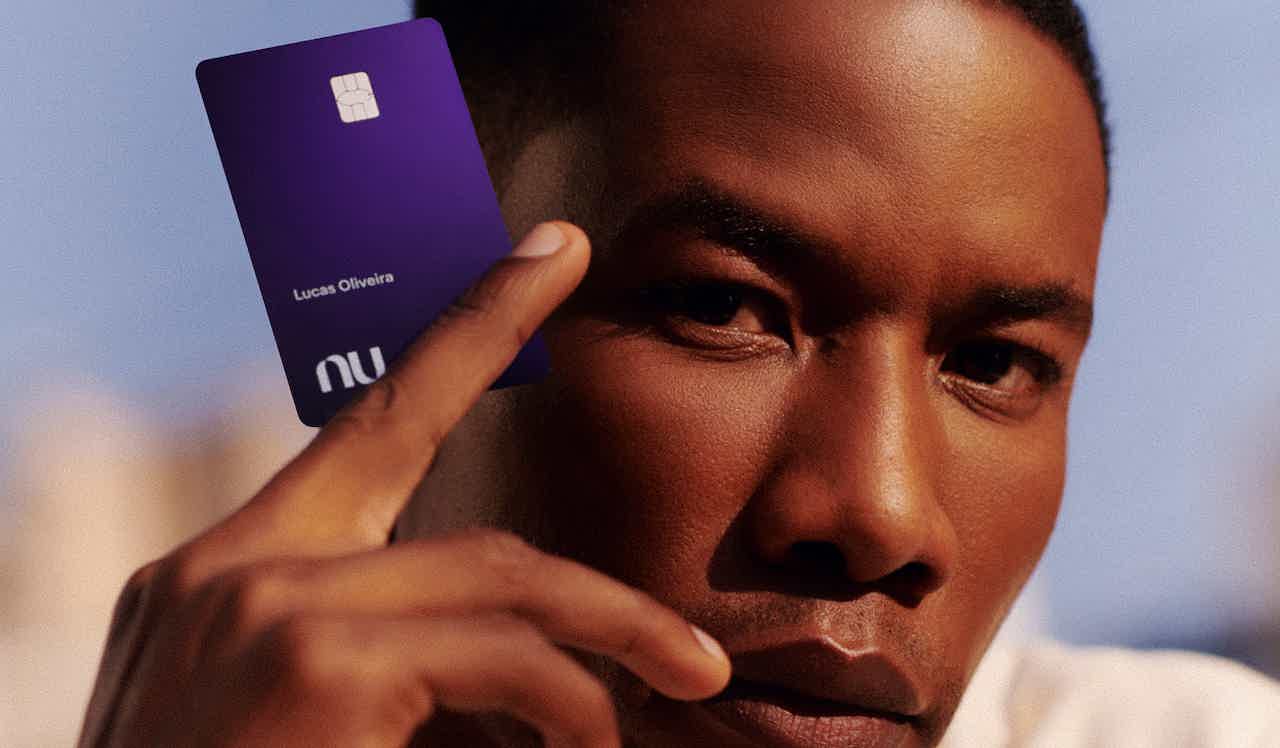

Nubank Ultraviolet Card

Certainly, Nubank cards are known for their practicality, security and speed of approval, in addition to being one of the first to offer a movement application.

As the years went by, Nubank decided to bring other versions, including Ultravioleta, which appears with a monthly fee and requires waiting on an interest list.

Knowing that it is a credit card like any other, the customer undergoes a credit analysis on this interest list and has a better chance of approval when he is already a Nubank customer.

Therefore, with this card you have the Mastercard Black flag, with benefits related to travel, cashback and even a metal card, where the numbers are only available in the app.

In addition, we will detail the advantages of this card below, which provides purchases in installments, the possibility of waiving the monthly fee and approval of a high limit upon analysis.

Santander SX Card

While many credit cards have more bureaucracies, Santander SX can be applied for over the internet and the customer undergoes a credit analysis with an assessment of the minimum income.

Therefore, when approved, the card can be monitored through the App Way, where you can make free and unlimited transactions, in addition to viewing invoices and checking your credit limit.

In order to make purchases easier for customers, this card has the Santander Pass, which is basically your card being used in different formats.

This means that payments can be made with wristbands, watch tags and even stickers, dispensing with the card itself or the cell phone in some cases!

Finally, this Santander option has become popular due to the low fees, ease of ordering and short waiting time for the arrival of the card with a good limit. So, check out more details of the advantages below.

What are the advantages of the Nubank Ultraviolet card?

Just like a credit card, this option can also be a source of savings for those looking for income and less travel expenses. Check out more benefits below.

- Have Masterassist Black, medical insurance available to customers who travel and have medical emergencies;

- Did you have to wait at airports? Wait in VIP Rooms with food and comfort;

- At the same time that every purchase returns 1% of the value, it yields annually;

- Therefore, the annual return reaches 200% of the CDI. Just leave the money in the account;

- Also, have a more secure metal card;

- The warranty on products is valid for theft or accidents for a period of 90 days;

- Spend at least R$ 5,000 per month or invest R$ 150,000 in the bank and be exempt from the monthly fee.

What are the advantages of the Santander SX card?

In addition to enjoying the benefits of the Santander SX card, there are also the advantages of the chosen brand, so check out much more below.

- Do not pay an annuity by spending only R$ 100.00 on the invoice per month;

- Install the invoice in up to 24 installments;

- Ensure approximation payments, even without the physical card;

- Register Pix keys in the digital account and also be free of annuity;

- Get discounts of up to 50% with Esfera partners;

- Withdraw the limit and pay only on the invoice.

What are the disadvantages of the Nubank Ultraviolet card?

Although it has benefits, the Nubank Ultravioleta card is not interesting for those with a dirty name, since it requires a credit analysis and waiting on an interest list.

In addition, the monthly fee of R$49.00 is fixed and monthly guarantees the benefits already mentioned, if you want to be free of this amount, you must have a high income.

This means that the customer needs to spend at least R$ 5 thousand on the bill or have R$ 150 thousand in investments in order not to pay the tariff, which also leaves this option distant for some people.

What are the disadvantages of the Santander SX card?

While the card offers the possibility of free annuity, the minimum income requirement is slightly higher when you are not a Santander account holder at the time of application.

Thus, the minimum income required is R$1,045.00 for the first order, in addition to the client going through a credit analysis and waiting a few days for approval.

Finally, even if there are additional cards, they also need to have expenses greater than R$100.00 on the invoice in order not to pay any monthly fee, which can be expensive.

Nubank Ultraviolet Card or Santander SX Card: which one to choose?

But, after all, did you manage to decide between the Nubank Ultravioleta card or the Santander SX card?

Just to exemplify, one represents an advanced version of the Nubank card, where the customer waits on a list of interest for approval while going through a credit analysis.

In the case of the Santander SX card, it is for any profile, as long as you have a clean name and can pay some fees, that is, if you do not spend the monthly amount required on the invoice.

So, before reaching a decision, observe the situation of your CPF and how fast you need the credit card, because if you need immediate approval, the option is not Nubank Ultravioleta.

Finally, don't worry if you haven't found the ideal option, since below we have one more option. Therefore, click below to check out a new comparison designed for you!

Atacadão card or Renner card

Get weekly discounts, chances of interest-free installments and online ordering are some of the advantages of these cards!

Trending Topics

Get to know Caixa real estate credit

Caixa's Real Estate credit has special advantages for you. With it, it is possible to finance your property in up to 35 years. Learn more in this article!

Keep Reading

Get to know CrediHome real estate credit

If you need to decide between several financing options, CrediHome can help you. Because it is a platform that simulates the best options for you!

Keep Reading

WhatsApp loan: how does it work and what are the options?

Understand how the WhatsApp loan works and how you can apply for it from Banco do Brasil and Crefisa!

Keep ReadingYou may also like

Wirecard: uncomplicated online payment

In today's post we will explain how the company Wirecard works, which acts as a payment intermediary. She can be a good ally of your business. Interested? Check the text!

Keep Reading

How to invest with the Santander Select Account

At Santander Select, you have access to premium credit cards full of benefits and a series of differentiated financial services for high-income customers. Check now how to invest with the help of a personalized advice.

Keep Reading

Who can apply for a payroll loan?

The payroll loan is a line of credit especially aimed at INSS beneficiaries and public servants. However, some institutions offer the opportunity to hire workers under the CLT regime. Check more here!

Keep Reading