Cards

Nubank card or Agibank card: which one to choose?

Do you want to choose between Nubank card or Agibank card? Because both are Mastercard branded cards, reliable and safe! Check out!

Advertisement

Nubank x Agibank: find out which one to choose

Initially, the Nubank Card or the Agibank Card are two card options with proposals such as a digital account, international coverage, discounts and exclusive offers for customers as a Mastercard program that is part of Mastercard.

Then, we will show you all the services that these two cards offer, as well as all the advantages and disadvantages that these cards have! Check out:

How to apply for the Agibank Mastercard card

Find out how to apply for the Agibank bank credit card, the digital inclusion card.

Nubank card

Initially, the Nubank card is issued by the Nubank bank, has a Mastercard brand and international coverage, that is, it can be purchased in national and international stores. And also, to participate in the Mastercad Surprise program.

There are two types of Nubank card: Gold and Platinum. Among the offers of the cards we have purchase protection insurance, travel consultancy, travel medical emergency insurance, international offers, car insurance, and several other advantages as a personalized app!

To apply for the Nubank card, you must be over 18 years old, be a resident of Brazil and have a regular CPF. From then on, it is possible to make the request through the Nubank application or through the Nubank website. It's all very fast and practical, no doubt about it!

Agibank card

Well, the Agibank credit card is a card issued by the Agibank bank, created at the request of the bank's customers to bring easier access to financial services with security and comfort, as well as debit and credit function and international coverage.

Furthermore, this card can only be used by account holders of the Agibank bank itself. That is, it is necessary to create a bank account to apply for the credit or debit card. Among the advantages of the Agibank card, there is an exemption from annuity in the first year.

To apply for the Agibank card, just download the Agibank bank application, available for Android and iOS. After that, click on “create account” and fill in your personal data. Then you can forward to the card request!

What are the advantages of the Nubank card?

Well, let's get to know the advantages of the Nubank card:

- Initially, one of the advantages of the Nubank card is the exemption from annuity, that is, there is no charge for card maintenance;

- Another advantage is that it is not necessary to prove a minimum income, which is great for the unemployed and self-employed;

- And in addition, it has a super secure and personalized app for customers to be able to take care of their finances directly through the app;

- You can also block or unblock the card through the Nubank application and also adjust the credit limit (depending on the credit analysis);

- Also, it is possible to pay by approximation and change the due date of the invoice;

- Unlike Agibank, a bank account is not required and you are guaranteed access to Nubank Rewards.

Nubank Rewards is an advantage program that offers several benefits to customers. For example, with each R$1 spent, you accumulate 1 point. And these points do not expire and can be used to pay invoices with restaurants, airline tickets, accommodation, Uber, Netflix and Ifood.

Furthermore, Nubank Rewards compensates customers who spend more than R$1600.00 per month on the Nubank card, being able to receive benefits in terms of points. You can also schedule payments and the account has online service 24 hours a day.

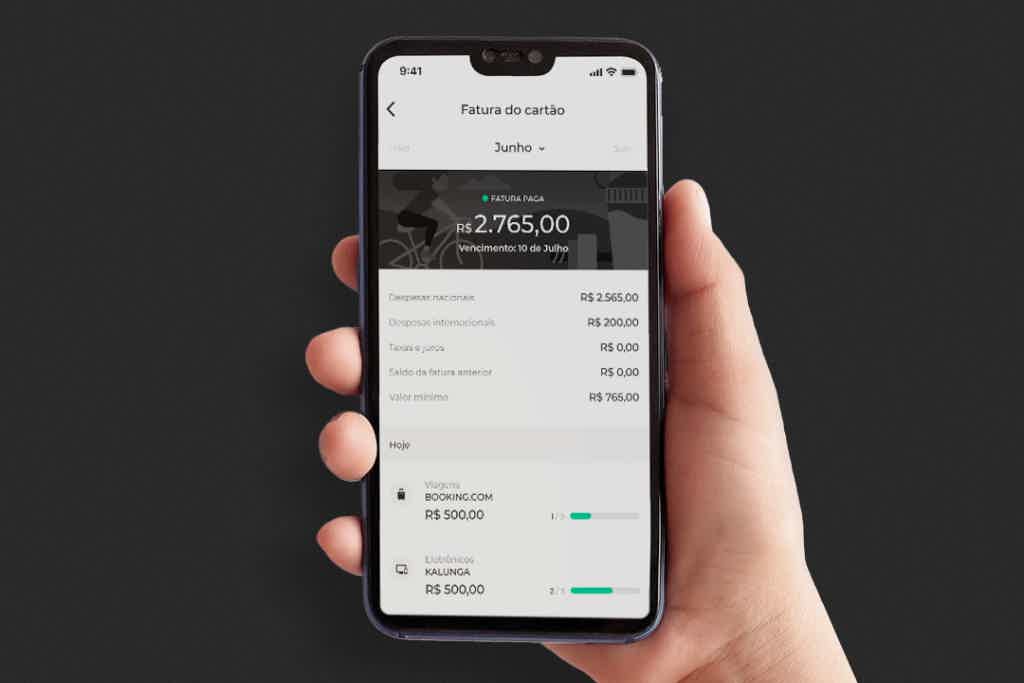

Through the Nubank application, it is possible to: consult expenses, request an increase in the Nubank card limit; check the due date of the invoice and also contact Nubank's customer service team. It is also possible to make a direct deposit into the account, yielding daily at a higher rate than the savings account.

What are the advantages of the Agibank card?

So, let's get to know the advantages of the Agibank card:

- At first, one of the advantages is the Agibank digital account, which allows you to make loans, pay bills and issue slips, make financial transfers and even have access to forms of investments;

- It is also possible to receive salary through the current account and make purchases with QR Corde;

- And in addition, withdrawals at Banco24Horas and even make direct payments to other people.

You can also access all Mastercard programs and offers. And in addition to being able to pay by credit or debit when shopping, the brand offers the Mastercard Surpreende program, which works by exchanging products for points.

In this regard, for each product spent with the Agibank card, the customer receives some points in exchange. And with the accumulation of these points, you can pay for products and services offered by the card's partner stores. That is, the more products you buy with the card, the more points you will receive and the more products you will earn.

Another difference is that Agibank has physical branches. That is, you can resolve your financial issues in person and through the application. This is because the applications, in addition to being digital, perform the same functions as physical branches.

Therefore, the Agibank card has the help of technology to offer users transparency, as well as security and personalized services!

What are the disadvantages of the Nubank card?

Well, among the disadvantages of Nubank we have that the card did not have a points program, but currently it has the Nubank Rewards program, for accumulating points, which is super interesting.

Another disadvantage of the Nubank card is the charging of fees for performing some services such as financial transfers; automatic debit option exemption; withdrawals are charged and there is no minimum free withdrawal limit; exemption from income tax withholding option.

So do some analysis to find out this card is a good fit for you!

What are the disadvantages of the Agibank card?

At first, the first disadvantage of the Agibank card is the annual fee. This is because, even if the annuity is not charged in the first year, after that period, the value is quite significant, as well as the services offered by the Agibank bank.

Furthermore, for investors, CDBs are also considered high, from R$1000.00 (no liquidity) and CDBs with liquidity from R$10000.00. So, before opting for the Agibank card, see all the pros and cons to see if it will be a good choice!

Nubank card or Agibank card: which one to choose?

Well, the Nubank Card or Agibank Card are very interesting card options with a digital account, payment with QR Code, Mastercard brand and Mastercard Surprise program, international coverage and several other exclusive advantages.

So, if you want to be part of the digital world, the Nubank card or Agibank Mastercard card are great options for you, as they provide several advantages, as well as programs and services! And one of the highlights is that they offer customers the possibility of carrying out all transactions over the internet.

But if you're still having doubts, we've separated another analysis for you to take a look at the recommended content below!

Saraiva Card or Pan Card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Ibicard card or Havan card: which one to choose?

Decide between the Ibicard or Havan card! While one is for negatives, the other does not charge membership fees, in addition to offering exclusive discounts.

Keep Reading

BMS personal loan: what is BMS?

Do you already know the BMS loan? It is a fast and secure credit modality. So keep reading because we'll tell you all about it!

Keep Reading

How to find the best mechanic jobs

Find the best mechanic vacancies here, understand how to apply and how to have a resume that attracts the attention of the recruiter.

Keep ReadingYou may also like

Discover the Geru personal loan

With an interest rate from 2% per month, you can request up to R$ 50 thousand reais. Learn more about the Geru personal loan in the text below.

Keep Reading

How to pay card invoice with Pix at C6 Bank?

Payment by Pix has undoubtedly arrived to simplify our lives. And did you know that it is now even possible to pay your card bill with Pix at C6 Bank? That's right, we explain more about it here, check it out!

Keep Reading

Kabum credit card: what is Kabum?

With the Kabum credit card, you can pay your game purchases in up to 24 installments and even get cashback if you use it at accredited stores. Want to know more? So read this post and check it out!

Keep Reading