Cards

Online Nubank card: no annual fee and exemption from fees

The online Nubank card is a completely digital and free option that offers great benefits to its users, such as access to the Mastercard Surpreenda program. Learn more about it in this post!

Advertisement

Know all about that card before you get yours

When applying for your Nubank card online, it is normal to have some doubts about it. After all, we always want to be sure that we are going to request the best option for our financial life.

However, the Nubank credit card can offer great advantages and attracts many people because it is digital and has no annual fee.

In addition, you still manage to access a digital account that yields more than savings and ensures that your money does not stand still and is always working for you.

Therefore, if you still have doubts about whether this is the best option, check out the following post and make sure that the Nubank credit card is the ideal option for you!

How to apply for Nubank card

Find out how to apply for the Nubank card and enjoy its benefits, such as the Mastercard Surprise program, annuity waiver and more!

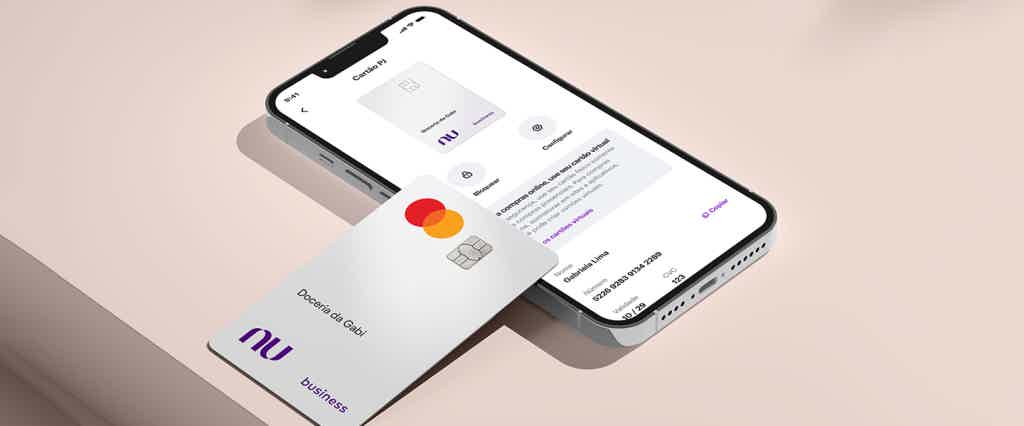

Nubank card

The Nubank credit card is a digital card option that offers several facilities for its users' lives.

In this sense, you can manage everything about your card in the Nubank application, completely online, without having to leave your home.

But being digital isn't the only thing this card offers. Next, you know some more features about it!

Characteristics

In summary, the Nubank credit card is one of the most used by Brazilians. Because it has great benefits and is completely digital, the card quickly became one of the public's favorites.

In this way, from the credit card, people can make their purchases more easily. They have the option of making approximation payments and using a virtual Nubank card for online purchases.

In addition, it also allows you to get a discount by anticipating installments for the current invoice, where you can save a little.

How does the Nubank credit card work?

In summary, the Nubank credit card works like any other credit card. Thus, from there you have a monthly limit that you can spend however you want on your purchases.

First of all, it is important to know that the card has the Mastercard flag, one of the most accepted by stores and that has international coverage.

So, if you want to take advantage of a promotion or buy a specific item on websites outside of Brazil, you can do so with peace of mind using this card.

What is the annual fee for the Nubank card?

Basically, one of the main advantages of Nubank cards is their annual fee, which is completely free.

Therefore, every month that you use the card, you will only have to pay for the purchases you have made. No additional fees will be added, even in months when there are no purchases.

Benefits

The Nubank card has many advantages for its users, as it was created with the aim of being easy. Therefore, it is possible to manage your card accounts in a much more practical way through your application.

In addition, by having the Mastercard brand, its users can access some benefits. One of them is the Mastercard Surpreenda program, which offers points and discounts on purchases.

Speaking of discounts, your purchases in installments with the Nubank card can also receive a discount when you make a purchase in advance.

Finally, the fact that the card does not charge an annual fee and no usage or opening fees also make it a great choice!

Limit

Now it's time to talk about one of the most sought after features of any credit card that can be applied for online: its limit.

In summary, the Nubank card is known for releasing a low initial limit. There are cases of people who were approved with the limit of R$50.00. But if you use the card a lot and pay your bills on time, you can receive increases.

What is the initial limit of the Nubank credit card?

At first, to set a limit, cards need to perform a credit analysis to find out if you have a good score and if you pay your bills on time.

For this, it is necessary to analyze several different factors that in the end will determine the initial limit of each person.

Thus, the initial value of the limit on the Nubank card can vary greatly from person to person. As it depends on your credit analysis, it is not possible to say a fixed amount that Nubank releases.

That way, to ensure you have a good initial limit, it might be interesting to keep your payments up to date, pay off any debt and try to improve your Serasa score.

How do I know the limit of my Nubank credit card?

Since the Nubank credit card is completely digital, checking your limit on the card also happens online.

Therefore, to find out the limit of your card, just access the application and go to your credit card area.

So, just click on the “Adjust Limit” button, where you can see the total limit of your card, what was used and what can be increased.

What is the Pre-approved limit on the Nubank credit card?

Basically, the pre-approved limit is the amount that the digital bank releases for you to use for your monthly purchases.

Thus, this amount is available every month and only decreases when you make a purchase that uses part of the available limit. To reset the limit to the initial amount, you must pay the invoice.

How long does it take to increase the Nubank card limit?

In summary, there is no predefined time for the Nubank card limit to increase. Basically, it will increase if your credit profile analysis is positive and allows for the increase.

But, in any case, you can always ask for an increase in the limit of the card. However, you will still need to go through the credit analysis for the bank to approve or not your application.

How to have a credit card at Nubank?

If all your questions have been answered and now you want to apply for a Nubank credit card, know that the application process is very simple!

As it is a digital bank, all requests are made online. So, you don't have to leave the house and you can do everything from your cell phone!

So, to know in detail how the process is done, you can check the post below that shows you the complete step-by-step!

How to apply for Nubank card

Find out how to apply for the Nubank card and enjoy its benefits, such as the Mastercard Surprise program, annuity waiver and more!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Pan Mastercard Platinum Card Review 2021

See the Pan Mastercard Platinum card review that we brought with all the data about this international card with cashback and benefits.

Keep Reading

Meet the XP card

For those who like to invest, the XP card can be a great option. In addition, it has cashback and does not charge annuity. Learn more in this article.

Keep Reading

5 bad credit cards

If having a dirty name is a problem getting a credit card, don't worry! Because we are going to show 5 credit cards for negative ones.

Keep ReadingYou may also like

WhatsApp loan: check the options

If you want more agility and security when taking out your credit, WhatsApp loan can be a good option. To learn more about this modality and check out some options, just continue reading with us!

Keep Reading

How to apply for the Nubank PJ Silver card

The Nubank PJ Prateado card is the solution you need to organize your company's finances and have a unique business card. To learn more about how to apply for yours, just read on!

Keep Reading

Carrefour Card or Muffato Card: which is better?

Carrefour has a credit card with benefits, such as exclusive promotions and larger installments. Meanwhile, Muffato has private label type cards to guarantee more discounts when shopping. Compare the two below and choose your favorite.

Keep Reading