Cards

Neon Card or Pan Card: Which is Best for You?

Need to decide between the Neon Card or the Pan Card? So know that both have Visa flag discount programs! Learn more here!

Advertisement

Find out which credit card to choose

Initially, the Neon card or the Pan card, two of which are very simple credit card options to apply for, with no annual fee and with exclusive advantages for users ranging from discounts at stores that accept Mastercard, as well as an app super intuitive to keep track of all card expenses!

So, let's show you a little more about Neon and Pan cards that have several advantages worth checking out! Check out:

How to apply for your Banco Pan credit card

Find out now the step-by-step process for applying for your Pan bank card, everything can be done 100% via the internet.

How to apply for the Neon card

Discover now how to order your neon card and enjoy the benefits associated with the international Visa flag.

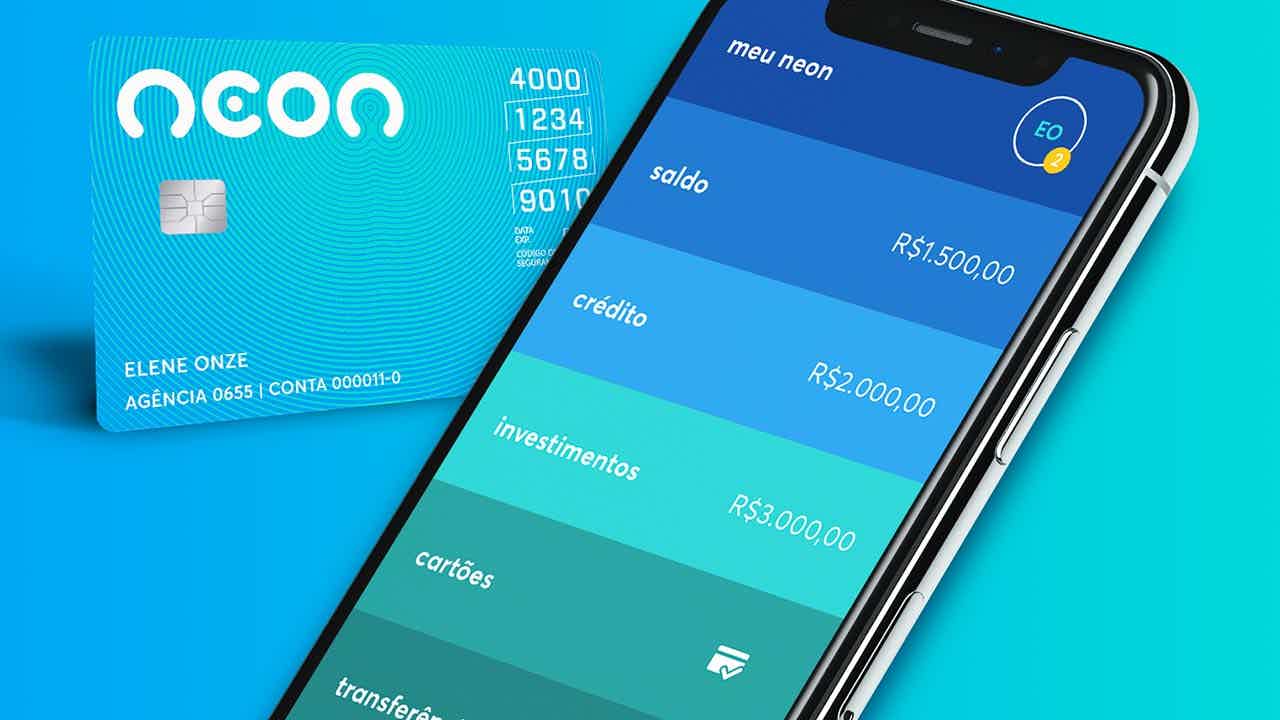

neon card

At first, the Neon card is a credit card that does not charge an annual fee, that is, there is no need to pay any annual fee to keep using the card and it is among the best cards on the market. This is because it provides technological services and provides greater autonomy for users.

Well, the Neon card has international coverage, that is, users can purchase products and services in stores in Brazil and abroad. Another super advantage of the Neon card is that it is conditioned to a digital account that provides various services.

So, Neon bank is a 100% digital bank, in which you are guaranteed access to various financial services. And, when registering with the Neon bank, you will be able to acquire the digital and physical versions of the Neon card, being able to use it in either version.

Applying for the Neon card is very simple. You just need to be over 18 years old, RG and CPF updated and request through the Neon bank app.

Therefore, the Neon card is a card accessible to anyone as long as they are over 18 years of age and have suitable documents to apply! In addition, the card has other advantages as we will see later.

pan card

In February 2020, Pan bank launched its first free digital account. In it, the bank offers a proposal for a package of exclusive benefits for users, for example, a discount program for use with Visa or Mastercard flags.

So, to apply for the Pan card is very simple, just apply online through the official website of Banco Pan. Just log in, fill in all your personal data, agree to the terms and wait for the credit analysis, which takes about 10 days.

That is, it may not be a good option for negatives. That's because, unlike other banks that we've already mentioned here, Banco Pan does credit analysis and, for people negative or with a low score, this becomes a disadvantage.

In addition, the Pan card has a personalized application, available in versions for Android and iOS, through which it is possible to hire services such as increasing credit card limits and requesting loans. in other words, it becomes a bank that values commitment and quality with customers.

Therefore, Banco Pan brings an innovative card model that also features contactless technology and international coverage under Visa and Mastercard flags to provide even more security and comfort for customers seeking quality and efficiency!

What are the advantages of the Neon card?

Well, let's get to know the advantages that the Neon card provides for customers:

- At first, the first advantage of the Neon card is the personalized app, where you can have access to all your credit card transactions, being able to control everything you do;

- Another advantage is the Visa flag with international coverage, being able to shop in stores inside and outside Brazil;

- Also, you can count on the annuity exemption, not having to pay credit card maintenance fees;

- Requesting and closing the Neon card is completely free;

- In addition, payment of the invoice can be made via direct debit;

- A free monthly withdrawal from the 24-hour bank.

Therefore, the Neon card is super versatile and still has a modern design and an intuitive and simple to use digital account!

What are the advantages of the Pan card?

So, let's get to know the advantages of the Pan bank credit card:

- At first, the first advantage of the Pan card is that it exists under the Visa and Mastercard brands, allowing customers to choose the brand that best suits their needs;

- Another advantage of the Pan card is that it is linked to a free 100% digital account, free of charge or with very low costs for financial transactions made from Pan bank to other financial institutions;

- Furthermore, the credit limit available on the card may vary according to the profile of each person, that is, do not limit yourself to the limits of known people, as yours may be much higher or lower, as the case may be;

- Another advantage is that the account allows you to make up to 30 transactions per month; including withdrawals at Banco24Horas terminals, transfers, TED and deposits by boleto;

- Also, it has an intuitive and modern app, where you can find functions such as being able to apply for loans and increase the limit for Banco Pan;

- Another advantage is contactless technology, approximation payment, which makes the card much safer when shopping.

Therefore, as we can see, one of the biggest advantages of the Pan card is the approach payment method that came to optimize payments with credit cards and bring more security to customers who do not need to register their password, running the risk of being cloned. !

What are the disadvantages of the Neon card?

At first, one of the biggest disadvantages of the Neon card is the fees charged for the services offered by Banco Neon. This is because fees are charged in the amounts of R$3.50 reais for transfers, as well as interest rates for installments of invoices and interest on delays.

And in addition, another disadvantage of the Neon card is the approval of the card, which tends to take a little longer than other digital bank cards. That's because Neon does a credit analysis, that is, it does a search at credit bureaus to see the situation of your name with companies.

What are the disadvantages of the Pan card?

Well, among the disadvantages of the Pan card, the biggest one is also the credit analysis to apply for the credit card. This is because the low score and the dirty name can become reasons for impeding the approval of the request.

And also, another negative point of the Pan card are the fees that may be charged by Banco Pan in some types of services that are offered by the bank, such as financial transfers. So it's worth doing some in-depth research to see if it's a good fit for you!

Neon Card or Pan Card: Which is Best for You?

Well then, the Neon card or the Pan card are safe, technological and interesting credit card options that aim to guarantee comfort and convenience.

Furthermore, they have exclusive advantages for their customers, valuing quality and efficiency in the proposals and discounts for users amidst advantages such as no annual fee, technological app and advantages of the Visa and Mastercard program.

So, do some research to find out which of these options is best for you and see which one best suits your interests! And if you still have doubts, see below a recommended content of new credit cards for you to review!

Saraiva card or Pan card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Superdigital personal loan: what it is and how it works

Check out the Superdigital loan that has extended terms to avoid default and assistance to make your life easier.

Keep Reading

Bradesco Neo Card or Next Card: which one is better?

Be it the Bradesco Neo Cartão Next card, both seek to offer quality services and have international coverage! Check out!

Keep Reading

Get to know the Benefit Brazil, Light and Gas

Get to know the Benefit Brazil, Light and Gas! The social program that helps low-income Brazilian families. Check it out now!

Keep ReadingYou may also like

Find out about the Futuro Abanca current account

At Abanca, you can subscribe to Conta Futuro and access banking services with lower fees. Also, the initial deposit is not required. Learn more about this account right now.

Keep Reading

Discover the Millennium Serviços Mínimos current account

In the Millennium Serviços Mínimos account, you can transfer amounts to other bank accounts, make deposits, register direct debits and much more. Take the opportunity to learn all about this service in the post below.

Keep Reading

What are the youth loan lines?

Taking out a loan can be a great option for those who want quick cash. In this sense, there are some options that are more suitable for the young audience. Want to know more? Continue reading and check it out.

Keep Reading