Cards

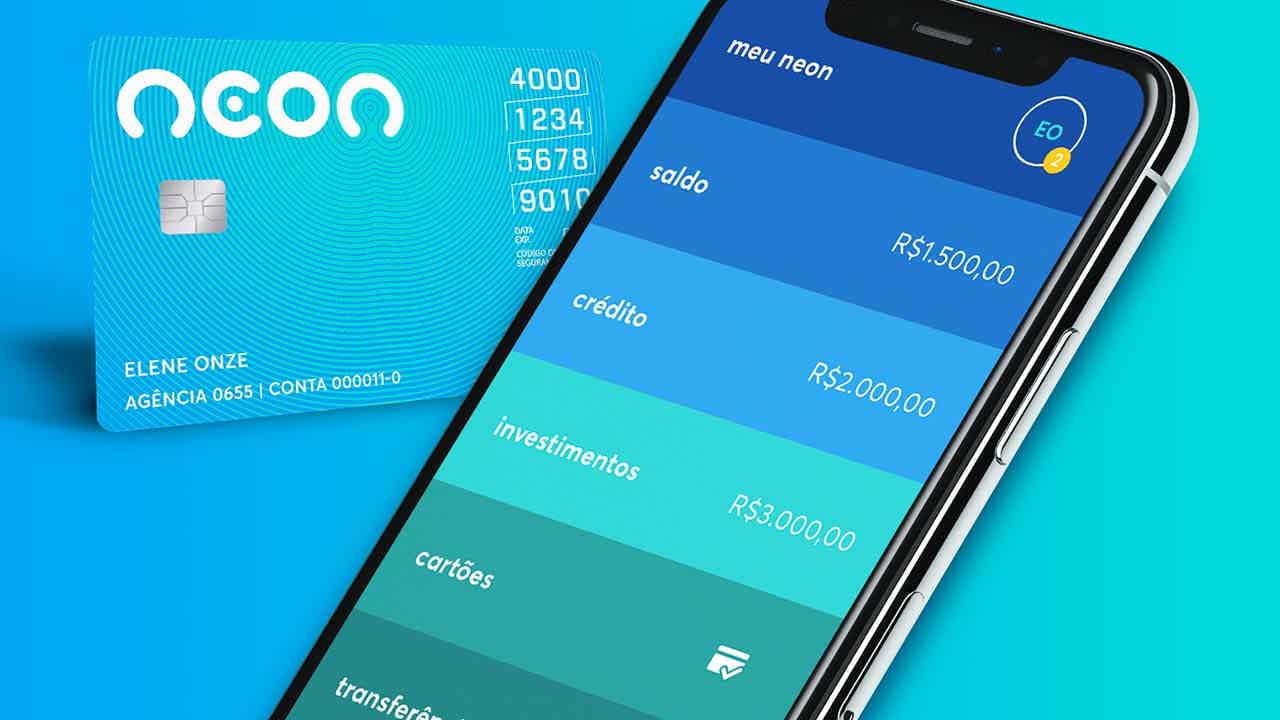

Online Neon Card: no annual fee and elastic limit

The Neon card was created to offer more practicality for those who need a credit card free of fees and with a flexible limit that can be increased to complete a purchase. Find out everything about him in this post.

Advertisement

Have a card that only pays for what you spend

The online Neon card is the ideal option for those who are tired of the high amounts charged for credit card annual fees and would like to access a form of plastic where you only pay for what you spent.

Therefore, this institution follows in the same line as others on the market by offering a credit card with good features and which is completely free.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | You can make purchases above the limit It is possible to pay by contact Request is 100% digital |

Therefore, due to its benefits and resources that it can offer, this card has already been issued by more than 1 and a half million people in Brazil who want to access more convenience.

But, before you request yours, it may be interesting to continue with this post and learn more about the Neon card online.

How does the online Neon card work?

The Neon online card is a Visa credit card that was created to offer you more convenience while making your purchases.

Therefore, the card can be used for your physical or virtual purchases, where you can be accepted in several establishments.

This happens because the card brand is Visa, which is known for being one of the largest card brands in Brazil.

Furthermore, the Neon online card has contactless technology, which allows you to make your purchases more quickly and without needing to have the card nearby.

To do this, you just need to have your cell phone or a smart watch that has your card registered. This way, you can pay for your purchase more quickly.

How to Apply for a Neon Credit Card

The request is made simply online from the bank's application. Check out!

What is the annual fee for the Neon card?

As previously mentioned, the Neon online card is completely free of annual fees, allowing you to only pay for what you spend in the month.

This feature is widely found nowadays in several digital banks, which want to offer more practicality and savings to their users.

Therefore, when requesting the Neon card online, you can rest assured that the institution will not charge annual fees or any other hidden fees. In that regard, Neon is very transparent.

What is the online Neon card limit?

When choosing a good credit card, many people already want to know the limit amount that this card can release.

And this is really interesting information, since the value will tell us what our purchasing power will be with it.

However, it is very difficult to know exactly how much limit the online Neon card has.

This happens because the institution carries out a credit analysis to understand your consumption history and payment profile.

Therefore, the limit value released will depend on these and other variables that are used to build your credit profile and approve your card.

But, regardless of the limit value that is released to you, know that it is possible to request an increase in this limit later.

How to increase the Neon card limit?

If you have already been approved to have the Neon card online, you can access the bank's application to request an increase in your limit.

To do this, simply go to the app and click on “Credit” and then on your limit amount. So, you just need to click on the “Request more limit” button and enter the amount you would like to have.

This way, simply send the value to the bank, which will analyze your proposal to decide whether to approve the new value or leave it as it was before.

Additionally, you can also access more limit from the Elastic Limit feature. This way, you can use it to make purchases that are slightly above the initially released limit.

Is it worth applying for the Neon card online?

So far you can learn more about the Neon card online and see that it has very interesting features.

But is it really worth applying for this card? To answer this question, you need to analyze the main positive and negative points of this solution.

Benefits

Namely, the online Neon card has very interesting advantages for you to take advantage of the card in your daily life.

The main one is the fact that the card does not charge any annual fees or hidden fees. This way, at the end of the month, you can only pay for what you used.

Furthermore, Neon has a super intuitive application for you to manage your card and, therefore, view your invoices and limits conveniently.

It also has an elastic limit that can help you in unforeseen circumstances, as it frees up extra value for one-off purchases.

Disadvantages

Despite the positive points, the online Neon card also has some disadvantages that need to be known.

Among them is the fact that the card does not have partnerships with stores to offer exclusive discounts and promotions to customers.

Furthermore, the card also does not have a points program nor does it offer cashback on your purchases.

How to get a credit card at Neon?

To be able to request a Neon card online, you must have already created an account with this institution.

Only with the account created can you access the application and request a credit card.

When you do this, Neon will analyze your credit profile to assess the limit that can be approved for you.

But, to find out in more detail how applying for a Neon card online works, you can check out the post below!

How to Apply for a Neon Credit Card

See how easy it is to access this card without annual fees and fees!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Saraiva Card or Santander SX Card?

To decide between the Saraiva or Santander SX card, know that both have points programs and international flags. Know more!

Keep Reading

Saraiva Card or Pan Card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

Keep Reading

7 credit cards for minimum wage earners

Discover in this post 7 credit cards for those who earn minimum wage. They have no annual fee and also have international coverage.

Keep ReadingYou may also like

How to transfer money from WiZink card?

Did you know that WiZink allows you to transfer part of your credit card allowance to your current account? If you didn't already know about this service, check out the step-by-step instructions for making the transfer here.

Keep Reading

Does the Santander SX card have an annual fee? Check the answer here!

Want to apply for a Santander SX credit card, but don't know if it charges an annuity fee? To get all the information about the annuity and other characteristics of the card, just stay here and check it out throughout the article.

Keep Reading

International Sugar Loaf Card: how to apply?

Do you want to apply for the Pão de Açúcar international card and don't know how? No problem, we have gathered here all the information regarding the application for this credit card. To check it out, just continue reading ahead and find out how to order yours!

Keep Reading