Cards

Mercado Pago Card or BTG+ Card: which one to choose?

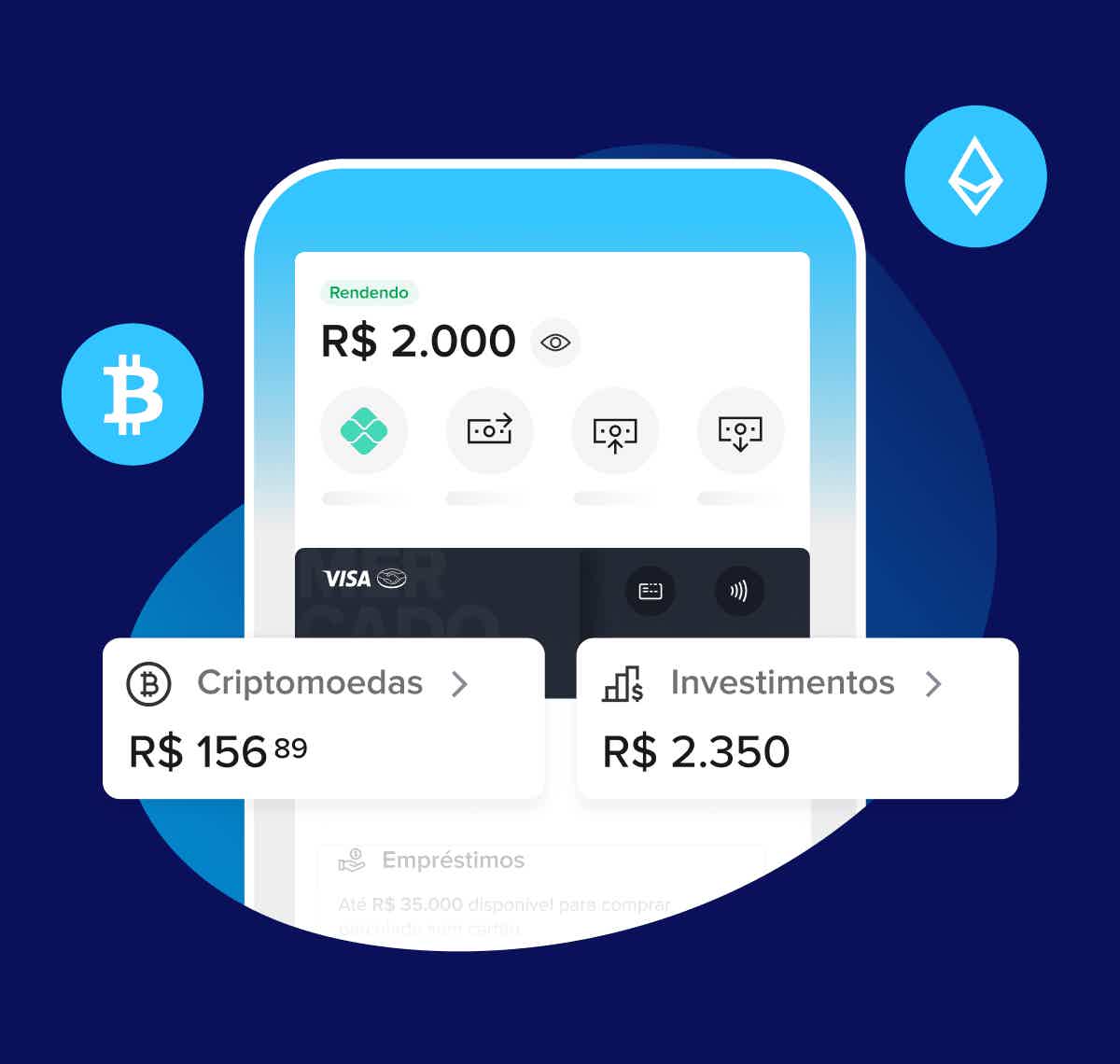

Even with different profiles, these digital bank cards do not charge annuity and offer investment opportunities. Decide between the Mercado Pago card or the BTG+ card by getting to know them better!

Advertisement

Mercado Pago vs BTG+: find out which one to choose

In the same way that making any decision can be difficult, choosing between the Mercado Pago card or the BTG+ card is also difficult, after all, they are credit cards with many benefits.

Undoubtedly, there are several advantageous credit card options available, but that doesn't mean they are ideal for everyone, does it? With that in mind, we created this comparison with well-evaluated cards in the financial market.

First, the Mercado Pago card, from Mercado Livre, appears as a suggestion for those with negative credit scores or those with a low score, since it does not require a credit analysis when opening an account and, depending on the use, it can even release a good credit limit.

On the other hand, we have the BTG+ card, which is from the BTG Pactual bank and can be the starting point for anyone who wants to become an investor paying little in fees, however, it is a digital account that requires a minimum income in some cases and has a strict profile analysis.

In addition, we will provide more details about these options so that you can ask for the credit card that best meets your needs, whether monthly payments for basic services or the card aimed at large routine purchases. So stay with us!

How to apply for the Mercado Pago card

Find out how to apply for the Mercado Pago card with no annual fee, with immediate approval and interest-free installments of up to 18 purchases. Check out!

How to apply for the BTG+ card

For investors, the BTG+ card retains amounts directly to a fund that becomes the beginning of your investments. Meet!

| Mercado Pago Card | BTG+ card | |

| Minimum Income | not informed | Does not require (Basic Option) |

| Annuity | Exempt | Exempt (Basic Option) |

| Flag | Visa | MasterCard |

| Roof | national or international | national or international |

| Benefits | Digital account without bureaucracy through the APP Move the account and ask for the credit function Have the Credit Market, which are loans Install your purchases in up to 18 interest-free installments | Get Invest+ and start investing safely Count on contactless technology Do not pay for the digital account Make interest-free installments in up to 24 installments Participate in Mastercard programs |

Mercado Pago Card

Since it was launched, the Mercado Pago digital account has appeared as one of the easiest ones, since it is opened through the application, without the need to prove documents and with immediate approval, for example.

In this way, it has become useful for both individuals and companies, as it offers a card machine, credit line and free account. In addition, he has an account that yields only if he leaves the money there, with a yield greater than the savings, that is, 100% of the CDI.

Just as it has a free account, it's important to point out that it's one of the few digital accounts that doesn't charge fees for transfers like TED, besides, don't worry about withdrawals: that's because the Mercado Pago card offers one of the lowest market, R$ 5.90 per withdrawal.

Finally, open your account through the app, move it around and even with a low score or dirty name, get a chance to have a credit limit to use the way you want. Then, count on Mercado Crédito, which makes loans available to customers, which is very advantageous, isn't it?

BTG+ card

Not just an investment bank, recently BTG Pactual has become a digital account that also has ways to reach financial investments in an easier way, without leaving your home.

In short, BTG+ is a digital bank that offers debit and credit card options, ranging from the Black option to the most basic option, that is, in the first case a high income is required.

Undoubtedly, it is ideal for anyone thinking of investing and already has a certain amount saved, but wants access to subscriptions to streaming services, or ride-hailing and food apps, without forgetting the day-to-day installments.

In this sense, BTG+ offers Invest+, where credit card expenses go directly to a fund, that is, in this fund your money earns just by being stopped in the account, another benefit for those who understand little about investment and want to see values grow little by little.

Since the Black version has a monthly annuity of R$ 90.00, requiring investments of up to 300 thousand reais in the bank, the basic option does not charge any annuity and offers a virtual card, travel insurance and much more. Therefore, it is ideal for anyone who wants a digital account and who invests their money effortlessly.

What are the advantages of the Mercado Pago card?

In any case, the Mercado Pago card is one of the easiest to access among digital banks, as it approves the virtual card in minutes, with the chance of using it only without paying any fee for not issuing the physical card, therefore, see other benefits below.

- Free digital account, with unlimited TEDs;

- Get discounts at restaurants, cell phone recharges and stores;

- Pay with the app without needing a credit or debit card;

- Sale with the Mercado Pago card machine.

What are the advantages of the BTG+ card?

If you happen to have a minimum income, the BTG+ card is also useful for taking the first steps in investments, in addition, for high incomes it offers advantages and lower fees, so follow other details.

- At Invest+, receive 0.75% cashback on every purchase;

- Do not pay monthly fees when expenses exceed R$ 3,500.00;

- The available value will always yield, regardless of the movement;

- Complete the entire process online and have a free digital account;

- Monitor your CPF and become Serasa Premium by being a good bank payer.

What are the disadvantages of the Mercado Pago card?

Since some people get credit limits higher than R$ 500.00, even they will have fees charged if purchases exceed this amount, because when it is exceeded, a fee of 2.99% is applied to this amount that was exceeded, which ends up being uninteresting.

What are the disadvantages of the BTG+ card?

It is worth noting that there is no minimum income requirement, however, the customer still undergoes a credit analysis, and will also have to wait some time for approval. Furthermore, it is not accessible for those with a dirty name or low score.

Mercado Pago card or BTG+ card: which one to choose?

Finally, we understand that it is a complicated decision to choose between the Mercado Pago card or the BTG+ card, after all, they are for different purposes, right?

Also, let's summarize some details to help you! In short, know that the Mercado Pago card has a digital account released in minutes and there are also chances of approval for those who have a negative name and want to access credit purchases.

On the other hand, the BTG+ card is focused on training new investors, who just by using the credit card already start investing in a fixed income fund, which could be the kick in the financial world for many, isn't it? ?

Chances are you're still having doubts, so don't worry! Below, we have another comparison designed for your financial profile, without forgetting the needs for purchases in the credit modality, so stay with us!

PagBank card or Atacadão card: which one to choose?

If you are looking for a card that offers several discounts at partner stores, as well as international coverage, Visa or Mastercard, check out our comparison.

Trending Topics

How to apply for the Bradesco Clube Angeloni Visa card

Do you want to know how to contract the Bradesco Clube Angeloni Visa card? In this article we will explain it step by step. See now!

Keep Reading

C6 Tag: what is it and what are the benefits?

Find out in this post how C6 Tag works, who can access this feature and what are its main advantages and disadvantages!

Keep Reading

Which financial institutions perform credit analysis?

Do you know how a credit analysis works? Because there are some institutions specializing in this, and it's important to know which ones they are. Look here!

Keep ReadingYou may also like

How to open a Mercado Pago account

The Mercado Pago account is the option you are looking for to improve your finances and have more security in your transactions. To see how to ask and how it can help you, see more information in the topic below.

Keep Reading

Discover the Ponto Frio credit card

Want more peace of mind when shopping? With the Ponto Frio credit card, you can pay in up to 24 months when purchasing selected products. Learn more below!

Keep Reading

All about Banco OpenBank: digital account, card and more

OpenBank is a complete digital bank that offers three types of accounts and three different cards. In addition, it has a function that helps you invest every month. Learn more details about OpenBank from now on.

Keep Reading