Cards

Méliuz Card or Mooba Card: which one to choose?

Be it the Méliuz card or the Mooba card, both are innovative, issued by Banco Pan and have very attractive proposals. Check out!

Advertisement

Find out which credit card to choose

Initially, the Méliuz card or Mooba card are two credit card options with advantage programs such as a cashback program and no annual fee for the Méliuz card. So, to get to know a little more about each of these cards, let's show you the pros and cons of each one of them!

The fact is that both are issued by Banco Pan and have innovative proposals so that customers have access to the best of credit cards and to guarantee credibility, security, transparency, comfort and quality in the provision of services.

How to apply for Mooba credit card

In this article you will learn step by step how to apply for your Mooba credit card without difficulties.

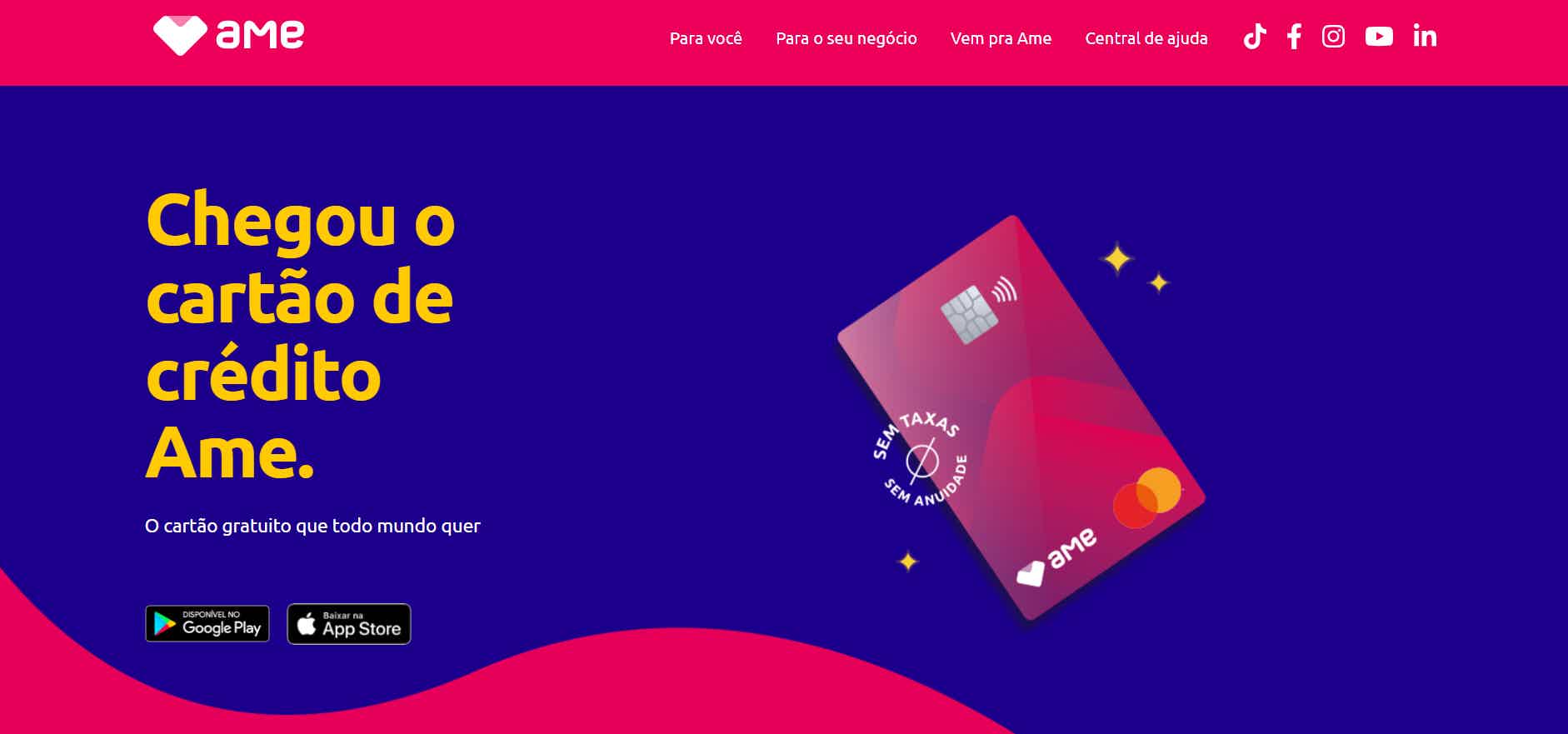

How to apply for AME card

The AME card offers exclusive benefits, in addition to cashback and international coverage with the Mastercard brand. See here how to apply!

Méliuz card

Well, the Méliuz card is a card issued by Banco Pan, one of the largest banks in Brazil. Among the advantages of the Méliuz card, we have the absence of an annual fee and a super interesting cashback program that refunds up to 1.8% of money on purchases made with the credit card!

So, the Méliuz card has this cashback proposal to return 1.8% of cashback so that customers can redeem the amount in their checking or savings accounts when the minimum limit of R$20 is reached.

To apply for the Méliuz card, you don't need to be a Pan bank account holder or any other bank. That's because the card is not conditioned to any digital account, and you can only apply for the card!

So, to follow up on the request, just download the Méliuz app, which is available in versions for Android and iOs, or you can access the Méliuz website. Then, fill in the fields with your personal data and wait for Banco Pan to carry out the credit analysis, which usually takes about 20 days.

And so, if the Méliuz card is approved, it will be sent within a maximum period of 15 working days. And in addition, this card has the Mastercard brand, international coverage, that is, the customer can make purchases in stores in Brazil and in the world, as long as it is in physical stores.

Therefore, Méliuz is a transparent, safe and comfortable card so that users can apply quickly and efficiently!

mooba card

Initially, Mooba is a platform that works as a partner for several online establishments. That is, when a user makes purchases at one of these establishments with a personalized link from the respective company, the latter receives a commission.

So, the Mooba platform provides the buyer with a value in the form of cashback. That is, if the customer buys at a Mooba partner store and the cashback of this store is 4%, if the purchase is worth R$100, then R$4 spent on the transaction will be returned.

And in addition, the Mooba card also has a card with its own cashback program. That is, when buying at any of the partner stores with their plastic, the customer receives twice the money back! Being a super advantage!

Well, the Mooba card has a relatively low annuity fee, does not do credit analysis, being a great option for people with a dirty name and the card has the VISA flag. It is important to mention that despite having an annuity, you can exempt yourself from this amount!

Therefore, the Mooba card is a card that offers a proposal that is different from all the others we have already mentioned here and offers a huge choice of partner stores so that you can do your shopping! That is, you can't waste time and, it's better to run to make the request, right?

What are the advantages of the Méliuz card?

Well then, let’s get to know the advantages of the Méliuz card:

- At first, the first advantage is the absence of annuity. That's because you don't pay a maintenance fee to keep using your credit card;

- Another advantage is the cashback program in which the card returns up to 1.8% of money to make purchases and use it as you wish;

- Also, the card has the Mastercard flag with international coverage. That is, you can shop in Brazil and around the world and still have access to Mastercard programs and offers;

- Another advantage is that the Méliuz card has an app where you can track your card statement and cashback (you can track it on the website too);

- And besides, you don't need to have an account to access the credit card, just make the request through the app or the website. This is because the card is not linked to any digital account, and it is not mandatory to have an account at Pan bank or another bank;

- There are several partner stores like Burguer King; Bahia Houses; Netflix; Damn Streak; iFood; Cultura Bookstore; Spotify; Americans; Havana; AliExpress and several other partner stores in a huge list of establishments to bring more options and comfort to customers;

- Ame + Méliuz Program: It is a program that works as a digital wallet where you can shop at stores such as Americanas and Submarino.

Therefore, the Méliuz card brings several exclusive offers and discounts to customers, focusing on the security and transparency of the services provided by Banco Pan!

What are the advantages of the Mooba card?

So, let's get to know the advantages of the Mooba card:

- At first, the first advantage of the Mooba card is the cashback program on the Mooba platform, which has several partner stores so you can make your purchases;

- Another advantage is the cashback program of the Mooba card itself, which has a new program in which the customer can receive up to twice as much cashback;

- And in addition, the Mooba card charges an annuity, however, you can reset this annuity amount, just by following some criteria;

- Another advantage is that the card does not require a minimum income, that is, it is also a good option for people with a dirty name.

Therefore, the Mooba card, which is another option issued by Banco Pan, is also worth it for negative people, as it does not require a minimum income and has proposals to zero the annuity.

What are the disadvantages of the Méliuz card?

At first, one of the biggest disadvantages of the Méliuz card is the fact that there is no virtual card for online purchases. That is, purchases need to be made in physical stores, which becomes a major disadvantage compared to other credit cards today.

Another disadvantage is that the withdrawal function is only available to restricted users. Furthermore, the card does not have a mileage accrual program, which is also very common in other credit cards, being a little less advantageous!

What are the disadvantages of the Mooba card?

Well, one of the biggest disadvantages of the Mooba card is the annual fee. This is because, we already know that most credit cards do not charge annuity amount, however, this amount can be completely reset by customers.

So, to be exempt from the annuity, the customer's monthly expenses must be greater than R$1,500.00 and, thus, the annuity will not be charged in the current month. And if in the next month the customer does not reach the minimum required, just pay the amount of R$15.00.

That is, there will be an exemption from the annuity in all months in which the invoice exceeds R$1,500.00. Therefore, the Mooba card allows you to adapt it to your needs and financial conditions, allowing you to enjoy all the advantages.

Méliuz Card or Mooba Card: Which is Best for You?

Well then, the Méliuz card or Mooba card are safe, transparent card options that offer innovative and attractive proposals so that customers feel really special. And even though there are some disadvantages such as charging an annuity in the case of Mooba, you can solve even this impediment, exempting yourself from the charge!

So, see which of these card options is the best within your interests and needs to make the best choice for you! And if you still have doubts, check out a new card comparison below that we bring in recommended content:

Santander SX card or Original card

The Santander SX card or Original card are credit card options for those looking for security and quality services. Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the payroll loan Auxílio Brasil Caixa

See in this post how you can apply for an Auxílio Brasil Caixa payroll loan and thus have more chances of having your credit approved!

Keep Reading

From popular to imported: Get to know the cars of the candidates for mayor of SP and RJ

Keep Reading

Discover the Inter Kids account

The Inter Kids account is perfect for independent children who want to learn more about financial life with the security of their parents. Check out!

Keep ReadingYou may also like

Consigned Cash Loan: how it works

Do you know the payroll loan? It offers great credit terms, such as a reduced interest rate. As well as the installments are deducted directly from your payroll. Read this post and learn more!

Keep Reading

Bradesco Visa Infinite Card Review 2022

The Bradesco Visa Infinite card is accredited by Visa and gives access to VIP rooms, purchase protection and the Livelo program. Want to know more? Continue reading and check out our review.

Keep Reading

Discover the Mateuscard credit card

With Mateuscard you have several benefits in everyday purchases and installments of up to 24 installments. Learn more in the text below!

Keep Reading