Cards

Itaucard Click card or Superdigital card: which one to choose?

Itaucard Click card or Superdigital card: find out everything about these cards offered by Banco Itaú and Superdigital. They have international coverage, exclusive discounts and the Mastercard Surpreenda program. Check out!

Advertisement

Itaucard Click x Superdigital: find out which one to choose

To begin with, the Itaucard Click card or Superdigital card are two card options with very interesting proposals.

This is because they have offer and discount programs, as well as international coverage and all the credibility that only Banco Itaú and Banco Superdigital can offer.

So, we will show you all the services that these two cards offer, as well as the advantages and disadvantages so that you can make the best choice. Check out!

How to apply for the Itaucard Click credit card

Don't know how to request your Click card? So, calm down, now you’ll know! It has international coverage, discounts on the Itaú bike network and unlimited withdrawals.

How to apply for the Superdigital credit card

If you are looking for a card with a digital account that accepts negative payments, the Superdigital card may be ideal. See how to order yours!

| Itaú Click | Superdigital | |

| Minimum Income | R$ 2,000.00 | not required |

| Annuity | Exempt on expenses above R$100.00 monthly | Exempt |

| Flag | Mastercard/Visa | MasterCard |

| Roof | International | International |

| Benefits | Associated with the flag | Without consultation with the SPC and SERASA low interest rates Ideal for negatives international coverage 5 additional cards |

Itaucard Click Card

So, the Itaucard Click card is a relatively new card, because it was launched in 2019 by Banco Itaú to become a major competitor in the financial market that has been bringing great innovations when it comes to credit cards.

This is because it brings exclusive benefits and exemption from annual fees, that is, if you spend at least R$100 per month, you will not need to pay the annual fee.

Furthermore, the card is available under Visa or Mastercard and also has international coverage.

In other words, you can shop in national and international stores.

Another super advantage is that you can make unlimited withdrawals on the Banco24Horas network and it is also possible to exceed the card's available limit by paying a fee and approval.

Therefore, requesting the Itaucard Click card is very simple, just go to the Banco Itaú website and fill out a form.

After that, just wait for the credit analysis carried out by the bank, which may or may not be approved, according to the institution's own criteria.

Furthermore, you only need to be at least 18 years old and have a regular CPF number.

And so, the bank will only research your financial habits and see how it can help you, so you don't need to worry about the analysis carried out, as it is usually very succinct.

Superdigital Card

Well, the Superdigital card is an ideal financial product for people with a negative name.

This is because Superdigital also does not carry out credit analysis at agencies, such as SPC and SERASA. It also does not require proof of income.

Furthermore, it also offers two models of credit cards: Firstly, it has the prepaid Mastercard Internacional and the virtual card.

After that, there is also the prepaid Mastercard Internacional, which is a card that allows you to make purchases in any store in the world, as well as withdraw money on Banco24Horas networks and also have access to the Mastercard Surpreenda program.

On the other hand, as it is a prepaid card, you need to put money into your Superdigital account to be able to use it.

This is because it works in the cash credit function, that is, the amounts are discounted immediately.

And, in addition, you also have the Superdigital virtual card that allows you to make purchases in online stores.

Thus, it has complete security, practicality and comfort, but, as it is a virtual card, there is no withdrawal function, nor can you pay in installments for purchases.

Therefore, if you are looking for versatility combined with technology and security, the Superdigital card could be a great card alternative for you.

What are the advantages of the Itaucard Click card?

So, among the various advantages of the Itaucard Click card, first and foremost is the annual fee exemption.

This is because, if you spend at least R$100 per month, you will not need to pay the annual fee.

And, in addition, the card is available under Visa or Mastercard and has international coverage, meaning you can make purchases in national and international stores.

Another super advantage is that you can make unlimited withdrawals on the Banco24Horas network and exceed the card's available limit upon payment of a fee and approval.

Plus, you get several exclusive discounts on the Itaú bike network, as well as in cinemas and Itaú bank partners, this provides more comfort when having fun.

Another advantage is that you guarantee access to the exclusive benefits of the Visa or Mastercard brands, such as the Vai de Visa and Mastercard Surpreenda programs.

What are the advantages of the Superdigital card?

Well, the first big advantage of the Superdigital card is the transfers to other banks, which cost R$5.90 per operation, the first of which is free of charge.

And, in addition, you can issue a balance or statement at any ATM in the Banco24Horas network for the amount of R$2.00. This means that it is a great value compared to other cards on the market.

Another advantage is that you can also make withdrawals at any ATM in the Banco24Horas network for the amount of R$6.40.

As well as having access to the extra physical card or duplicate for the value of R$14.90. Furthermore, the bill issuance fee is R$2.90, and you can make withdrawals abroad through the Cirrus Network.

And in addition to all these advantages, the Superdigital card also guarantees customers the right to 1 free withdrawal or transfer per month to other banks and also 1 physical card and 5 additional cards.

Therefore, the Superdigital card has several card options for customers looking for a financial institution that offers credit for the whole family.

What are the disadvantages of the Itaucard Click card?

So, despite so many advantages, the Itaucard Click card also has some disadvantages, such as the mandatory minimum income of R$2,000.00.

And, in addition, there will be an annual fee if you do not spend the monthly R$100.

Another disadvantage is that, unlike other cards on the market, Itaucard does not have a points program.

So, despite having several advantages, it is worth researching other options on the market, such as the Superdigital card, to find out if this is the best alternative for you.

What are the disadvantages of the Superdigital card?

Well, the first major disadvantage of the Superdigital prepaid card is the fact that it does not allow purchases to be paid in installments.

This is because you can only make purchases using the card if you have an available balance on your account, as well as if you do not have pre-approved credit.

And, in addition, to access the digital account it is necessary to make purchases above R$500 per month, to be completely exempt from the annual fee.

Therefore, if you have a bad name, the Superdigital card can be a good alternative, but you need to analyze the disadvantages that the card offers, such as the fact that you cannot pay in installments, which for the majority of Brazilians is a big disadvantage.

Itaucard Click Card or Superdigital Card: which one to choose?

So, the Itaucard Click card or Superdigital card are two card options with different proposals, but which seek to give customers unique experiences when having a credit card.

This is because they offer comfort, exemption from annual fees, a discount program and several other exclusive benefits. Therefore, do a good analysis between them before opting for one or the other.

Furthermore, if you want to know other card options, read our recommended content and check them out!

Santander SX card or Pan card: which one to choose?

The Santander SX card or Pan card are credit card options for those looking for practicality, security and autonomy in using their credit card. Check more here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

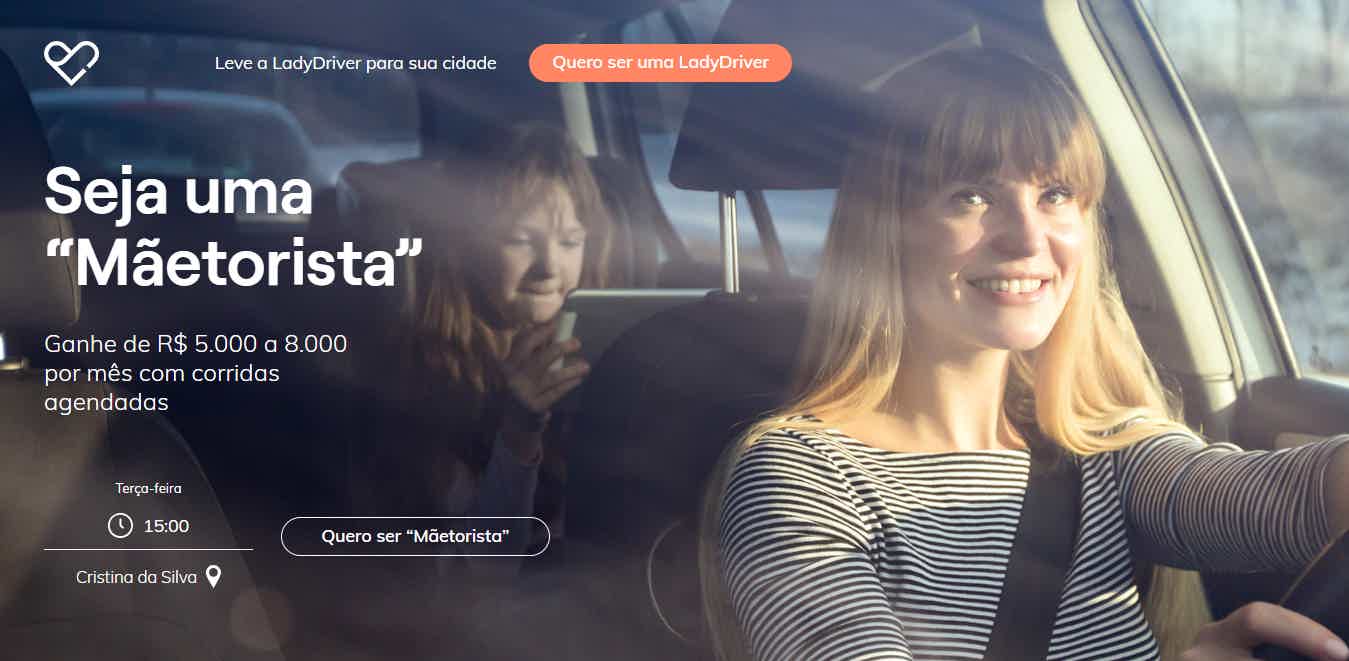

Lady Driver driver: what you need to know

Find out in this post everything about what it's like to be a Lady Driver driver and learn about the main services that the application offers!

Keep Reading

How to apply for the Maré card

The Maré card is a prepaid card with no annual fee, proof of minimum income and attractive rates. Find out how to order yours here!

Keep Reading

Discover the free courses Descomplica

Discover the free Descomplica courses that you can take online 100% and with a special methodology for you to learn faster!

Keep ReadingYou may also like

How to apply for a Mattress Firm card

To have a Mattress Firm store credit card that has no annual fee, you just need to access the official website to apply. Want to know the step by step and what is needed? So check it out here.

Keep Reading

Discover the Provu loan

Provu loan offers credit solutions in a simple and bureaucratic way through its digital platform. With competitive interest rates and installments of up to 36 installments, it can be the ideal solution for organizing your financial life.

Keep Reading

7 credit card options for negative credit with a limit

Did you know that it is possible to find a negative credit card with a limit? No? So, check out the best options on the market below and choose the one that best fits your financial life. Don't miss it!

Keep Reading