Cards

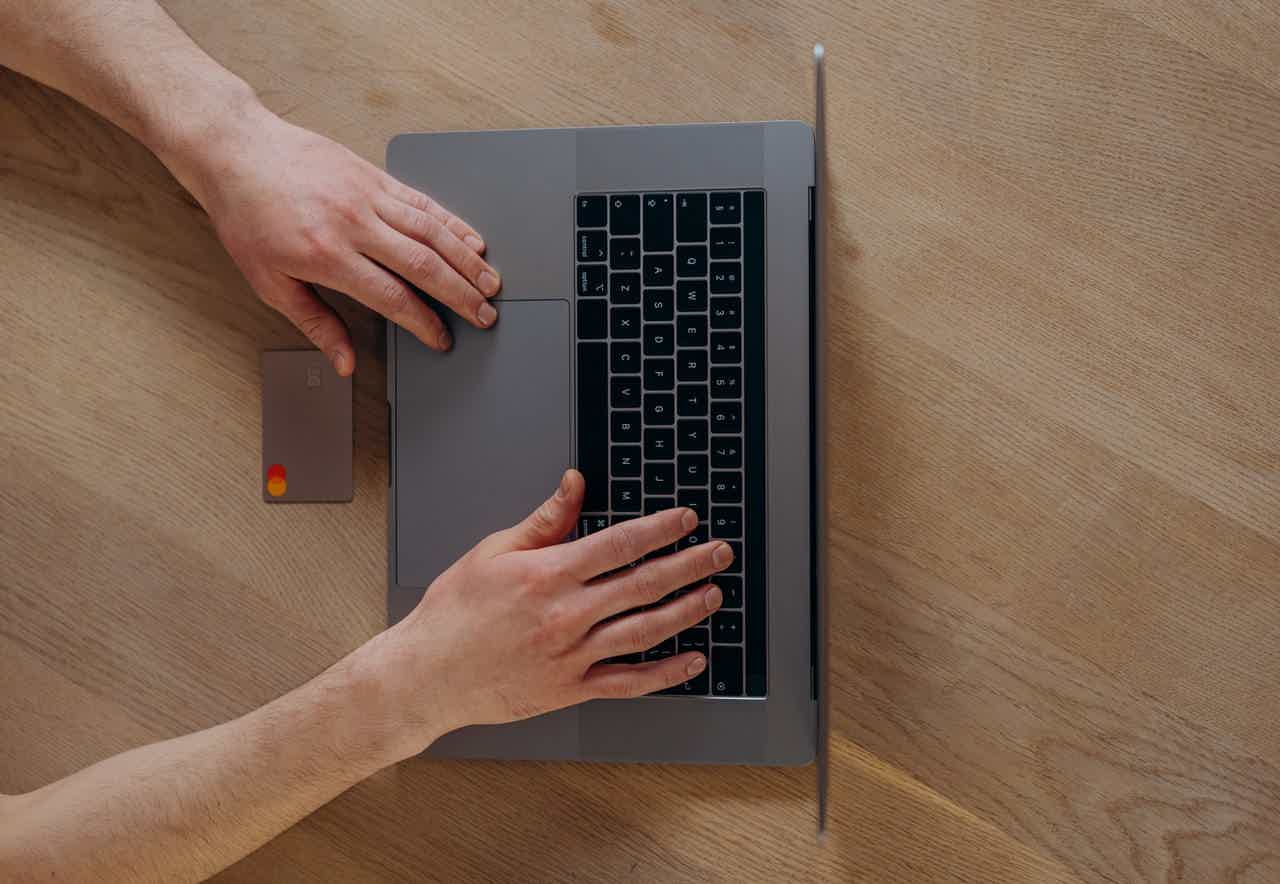

How to get an unlimited credit card

Do you know if there is an unlimited credit card? Read this post and find out the answer to this question, and also check out 3 ways to get a high limit for longer purchases and installments.

Advertisement

Check out the best unlimited credit card options

It is indisputable that having a credit card with a high limit brings several advantages for the customer when making purchases, as well as for obtaining larger installments. In addition, if used properly, it reduces the chances of entering the overdraft. But, after all, is there a credit card with no limit?

If you have this doubt, don't worry, because we'll tell you if it's possible to have an unlimited card. Check out!

So, is there an unlimited credit card?

So, this question is asked by many consumers who are looking for a financial product, such as an unlimited credit card, to make their purchases. So, you don't have to worry about whether or not you have a maximum limit, which can be very interesting.

But, the truth is that there are no credit cards without a limit, because cards are lines of credit offered by financial institutions to consumers, so they can make purchases through them, but always with a maximum limit.

This means that this limit is actually the maximum amount of credit that the financial institution is granting to the customer. Therefore, credit analysis is important, as it is from it that the bank assesses your financial history and determines your limit.

So, even for consumers with a high credit score, the unlimited credit card would be denied. That's because it would be like asking the financial institution for an unlimited line of credit for the consumer, that is, the customer could get out of control in spending and be indebted to the bank.

Therefore, thinking about an unlimited credit card is a reality that, at least for now, in Brazil, is far from happening. But, you can find alternatives on the market with a higher limit than traditional cards.

Which option is similar to the no-limit credit card?

First, although there is no limitless credit card, there is a similar alternative on the market that is a pre-established line of credit.

This means that not even the customer knows what the card limit is, so it has a high limit, but not no limit.

On the other hand, if the financial institution realizes that the customer cannot afford to pay the card, it may deny the credit line. So, be aware of your expenses before applying for this line of credit.

And, in addition, remember that even with a higher credit limit, it is important to be careful with installments.

5 best practices about card installments

A credit card can be a great financial ally, but it's important to pay attention to installments so that finances don't get out of hand!

What is the highest credit card limit?

So there are some interesting high limit card alternatives on the market, check them out!

Home Equity – Banco Bari

First, this line of credit is a great alternative for making payments and shopping. In this case, the contracted loan amount becomes the limit of your card.

So, Home Equity is a real estate loan issued by Banco Bari, also known as a loan with a property guarantee or refinancing, being a credit granted through the presentation of a property as collateral.

This means that, as the customer gives the property as a guarantee of payment to the financial institution, Bari can grant credit with longer terms and lower interest rates.

And, in addition, it is important to emphasize that the property is given as payment guarantee, that is, it remains yours and you can live or rent it, however, if you do not pay the loan, the property will be transferred to Banco Bari.

| Minimum Income | not informed |

| Interest rate | not informed |

| Deadline to pay | Up to 240 months |

| release period | Immediate after approval |

| loan amount | Up to 60% of property value or up to 1 million |

| Do you accept negatives? | Uninformed |

| Benefits | Reduced interest rate; Online simulation; Extended payment term. |

Inter Limit Invested

Now, let's talk about the Inter Limite Investido card, in which any amount you invest can be converted into a limit for your card.

So, in Inter Limite Investido, you invest any amount from R$100.00 and this amount will be converted into a limit for your credit card, so the more you invest in your card, the money will continue to be applied and yielding 100% of CDI.

And, in addition, if you are part of Inter's investment community, you can receive up to 102% in return from the CDI, this means that the card is not a prepaid card, but works as an investment modality.

In addition, the card has an international Mastercard brand, that is, you can enjoy the advantages of the brand, such as the Mastercard Surpreenda program, as well as 24-hour assistance.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Cashback; Mastercard Surprise Program. |

How to apply for an Inter Limite Invested card

See how to apply for the Inter Limite Invested card in the comfort of your home, with all the security, practicality and ease you need.

Havana card

So let's talk now about the Havan card. It has a limit based on the customer's financial history, but the more you use the card, the higher the limit.

First, the Havan card is a non-branded financial product created exclusively for customers who shop frequently at Havan chain stores. This is because the company seeks to offer comfort, security, discounts, promotions and differentiated installments.

And, in addition, one of the advantages of this card is the credit limit, because, when performing a credit analysis based on the customer's financial history, Havan allows you to request an increase in the limit, as long as you are using the card frequently. .

In addition, the Havan card also brings other advantages such as a free copy of the card, exemption from issuing fees or annuities, flexibility in choosing the expiration date, additional card for dependents over 16 years of age, grace period of up to 40 days for the first purchase and online statement query at any time.

So, there is no need to worry about this, because the more you use the Havan card, the more limit you can use.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | no flag |

| Roof | National |

| Benefits | Up to 40 days to pay for the first purchase; Limit increases according to purchases; Differentiated installments. |

How to apply for the Havan card

Although it can only be used in chain stores, the Havan card offers many benefits at the time of purchase. Next, see how to request yours in a simple and practical way.

How to get a credit card with a high limit?

First, we recommend that you have your name unrestricted from the credit bureaus.

This is because names with restrictions tend to have difficulties, including gaining access to a credit card or financial loan.

And, in addition, it is also recommended to have a high score, because the higher your score, the more limits your card may have. As well as, people with high income also usually get approved to have high limit.

Next, we bring you recommended content with several options for credit cards with different limits from Banco Itaú, so that you can choose the best alternative for you. Check out!

Discover all Itaú cards

Do you know all Itaú cards? Today, we are going to present the main cards so that you can choose the best option according to your lifestyle.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Will Bank Card or Banco Pan Card: which is better?

Will Bank card or Banco Pan card? Which one is the best? Both are international and with several benefits. Check out!

Keep Reading

Digio card review 2021

Meet the Digio card review. It has international coverage, does not charge revolving interest and also has the benefits of the Visa brand.

Keep Reading

Discover the Digimais credit card

Get to know the digital credit card, an ideal card for people with a dirty name and who want more practicality in their daily lives.

Keep ReadingYou may also like

Discover the ActivoBank Premium current account

At ActivoBank, when you subscribe to the Premium account, you have access to numerous benefits such as: card with no annual fee, unlimited transfers, free insurance, discounts on household expenses, etc. Take the opportunity to get to know this account and see how to request it in the following post.

Keep Reading

Discover the Leroy Merlin PT credit card

Do you know the Leroy Merlin PT credit card? It is exclusive to stores in Portugal. It also offers many benefits, such as discounts and special payment conditions. Read this post and learn all about it.

Keep Reading

Black Sugar Loaf Card: how to apply?

Having a Pão de Açúcar Black card to call your own is simple, easy and completely digital. Do you want to see it? Check out the whole step by step and learn how to apply for your credit card today. Learn more later.

Keep Reading