Tips

5 cards that don't require a high Serasa Score

Do you have a dirty name, a low score and need a negative credit card? So keep reading and we'll give you 5 options! Check out!

Advertisement

Know options for those with low credit scores

Initially, the credit card is a widely used form of payment in Brazil, as it offers security and practicality when making purchases. The fact is that people with a dirty name encounter some problems when applying for one, but is it possible to have a credit card for negatives?

Well, let's show you 5 credit cards that don't require a high score and have several advantages such as international coverage, for you to shop in national and international stores, zero annuity and even incredible offer packages! Check out!

Know options for those with low credit scores

Well, the credit score is a score assigned to consumers, which is based on financial habits regarding the payment of debts, that is, the ratings and scores of the score go according to the consumer's financial history.

So, for example, if you pay your bills on time, if you don't have any financial debts in your name, and if you shop frequently, your score will probably be high. The fact is, if bills are not paid on time, or if your name is dirty, your score will be low.

In this, the chances of getting a credit card also decrease, as most banks seek to offer cards to customers who have a high score, that is, who have a history of “good payer”. But, don't worry, you can find cards that accept a low score. Check out!

Impact Bank Card

At first, the Impact Bank card is a prepaid card that can be requested even if you have a dirty name, because it works in the credit function, but purchases are only debited if you have an available balance in your account as a prepaid card.

And in addition, the Impact Bank card is also available in a virtual version for online purchases. Impact Bank is a digital platform that returns R$0.10 for impact initiatives with each fee-based transaction carried out by customers.

How to apply for the Impact Bank Card

Learn how to apply for an Impact Bank card, which offers a Mastercard brand, international coverage and several other exclusive benefits! Check out!

neon card

Well, the Neon card is another credit card model for negatives. That is, it is an annual fee-free card, with international coverage, that is, you can shop in national stores and also in stores outside Brazil.

And in addition, the Neon card is linked to the Neon account, that is, to have access to the card, it is necessary to open an account with Neon. In this account, you can make transfers, deposit slips and several other services that are found in the Neon app.

To open an account at Neon, you just need to be 18 years old and have your CPF numbered, install the Neon application and register your personal data. After that, it is necessary to wait for Neon's credit analysis and after approval, the credit function is unlocked!

next card

So, the Next card is a credit card for negatives with international coverage, it has a Visa flag, it is free of annuity, with a cashback program, and it has been offered by Bradesco since 2017.

In the Next account, you can make bill payments, transfers, withdrawals and other operations. And in addition, to apply for the card, just download the application and open the digital account, which is completely free!

This account is accessible to anyone over 18 years of age and the bank usually takes 7 business days to approve and release the card!

How to apply for the Next card step by step

Find out now the exact step by step for you to order the Next card without ado, the process is 100% online.

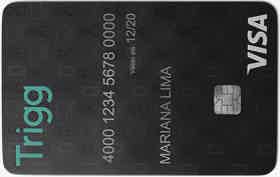

Trig Cardg

Well, the Trigg card has a cashback program and proximity payment bracelet, super technological and interesting for customers. To apply for the card, it is not necessary to prove income, being ideal for people with low scores!

And in addition, you can manage all card movements directly in the Trigg application, which does not charge annuity in the first 3 months!

How to apply for the Trigg card

See how to apply online and other ways to answer questions to get your Trigg card and enjoy all the benefits!

Superdigital Card

So, the Superdigital card belongs to the Santander bank, has a Mastercard flag and international coverage. And it's also a great credit card for negatives!

To access the Superdigital card, you just need to be over 18 years old and have a regular CPF, with no consultation with credit bureaus such as SPC and SERASA, so even with a dirty name, you can have your registration approved!

And in addition, the card has no annual fee, however, it works only in prepaid mode. That is, when shopping, you use it as credit, but the amount is deducted from the available balance in your account.

How to apply for the Superdigital credit card

If you have doubts about how to apply for the Superdigital credit card, after this text you will definitely not have any more!

How to increase your credit score?

Well, as we mentioned, having a low credit score can become a problem, as it prevents you from opening a bank account, applying for a credit card and even getting a loan! Hence the importance of keeping score numbers high!

There are several ways to improve your credit score, and the first one is to clear your name. That's because, the dirty name, causes the credit score to drop a lot, indicating that your financial history has serious financial pendencies!

So clearing the name is the first step to raising the credit score!

Another tip is to pay the bills before the due date, as it shows the credit market that you honor your financial commitments.

And in addition, keeping the data up to date helps to increase the score, as it demonstrates that you have no problem exposing personal data!

Finally, make the Positive Registration and try not to frequently ask for credit from financial institutions! Through the Positive Register, companies can access the purchase history and not just the negative CPF history!

So, the Positive Register helps to increase the credit score and, with a high score, it is even easier to have access to credit cards, not having to be just a credit card for negatives!

Complete guide to increase your score in 2021

Want to know how to increase your score in 2021? Then read our text and clear all doubts on the subject. Good reading!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Online loan is with Credisfera

Do you want to apply for a loan to fix your financial life without leaving the comfort of your home? If so, then get to know Credisfera right now.

Keep Reading

Itaú Consigned Loan or C6 Consig Loan: which is better?

Want to decide between Itaú Consignado loan or C6 Consig loan? In today's article we will show you the pros and cons of both.

Keep Reading

How much does a 2022 App Driver make?

Find out firsthand how much an app driver earns in 2022 and see if it's worth investing in the profession these days.

Keep ReadingYou may also like

Nubank account or Digi+: which is the best digital account?

With a Nubank or Digi+ account, you have access to more payment facilities in your daily life, an investment platform and much more. To learn more about each of the digital accounts, just keep reading!

Keep Reading

Right Agreement: negotiate Santander debts

Do you have outstanding debts with Banco Santander? Don't despair, this can be resolved! Find out here how the Agreement Right platform can help you stay up to date with your finances.

Keep Reading

Card for negative C6 Bank: how it works

If you are looking for a credit card to organize finances, C6 Bank may be the ideal option. Thus, you can apply even if you are negative and enjoy all its advantages, such as international coverage, the Mastercard Surprise program and much more. Meet here!

Keep Reading