Cards

Corinthias BMG credit card: what is Corinthias BMG?

Do you already know the Corinthians BMG card? No? So read on, because we're going to tell you all about this card! Check out!

Advertisement

Corinthians BMG credit card

So, the Corinthians BMG card is a card that offers payments at any time of the day, free transfers, cell phone recharge and several other services. Plus, you guarantee an exclusive digital account for timão fans!

Today, we are going to show you another useful information about this card! Check out!

How to apply for Corinthias BMG card

Do you want to learn how to apply for the Corinthians BMG card with international coverage, cashback program and exclusive digital account? So read on to learn.

| Annuity | free |

| minimum income | on request |

| Flag | MasterCard |

| Roof | International |

| Benefits | Credit withdrawals at Banco24Horas tellers No SPC/Serasa consultation Cell phone recharges Credit life insurance Expense control via the app Mastercard Surprise |

Advantages Corinthians BMG

So, the Corinthians BMG credit card is a card that has the Mastercard brand, that is, you guarantee access to all the benefits of the Mastercard brand, such as the Mastercard Surpreenda program.

And in addition, it has international coverage, so you can shop at stores in Brazil and abroad, as well as credit withdrawals at Banco 24 Horas cashiers.

It also has cell phone recharges, free transfers and bill payment at any time of the day, as well as expense control via the app and credit life insurance!

Another advantage is that the bank does not consult the SPC and SERASA, that is, even with a dirty name you can have access to the card! Too much isn't it?

Corinthias BMG main features

So, two years ago, Banco BMG and Sport Clube Corinthians Paulista launched Meu Corinthians BMG, a digital account that comes with your Corinthians credit card!

This year, the number of accessions to the digital account grew by around 50%, hitting the mark of 150,000 accounts opened! There, you can make free transfers 24 hours a day, pay bills and have access to several other exclusive offers!

Who the card is for

So, this card is ideal for customers looking for interesting and exclusive offers when shopping, as well as great options for paying bills, having access to a free 100% digital account with international coverage and ideal for negatives!

Therefore, apply for your Corinthians BMG card today! But if you are in doubt, in the recommended content below, we bring you a post with even more information about this card! So check it out.

Discover the Corinthias BMG credit card

Get to know the Corinthias BMG credit card and see if this card is what you need right now! Ah, he is ideal for negatives! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

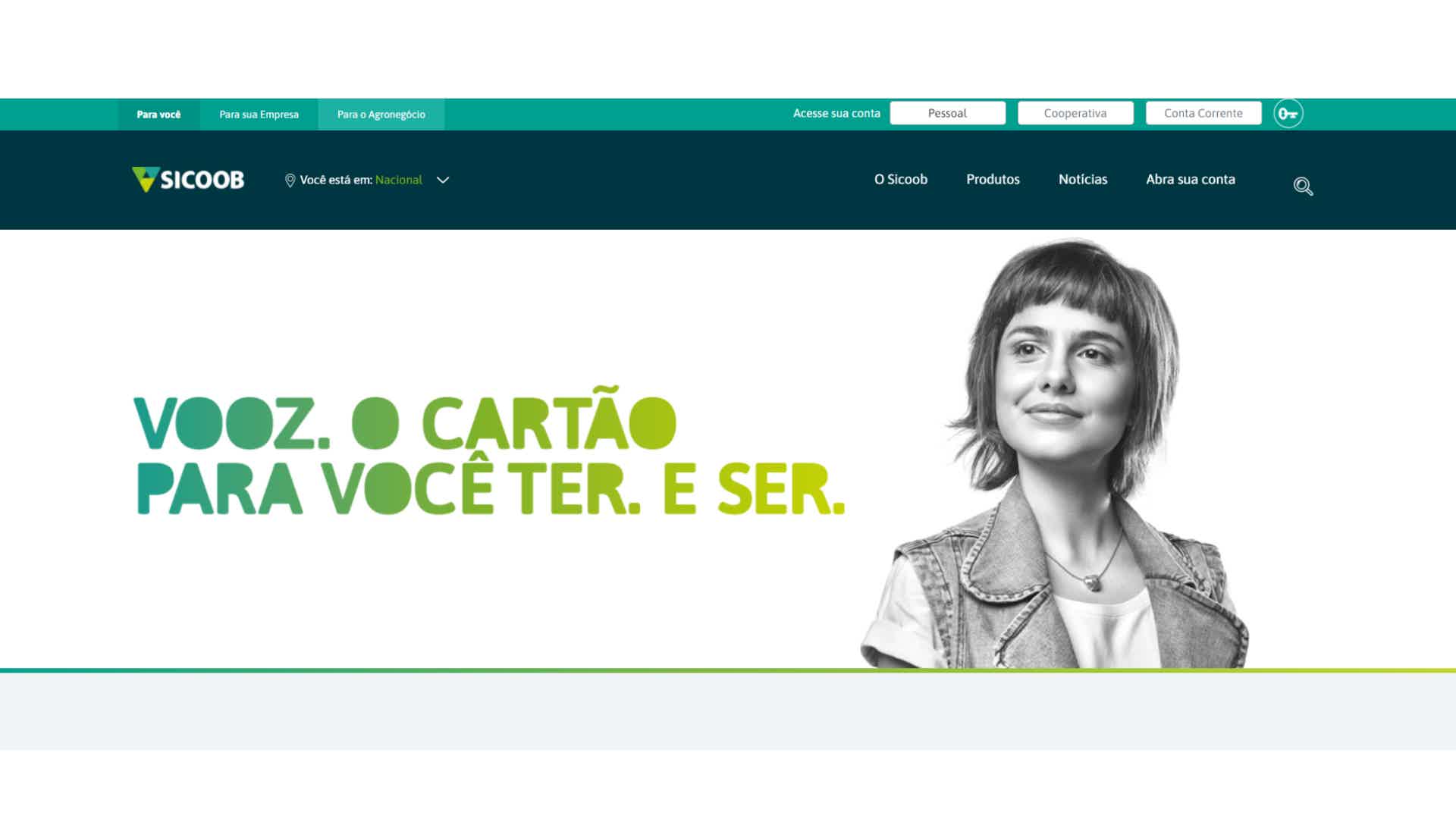

How to apply for the Vooz card

Find out how to apply for the Vooz card. It is international, has two flag options and has contactless technology. Check out!

Keep Reading

Mercado Pago Card or BTG+ Card: which one to choose?

Even with different profiles, these cards do not charge annuity with investment chances! Decide between the Mercado Pago card or the BTG+ card.

Keep Reading

Is it worth opening a savings account?

Opening a savings account can bring security, but it is no longer so advantageous in terms of income. So is it worth it? Check it out here!

Keep ReadingYou may also like

Discover the postgraduate courses that are trending in 2021

Knowledge is an essential element for professional prominence. So, check out our postgraduate course tips that are trending for 2021 here.

Keep Reading

Did you receive IR refund in 2021? See how to declare it on this year's IR

Those who received the Income Tax refund last year are obliged to declare the amount in the 2022 IR so as not to run the risk of falling into the fine mesh! Check out the step-by-step process to complete the document.

Keep Reading

Do you need to have an account at Caixa to apply for the new microcredit of up to R$3 thousand?

Anyone who is a micro-entrepreneur or wants to start their own business can now count on the help of Caixa Econômica. Through Sim Digital, consumers can borrow up to R$3 thousand from the bank to invest. However, is it necessary to have an account opened at the institution to apply for the line of credit? Check out!

Keep Reading