Cards

Caixa SIM card or Digio card: which one is better?

Both cards have the Visa brand, but the SIM also has the Elo brand option. Furthermore, they are international and do not charge an annual fee. Let's meet?

Advertisement

SIM box x Digio: find out which one to choose

It is not difficult to imagine the various credit cards that exist on the market and they appear to us all the time, whether on television or the internet, making the choice of which one to choose even more complicated. With that in mind, today we are going to help you by presenting you with two new options: Caixa SIM Card or Digio Card.

In this sense, you don't even need to worry as we won't complicate your mind any further, but simply help you better understand how they work.

In the end, if it's still not what you need, we'll provide new content with two other cards so you can make a new comparison and then request the card made for you. Check out!

| SIM Box Card | digital card | |

| Minimum Income | not informed | not required |

| Annuity | Exempt | Exempt |

| Flag | Visa or Link | Visa |

| Roof | International | International |

| Benefits | No annual fee, full control through the app, reduced interest and brand benefits | No retroactive interest, Vai de Visa program, Digio Store. |

How to apply for a Caixa SIM credit card

Do you have a dirty name? Understand the step-by-step process to apply for your Caixa SIM card and count on international coverage and several other benefits.

How to apply for Digi card

The Digio card has been successful among digital bank cards. So, see today how to get it and get rid of the annuity without giving up benefits.

SIM Box Card

First, let's get to know the Caixa SIM card. With it, you can make purchases in Brazil and other countries as it is an international card.

And, in addition, it is more accessible and has low interest rates, on the credit card itself and also on the special check.

And we know that Caixa always surprises us with its products, right? So, Caixa SIM has life insurance and even covers the credit limits if the holder dies, all you have to do is pay the monthly fee of R$25. Incredible isn't it? In fact, the fee is returned as a bonus to your cell phone.

To pay for your purchases, just approach without having to enter your password and that's it, payment made safely and quickly!

digital card

Hey, do you want to know about a new credit card full of advantages? So, know that Digio may have what you need! Digio is a financial institution that offers incredible financial products like the Digio credit card. It is international and has a Visa flag.

In this sense, you can participate in several promotions and exclusive conditions not only for the card, but also for the Visa brand, in addition to purchases in more than 40 million establishments in Brazil and other countries in online and physical purchases.

To request the card, apply online and wait for it to be released. After that, all you have to do is wait for the credit analysis, which varies with each person.

What are the advantages of the Caixa SIM card?

Caixa Econômica Federal always provides quality financial products to its customers and the Caixa SIM card is an example of this. Firstly, it is free of annual fees, meaning you don't have to worry about that annoying fee to use the card's services. In fact, interest rates are low.

And, in addition, you can control everything that happens with your credit card through the Cartões Caixa app and you can even choose which brand you use for your card: Visa or Elo.

At Caixa SIM Visa, you participate in the Vai de Visa program and can exchange points for products in addition to earning the Extended Warranty when purchasing a product.

At Caixa SIM Elo, you can purchase Elo WI FI, Clube Elo Mania to exchange for various benefits on the Elo platform such as Home Auto in addition to Basic Residential, Emergency Auto and other advantages.

Won't be able to pay your bill for next month? Relax, Caixa allows you to pay in up to 36 installments and you also receive everything via email or even SMS for free and you can control everything, once again, via the Caixa Cards app.

And speaking of installments, you can also pay for your purchases in up to 24 interest-free installments!

Finally, you can also request an additional card and make purchases in Brazil and other countries as coverage is international!

What are the advantages of the Digio card?

To choose a quality credit card, you need to know the advantages it offers. Initially, Digio does not require a maintenance fee or annual fee, meaning you can take advantage of the company's services without paying anything for it.

And you know those moments when you find yourself full of unpaid bills and financial problems and can't pay your card bill? Don't worry, Digio doesn't charge revolving interest!

Speaking of cards, you can also participate in DigioStore, a store that belongs to Digio bank and you can purchase various services and products at special prices.

The brand is also an important requirement for a credit card and the Digio card is the Visa brand. With it, you participate in the Vai de Visa program and can accumulate points and exchange them for products.

What are the disadvantages of the Caixa SIM card?

Despite being a great credit card as we showed previously, Caixa SIM has a small disadvantage, which is the fact that only people over 18 years of age or emancipated 16 years of age can apply for the credit card.

Therefore, if you are still a minor, you will need to look for other card models to apply.

What are the disadvantages of the Digio card?

As with other financial products, the Digio card also has disadvantages. For starters, you won't be able to pay the minimum bill if you can't pay the entire bill.

Furthermore, the card only has a credit function, meaning you need to pay in installments.

Caixa SIM Card or Digio Card: which one to choose?

Now that you know how the Caixa SIM card or Digio card works, you can see which is the best alternative for you. Remembering that, both are exempt from annual fees and international coverage in addition to the Visa brand, which is the second largest in the world.

However, the SIM card also has the Elo flag so you can choose the flag you think is best. Still, if none of these options are what you want in the world, there are others available on the market, see the recommended content below.

Access Card or CEA Card: which one to choose?

Are you negative, need to buy on credit and don't know what to do? On the other hand, do you have a high score and want a hassle-free credit card? So decide.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

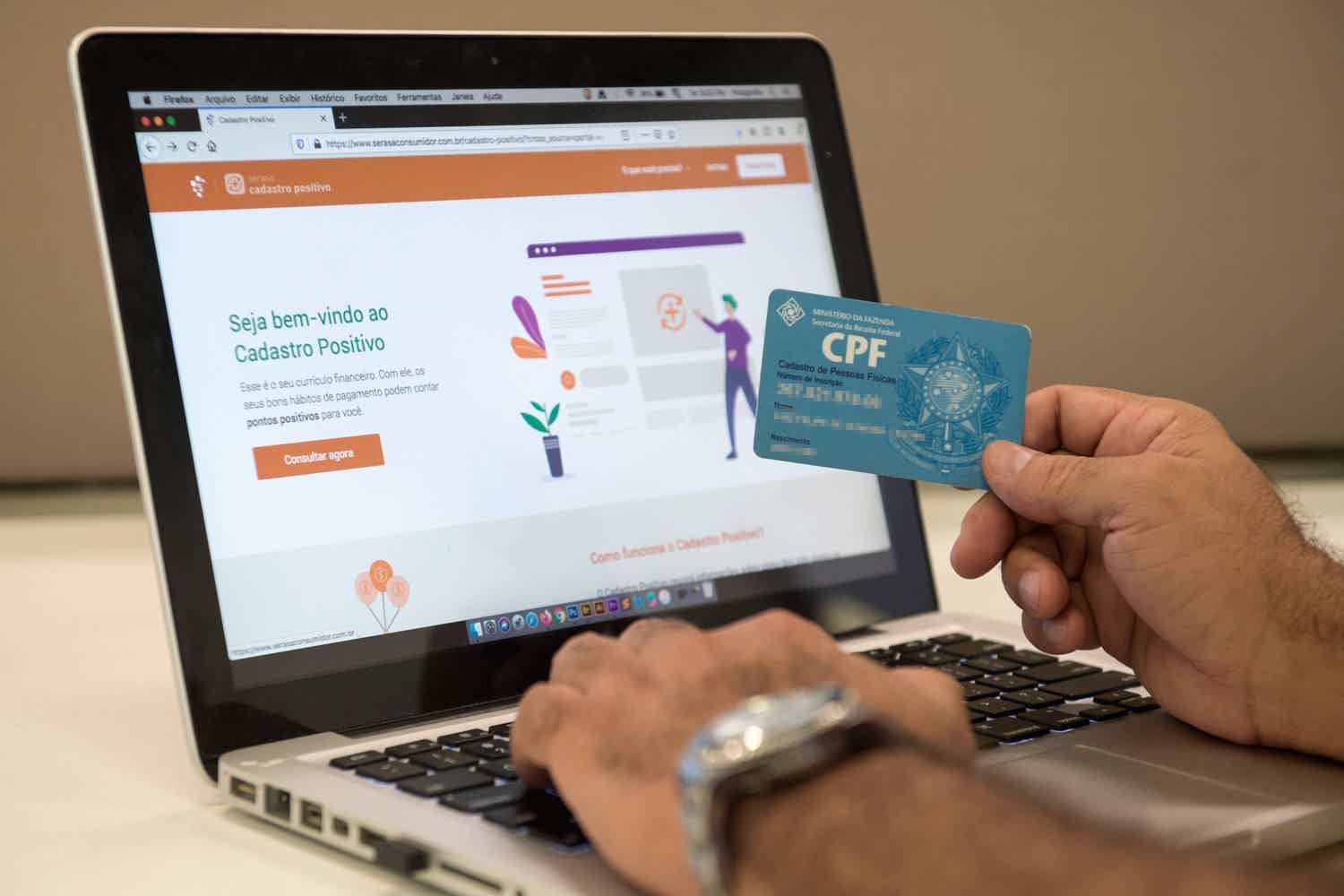

Monitoring CPF: how important is it for you?

Did you know that monitoring your CPF is important to protect your anti-fraud data? See why and how to monitor your data and avoid fraud

Keep Reading

Learn how to make money with your own business

Check now the whole registration process of the Rommanel reseller and see how much you will have to invest to resell the jewels.

Keep Reading

How does the Bradesco PoupCard work?

Do you know the Bradesco PoupCard? With it, you keep your savings and have a credit card. See if it's worth it in this article!

Keep ReadingYou may also like

How to apply for Sollus card

Do you want a card with international coverage and annuity waiver? Then find out how to apply for the Sollus card.

Keep Reading

Discover the EuroBic Base current account

Want a checking account that has all the essentials and nothing more? Then take the opportunity to discover the EuroBic Base account, ideal for those who don't want complications. Find out more information in the post below.

Keep Reading

Housing loan interest: will the installment go up?

Interest will go up! And now, how is my home loan? We created complete content so that you know everything about it and plan for high interest rates. Continue reading and find out more!

Keep Reading