Cards

Caixa Elo card or Digio card: which is better?

On one side, a digital bank card. On the other, a card from one of the largest financial institutions in Brazil. Both with international coverage and exclusive conditions, but one is exempt from annual fees. So, what is the best option?

Advertisement

Caixa Elo x Digio: find out which one to choose

What do you expect to find on a credit card? Exemption or low annual fee? Flag that allows you to shop at various establishments in addition to participating in programs? Minimum income that allows you to apply for the card? No matter what criteria you use, the Caixa Elo Card or Digio Card may have what you need.

In this sense, in this article, we will show you the main characteristics of both cards as well as the positive and negative points and also direct you to the request so that you can request your card today! Check out!

| Cash Card Link | digital card | |

| Minimum Income | not informed | not required |

| Annuity | 12x of R$ 17.25 | Exempt |

| Flag | Link | Visa |

| Roof | International | International |

| Benefits | Points Program and Elo Flex | No retroactive interest, Vai de Visa program, Digio Store. |

How to apply for the Caixa Mais card

The Caixa Mais card has an exclusive points program that offers you an initial bonus of 2,000 points when you pay your first invoice.

How to apply for Digi card

The Digio card has been successful among digital bank cards. So, see today how to get it and get rid of the annuity without giving up benefits.

Link Box Card

To start, let's get to know Caixa Elo. It is an international card and as the name suggests, it has the Elo flag.

In this sense, it is a card that allows you to participate in all Elo programs in addition to Caixa advantages such as the Caixa Points Program, as well as being a great card option for people with low income.

On the other hand, if you like to shop in physical and online stores in Brazil or other countries, you will also be able to do so through the Discover or Diners Club Internation brands and, for withdrawals, look for the Pulse brand at ATMs.

To apply for the card, the requirements are to be over 18 years old or over 16 years old, emancipated or assisted by a father with his own income.

Finally, the annual fee for the card is R$207.00 in 12 installments of R$17.25 and you are guaranteed a 50% discount on the first annual fee.

digital card

To choose the Digio card, let's learn a little about Digio bank. It is a multiple bank, which operates through a digital platform for individuals and belongs to Banco Bradesco. In fact, it offers several financial products and services such as cards and loans.

In this sense, the card is international and has a Visa brand, which is the second most used brand in the world, so you can use it in thousands of establishments.

Furthermore, the request is usually very careful, as the credit analysis will depend on each person, as well as the limit also varies a lot. In fact, to apply, just make the application online and wait for the card to be released!

What are the advantages of the Caixa Elo card?

And the Elo card? It's full of advantages for you. Firstly, you can pay in installments for your purchases interest-free and without a down payment, in addition to being able to pay in installments for your airline tickets and tourist packages, national and international, as long as they are in Reais.

And in addition, you get a bonus of 2,000 points that will be credited right after you pay the invoice for your first purchase and 1.2 points for U$1.00 spent.

On the Elo Flex platform, you will find several advantages in the Pet, Life, Auto and Home categories as well as other categories and you can also exchange the advantages for others that better match what you need. So, you can exchange as many benefits as you want within your card limit.

In fact, Caixa Mais Elo already comes with 5 great Flex advantages, Elo Wi Fi, Basic Residential, Emergency Auto, Installation and Fixing, Elo Mania Club, which can all be exchanged at Elo Flex for others that suit your preferences and are not within the five.

You can also participate in the Caixa Points Program, which works as a rewards system that grants points proportional to the use of your Caixa Elo Mais Card. This means that purchases you make in Brazil or other countries automatically accumulate points.

After that, all you have to do is redeem and use it in the programs: Tudo Azul, Smiles, LATAM Pass, Tap Miles&Go and Dotz.

To make your credit card, the limit will be available according to the credit analysis, being at least R$1,000.00 and you can still finance the outstanding balance of the factor, even for purchases outside Brazil after paying the minimum amount. your invoice.

Finally, you can still make your purchases that you have up to 40 days to pay for. So, what are you waiting for to request your Caixa Elo?

What are the advantages of the Digio card?

Now that you know how Digio works, let’s learn more about its advantages? Initially, the card is exempt from annual fees, that is, you don't pay any fees even if you don't use the card, that is, you haven't made any purchases? You don't pay anything either!

Digio also has DigioStore, a platform with products and services with exclusive conditions for Digio bank customers.

And besides, if you can't pay your card bill, don't worry, you don't have to pay revolving interest.

In fact, the card has a Visa brand and you can sign up to participate in the Vai de Visa program. With each purchase you make, you accumulate points to exchange for products or services.

What are the disadvantages of the Caixa Elo card?

Despite several advantages, Caixa Elo has disadvantages. The biggest disadvantage is that the card is only permitted for adults over 18 or those aged 16 who have been emancipated.

Furthermore, Caixa Elo charges an annual fee, which is a disadvantage compared to other credit cards on the market.

What are the disadvantages of the Digio card?

Among the disadvantages, Digio does not allow you to pay the minimum bill, as well as the card only works in the credit function.

Caixa Elo Card or Digio Card: which one to choose?

Now that you know how the Caixa Elo card or Digio card works, you can compare it with your financial situation to know which is the best option for you. In fact, both have international coverage and unique conditions, but Elo charges an annual fee.

On the other hand, if none of these options are what you want in the world, there are others available on the market, see the recommended content below.

Caixa Mais Card or Caixa SIM Card

Confused about which Caixa card is best for you? Check out our comparison between the Caixa SIM Card and the Caixa Mais Card below!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Check out how to buy a ticket on Decolar with up to 60% discount

Understand how to buy airfare at Despegar and save a lot of money, discover all the services on the site and see if it's worth it.

Keep Reading

How to find the best mechanic jobs

Find the best mechanic vacancies here, understand how to apply and how to have a resume that attracts the attention of the recruiter.

Keep Reading

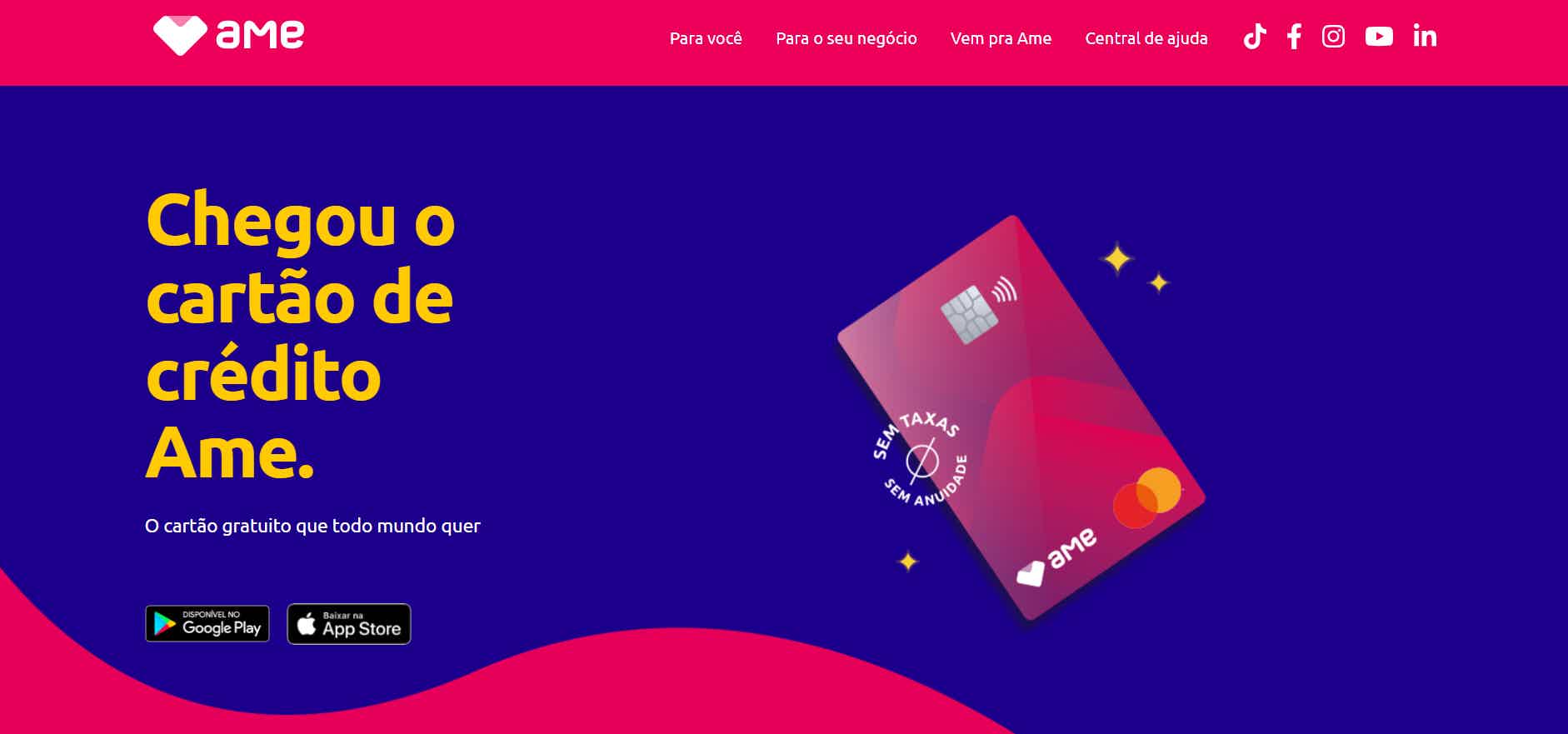

How to apply for AME card

The AME card offers exclusive benefits, in addition to cashback and international coverage with the Mastercard brand. See here how to apply!

Keep ReadingYou may also like

Méliuz should launch credit card without magnetic stripe in 2022

With the aim of innovating once again in the financial market, Méliuz enters the new year full of novelties for its customers. So, the most recent one is the issuance of a card without a magnetic stripe, with payments only by approximation. Understand.

Keep Reading

Discover the BIG Serviços Mínimos current account

Are you looking for an account that has the basics to take care of your money on a day-to-day basis? Then take the opportunity to learn about BIG's Minimum Services account and enjoy exclusive benefits. Learn more below.

Keep Reading

Discover the Caixa Nacional card

Do you want to have a card that allows you to make domestic purchases in cash or in installments, with a minimum initial limit of 800 reais? See here everything about the Caixa Nacional credit card!

Keep Reading