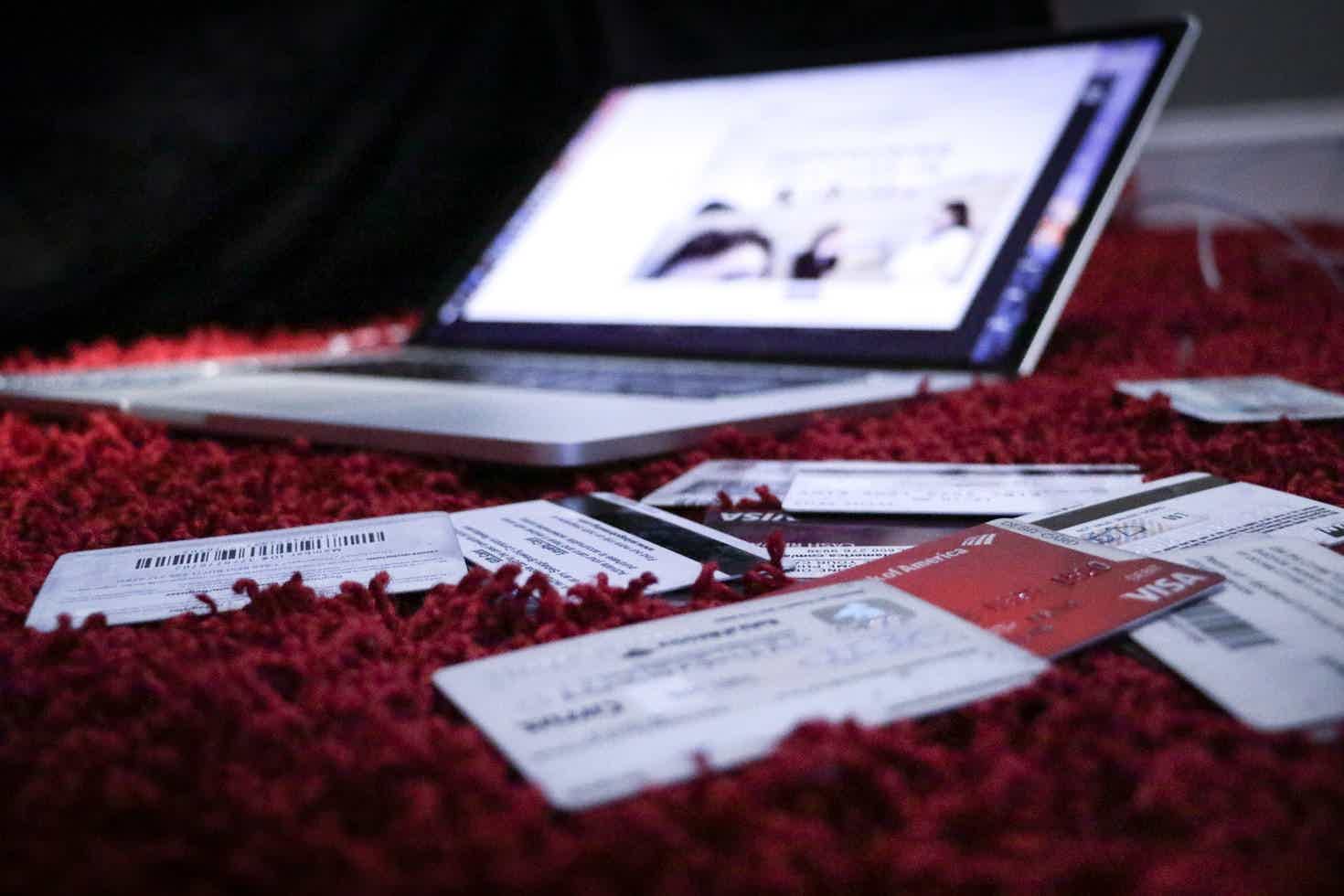

Cards

Online C6 Bank card: no annual fee and with a points program

C6 Bank allows you to access the points program on all cards and also have the C6 Tag. Find out in this post what else you can have with this card!

Advertisement

Access a points program that never expires

The C6 Bank online card is an annual fee-free credit card option in its two main models that offers a great points program and several benefits from the Mastercard brand.

Furthermore, the C6 Bank card online is one of the few on the market where you can customize the look of the card. So, you can add the color you prefer and the name you most want on your card.

| Annuity | Exempt – C6 Bank Exempt – Platinum 12x of R$ 85.00 – Carbon |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Atoms points program C6 Toll and parking tag Mastercard Surprise Program |

In this way, the C6 Bank online card becomes a very attractive option for those who are more adept at digital banking and want to access a card with practicality.

But, before requesting it, it is important to know the main features of each of the C6 Bank cards to see what it can offer. To find out, just keep reading this post!

What are the C6 Bank cards?

Namely, this digital bank works by issuing 3 credit card options. They all give you access to the points program and have the Mastercard brand.

Furthermore, they can be customized with available colors and allow users to access the C6 Tag by paying just R$ 5.00 per month to use them.

Regarding annual fees, the C6 Bank and C6 Platinum cards continue to have a completely free annual fee. Only the Black option has an annual fee, but it is possible to receive a discount of 100% on the value.

Below, you will learn more about each card and learn how the request for each card works.

C6 Bank Card

Starting with the most basic online C6 Bank card option, which manages to offer many interesting features for users.

Using the C6 Bank card, you can make international purchases and participate in the points program, where for every real spent you receive 0.05 points. However, it is possible to access more points by subscribing to a program plan.

In addition, the card gives access to the Mastercard Surpreenda program, where you can receive exclusive discounts and promotions from the brand's partner stores.

C6 Bank Platinum Card

The Platinum option of the C6 Bank online card also allows you to make international purchases and access the same points program.

However, from there you can access more Mastercard benefits, such as:

- Concierge services;

- Mastercard Surprise;

- travel assistant;

- Car insurance;

- MasterAssist Plus;

- And many others!

In short, you can have all the benefits offered by the Mastercard Platinum banner to enjoy your purchases and travels with peace of mind.

C6 Bank Carbon Card

Finally, the last C6 Bank card option online is the Black card, which can offer more sophisticated benefits to those who access it.

Starting with the fact that in the points program you can receive 2.5 points for every dollar spent.

Additionally, you can have up to 4 free C6 tags, unlimited access to VIP lounges in Guarulhos and up to 4 free access to Mastercard Airport Experiences lounges.

You can still access all the benefits of the Mastercard brand in the Black version.

How to request C6 Carbon card

Option with exclusive and more sophisticated benefits. Check here how to request it.

How do C6 Bank cards work online?

In summary, C6 Bank bank cards allow you to make purchases using credit and debit functions both in Brazil and abroad.

And as all cards participate in the points program, when you request them and make a purchase, you automatically start accumulating points.

Therefore, unlike other options on the market, there is no need to register with it to access the points program. This function is already activated.

Furthermore, when requesting any of the cards, you can request at least 1 additional card free of charge. The only exception is the C6 Carbon card, which allows you to request up to 6 additional cards free of charge.

Finally, the C6 Bank card online also allows you to access a virtual card. So, while you wait for your physical card to arrive, you can shop online with it.

What is the annual fee for the C6 Bank card?

In principle, only two C6 Bank cards are completely free of annual fees, namely the C6 Bank and the C6 Platinum.

The C6 Carbon card has an annual fee of R$ 85.00 per month, as it offers more sophisticated benefits.

However, it is possible to receive discounts on the value of annual fees at three times:

- 50% discount when making purchases from R$ 4,000.00 on the card;

- 100% discount when making purchases from R$ 8,000.00 on the card;

- 100% discount when investing from R$ 50 thousand in C6 Bank CDBs.

Therefore, despite having annual fees, it is still possible to make it completely free.

What is the limit for the C6 Bank card online?

Knowing the limit that can be released on a credit card option is information that many people seek, as it is from this that it is possible to know the purchasing power we have with a given card.

However, the limit value is determined by the credit analysis that the bank carries out on your financial profile. Therefore, after this analysis, different values can be released to the public.

Therefore, it is not possible to know exactly what limit amount the bank can offer you. But, regardless of the limit that the bank has released, you can still request an increase in the amount.

How to increase the C6 Bank card limit?

To do this, simply log into the C6 Bank app and go to “My Limits”. In this part, you can check the pre-approved limit or request an increase via chat.

So, you can enter the app's chat and type “Increase limit”. This way, just follow the instructions and add the new value you would like to have.

When you do this, the bank will carry out a new credit analysis to check if you can really be approved for the new amount.

Is it worth applying for the C6 Bank card online?

The C6 Bank card online has several interesting features, but before requesting it, it is important to take a closer look at its positive and negative points, as you can see below.

Benefits

C6 bank cards have several very attractive advantages that make the public interested in them, such as:

- Personalization of the card with color and name;

- Access the points program on all cards;

- Have points that never expire;

- Being able to access a higher score when subscribing to a plan;

- Access additional cards for free.

Of all the advantages, the highlight goes to the points program offered by C6 Bank.

With it, all the points you accumulate never expire. This way, you can only change them whenever you want.

Additionally, you can subscribe to plans that cost less than R$ 50.00 per month to access a higher score and thus accumulate more points.

Disadvantages

On the other hand, the online C6 Bank card also has some negative points, such as the annual fee charged on the Black card and the fact that the user needs to pay for each C6 Tag they access.

Nowadays, it is easy to find other banks that offer free 100% toll and parking tags, where you do not need to pay any monthly fee to use them.

How to get a credit card at C6 Bank?

To request the C6 Bank card online, you only need to be over 18 years old and have an open C6 Bank account to access the card.

This way, you will be able to have a card completely online, without needing to leave home and being able to use the virtual card even before the physical one arrives.

Therefore, to find out in more detail how applying for a C6 Bank card online works, just check out the post below!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Agreement Right Platform or BMG Loan: which is better?

How about learning more about solutions for negatives? So, decide between the Certo Agreement platform or BMG loan and get out of debt.

Keep Reading

Check out how to buy Latam tickets from 10x

See all the services and discount opportunities you will have when you buy cheap Latam airfare using Latam Pass.

Keep Reading

Zencard card or Atacadão card: which is better?

Check out all the features, advantages and disadvantages and find out which card is best for you between the Zencard card and the Atacadão card.

Keep ReadingYou may also like

Discover the Credisfera personal loan

An online personal loan has less bureaucracy and falls into your account faster than a conventional loan. Want to know more about Credisfera? Read below!

Keep Reading

PIX surpasses the credit card and becomes the preferred method of payment for Brazilians

The PIX instant payment feature has become hugely popular since its launch in 2020. In a study carried out by the Central Bank, the tool reached the top of payment methods for the first time in Brazil. Know more!

Keep Reading

Will Bank Card or Caixa Elo Card: which one is better?

Do you know that question about which card to choose and which one is best suited to your current financial situation? You no longer need to go through this, as you will discover the Will Bank card or Caixa Elo card. By knowing how to use your credit card to your advantage, your financial life flows better. See more on the subject below.

Keep Reading