Cards

BMG card or Pride card: which is better?

Are you in doubt between the BMG Card or the Pride Card? Both are great credit card options with international coverage. Check out!

Advertisement

BMG x Pride: find out which one to choose

If you can't decide between the BMG card or the Pride card, then you've come to the right place! In this text, we will present all the characteristics of these two cards. Thus, you will be able to choose which option is best for your financial life.

Both cards have international coverage and use the Mastercard brand. Thus, customers can take advantage of discounts with partner stores and benefit programs offered by the brand.

In addition, each one has exclusive advantages for its users. Below you will find out all the pros and cons of the BMG card and the Pride card. That way, it will be much easier for you to decide which one is the most interesting for you. Let's go?

How to apply for BMG card for negatives?

The BMG credit card for negatives is a card that offers ease of approval and can be personalized. Find out how to apply here!

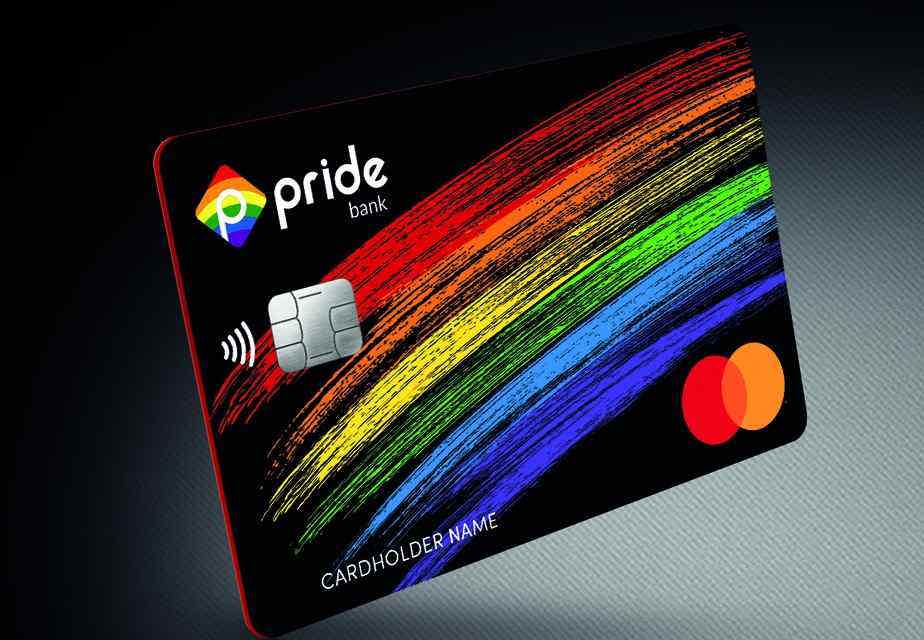

How to apply for Pride Bank Prepaid

See how you can apply for Pride Bank Prepaid, Pride Bank digital bank card, the world's first LGBT digital bank!

| BMG | Pride | |

| minimum income | not informed | not informed |

| Annuity | Free | Varies by account type |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Cashback | Digital account, support for social causes |

BMG card

Let's start by talking a little about the BMG card.

The BMG card is an ideal option for those looking for practicality and convenience in their day-to-day tasks. With it, it is very easy to make purchases in Brazil and abroad, as it has international coverage. In addition, you can purchase products in physical and digital stores.

As we have already mentioned, the Mastercard brand on the card offers several advantages to its users, such as exclusive discounts. In addition, you can register for benefit programs, such as Mastercard Surpreenda, and accumulate points.

Want to know another amazing perk? The BMG card does not charge an annual fee. This way, you won't need to have that extra expense in finance!

Another feature is that the card is linked to a digital bank, Banco BMG. Therefore, to apply for your card, you must create an account at the institution. After your registration, you will receive the debit card and you will also be able to request the credit function.

Want to know more details about the card? So, read on and check it out!

Pride Card

The Pride card is a new option on the market that has arrived to bring a modern vision to the financial universe.

This is because it is a product of the Brazilian bank Pride Bank, considered the first LGBTI+ digital bank in the world. Its philosophy is to bring more empathy and respect by offering a modern and inclusive card for everyone.

Although the Pride card is aimed at the LGBTI+ community, it can be requested by anyone. Thus, everyone can enjoy the benefits and advantages offered by it.

The Pride card is a prepaid credit card with international coverage. This allows its user to make purchases quickly and easily, both in physical and virtual stores. In addition, your Mastercard brand gives you access to the benefits and discounts associated with it.

Furthermore, all its functions are 100% online and you can control your finances, make transfers and use your services through the digital account.

What are the advantages of the BMG card?

Now that we know a little about both cards, let's talk about their pros and cons. So, with all the information at hand, you can make the best decision for you. Let's go?

Well, let's talk about the BMG card. One of its positive points is that the application process is done 100% online. In addition, you can use the bank app to manage your account, check your limit and many other functions. This is great in the rush of everyday life, don't you think?

In addition, the card has two exclusive cashback programs. With them, you get back part of the money spent on transactions.

With the Volta pra Mim program, you receive a percentage of the amount spent on debit and credit purchases. How it works is as follows: when using the debit function, you can receive up to 0.30% of the amount spent. On credit, this amount can reach up to 0.80%.

The Poupa pra Mim program rounds up the cents spent on your transactions and puts them in a virtual piggy bank. Once it reaches R$ 50.00, your money is invested in a secure application and you can redeem it quickly and easily, whenever you want. Amazing, isn't it?

What are the benefits of the Pride card?

Sure, one of the good points of the Pride card is that even though it's prepaid, you don't need to load your card to use it. This is because it is linked to your Pride Bank account. Thus, when making a purchase, you directly use your account balance.

In addition, the bank does not carry out credit analysis. Therefore, even if you are negative, you can apply for your Pride card!

Another very interesting feature is that the bank reverts 5% of its gross income to donations to NGOs. The benefited social causes aim to help the LGBTI+ community. That way, when you purchase one of the card plans, in addition to purchasing a modern product, you will be contributing to a more inclusive world!

In addition, the card brings another advantage to the LGBTI+ public: you can request that the card be written with your social name.

Both cards offer several advantages to their customers. So read on to find out more about each of them!

What are the disadvantages of the BMG card?

Okay, now let's talk about the disadvantages of each card. Thus, you will feel more secure when making a decision between the BMG card or the Pride card!

Well, one of the negative points of the BMG card is that it is linked to a digital bank. Therefore, to apply for your card, you need to register and open a new account. So this can be an inconvenience if you already have an account at another bank and don't want to manage a new one.

Also, although all customers have access to the basic plan of the Volta pra Mim cashback program, you will have to pay for the monthly plan to get more benefits.

What are the disadvantages of the Pride card?

Well, one of the disadvantages of the Pride card is the fees charged for some of its features.

Thus, the monthly packages can be contracted by individuals or legal entities and vary in price according to the chosen plan. For individuals, the amounts can range from R$ 9.99 to R$ 39.99. As for legal entities, the plans range from R$ 29.99 to R$149.99.

In addition, there are fees for some services, such as R$ 7.50 for withdrawals on the 24-hour network, R$ 5.00 for TED transfers and R$ 19.90 for issuing a prepaid card.

BMG card or Pride card: which one to choose?

Well, whatever your decision, both cards are great options for credit cards with international coverage. In addition, both the BMG card and the Pride card use the Mastercard brand.

As differences, the BMG card has great cashback programs and the Pride card is a modern and inclusive option for its customers!

So, calmly evaluate all the pros and cons of cards and choose the best option for your financial life: BMG card or Pride card?

If you're still in doubt about which card to choose, no problem! Then you can continue your reading and get to know other cards. Check out!

Pride Card or BBB Card: which is better?

Are you in doubt between the Pride Card or the BBB Card? Both are prepaid cards with international coverage. Check your benefits here!

Trending Topics

Overview of indebtedness in Brazil

We prepared an overview of indebtedness in Brazil so that you understand the context of the current situation and how to settle your debts.

Keep Reading

How to apply for the Porto Seguro car consortium

With the Porto Seguro car consortium, you have up to R$ 125 thousand to buy your new vehicle with installments that fit in your pocket, Check out how to get it.

Keep ReadingYou may also like

How to open a current account at BPI Age Jovem

At BPI, anyone aged between 13 and 25 can create an account with a minimum opening fee and no maintenance fee. Check here how to open yours today.

Keep Reading

Discover the BP Powerplus Unicre credit card

Find out everything about the BP Powerplus Unicre credit card here and get access to a card with no annual fee, with fuel discounts and a points program that you can exchange for offers and products. Check out!

Keep Reading

How to apply for the Credicard Beta card

Do you already know the Credicard Beta credit card? It was designed especially for young people and has zero annual fees. Check out!

Keep Reading