Cards

Online BMG card: no annual fee and yield of 100% CDI

The online BMG card has everything you need to manage your finances, as it has no annual fee and offers several benefits, such as cashback. To learn more about the card, just continue reading with us!

Advertisement

Check out everything about the BMG card online and find out about its main benefits

Online BMG card is a complete plastic that brings many features and more. That's because over time, cards have been assuming an increasingly important role in our financial life.

With them, we can pay for purchases in installments, purchase products at a higher price and have a resource to rely on in times of emergency or unexpected situations.

| Annuity | Exempt |

| minimum income | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | No annual fee, low interest, international coverage, widely accepted brand, cashback program |

In this sense, the BMG card has no annual fee, one of the lowest interest rates on the market, the Mastercard brand and several other advantages. Therefore, it is the ideal card for those who want to save money and have a reliable resource whenever they need it.

So, are you curious and want to know more about this complete credit card option to take care of your finances? So come with us and check it out firsthand!

BMG card

Knowing as much information as possible about the credit card before applying for it is one of the ways to ensure the safety of your finances and also your assets.

But, the online BMG card is simple, without bureaucracy and without complications. With it, you have access to the main resources to keep your finances healthy, from bill installments to an extra credit limit, if necessary and if approved.

In addition, you participate in a club of advantages complete with discounts and cashback program, to receive cash back in your account, both in credit and debit, in several purchases.

With the Mastercard brand and international coverage, the card is widely accepted across the country and the world, and you can use it safely for internet purchases.

Below, check out more information about the BMG card online, its advantages and disadvantages, credit limit and other important information. Let's go?

How to apply for the BMG card

Applying for a BMG credit card online to be yours is easier than you might think! Check out the full step-by-step here and see how to order yours.

Which bank does the BMG card belong to?

The BMG online card is issued and managed by the BMG SA bank itself, both for retirees, pensioners and public servants who are affiliated with the bank (payroll card) and traditional credit cards, linked or not to the bank's digital account.

How does the BMG account card work?

The BMG online account card is complete in all respects: no bureaucracy, no annual fee and no hidden fees.

It's ideal for those who want more facilities in their financial routine, and don't want to waste time paying fees and other items that can overload the bill at the end of the month.

With it, it is possible to shop online and in physical stores and, in addition, receive part of the money back with the cashback program.

But, in addition to the credit card, you can also request the debit function in your physical form, and use it both ways to make your life easier.

Both modalities are linked to the BMG digital account, so to request your card, you must first open a digital account through the app.

Benefits

Credit card advantages directly interfere with the quality of your financial life. Therefore, they are very important and should be analyzed before even requesting yours.

Check below what are the main benefits of the BMG online bank credit card.

- No annuity;

- International coverage, widely accepted around the world;

- Cash back on debit and credit;

- The card can be multiple (debit and credit);

- Advantage club with exclusive discounts;

- Best interest rates on the market, up to 4x lower compared to other cards;

- Mastercard Surprise Program;

- Mastercard brand benefits, such as price and purchase protection;

- etc.

Disadvantages

But, as much as the card is a great option to take care of your finances, it also has some disadvantages, and these should be taken into account before applying for yours.

Some of the main disadvantages are, for example, described below.

- The card is subject to credit review;

- 100% requests and manages the card online, that is, if you are not used to this modality, this may not be the best option for you;

- To apply for the card, you must have a BMG account;

- etc.

What is the BMG card limit online?

The BMG card limit is different for each person, as the amount is released according to the credit analysis carried out by the financial institution itself.

The threshold is usually calculated as follows: 5% of your net income (after any applicable discounts) and multiply by 27%.

If the card is released, this may be your credit limit amount. According to the bank itself, the initial credit limit is usually R$300.00, but as we have informed, it will depend on the credit analysis carried out by the institution.

For the time being, there is no way to request an increase in the BMG card limit via the app or internet banking.

But, if you are interested in receiving this limit increase, there are some things you can do to facilitate this process, such as avoiding late payment of the invoice and installments and also using your credit card a lot, up to its limit.

By avoiding paying the invoice in installments and letting the amounts fall into the system of revolving interest, you show the financial institution that, as a credit card holder, you take the organization of your financial life seriously.

In addition, using the card a lot, especially up to its current maximum limit, helps to show the bank that you need a higher limit, and that you are also a good payer.

What do you need to pass the BMG?

To apply for your BMG card, in addition to being over 18 years old, it is ideal to have a good financial history and score, as this information counts a lot when it comes to credit analysis.

But, BMG also has card options for negatives, just check it out on the bank's official website. If the credit card is not released to you, the bank releases the digital account and the debit card.

By using and creating a good relationship with the financial institution, the chances of being approved for credit are greater.

How to apply for the BMG credit card?

To apply for your BMG credit card online, just access the bank's official website and request yours, filling out the form with your personal data correctly.

But, if you prefer, you can request it directly in the Meu BMG application. Just download the app on your smartphone, open your account and request the card or just request the credit function.

So, what did you think of the BMG card? It's a complete and full-featured option, isn't it?

We hope that our content will help answer the main questions about the card and who will soon be enjoying all its benefits.

If you are interested in learning more about the application process, please visit the recommended content below.

Until later!

How to apply for the BMG card

Applying for a BMG credit card online to be yours is easier than you might think! Check out the full step-by-step here and see how to order yours.

About the author / Maria Luisa Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Access Card or CEA Card: which one to choose?

Are you negative, do you need to buy on credit? Or do you still have a high score and want a credit card? Decide between the Access card or the CEA card.

Keep Reading

Discover the Santander digital account

The Santander digital account has an application with unlimited movements and the possibility of being free. So find out more details here!

Keep Reading

Discover the Leader credit card

The Leader credit card offers exclusive discounts and installments at the brand's stores, as well as participating in the Vai de Visa program. Learn more here!

Keep ReadingYou may also like

How to know which is the best company for personal loan?

In today's post, we will help you find out which is the best company for a personal loan. This will be done through questions you should ask yourself before deciding which one to hire. Interested? Check out!

Keep Reading

Carrefour Card or Muffato Card: which is better?

Carrefour has a credit card with benefits, such as exclusive promotions and larger installments. Meanwhile, Muffato has private label type cards to guarantee more discounts when shopping. Compare the two below and choose your favorite.

Keep Reading

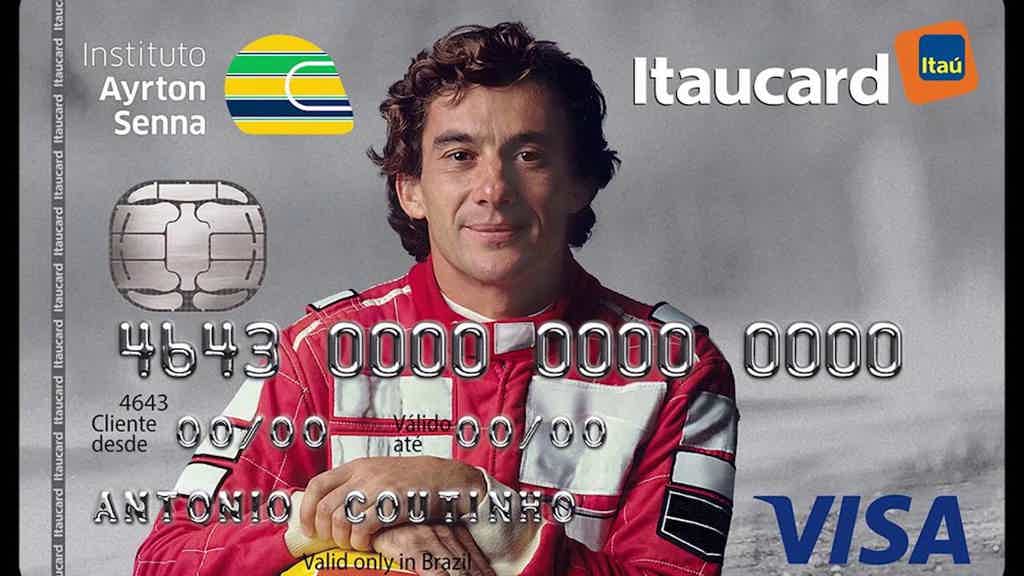

9 benefits of the Ayrton Senna Itaucard Card

Discover the benefits of the Ayrton Senna Itaucard Card.

Keep Reading