Cards

Atacadão Card or Avista Card: which is better?

Decide between the Atacadão card or the Avista card, both have a low annual fee, immediate approval and international coverage. Check out the comparison here and decide which one is the best option.

Advertisement

Atacadão x Avista: find out which one to choose!

Regardless of the financial situation, it is necessary to have a credit card, so why not decide between the Atacadão card or the Avista card?

Likewise, the cards have a low annuity, international credit brand, limit for purchases and advantages created by the companies themselves.

In addition, the Avista card is for those who cannot prove income, as it is ideal for self-employed people and even low score users.

On the other hand, the Atacadão card has credit analysis, proof of documents, and is indicated for merchants and large families.

With that in mind, we have created a detailed comparison between the two, so that you can choose which one will best meet your financial needs. Let's go!

How to apply for the Atacadão credit card

Get access to an international card that provides discounts, interest-free installments and has a low annual fee. So, check out how to apply for the Atacadão card.

How to apply for Avista card

You have up to 45 days to pay your invoice and initial credit limit of R$ 700.00 with the Avista card. Find out how to apply here!

| Atacadão Card | Avista Card | |

| Minimum Income | not informed | not informed |

| Annuity | 12x of R$ 11.99 | 12x of R$ 16.99 |

| Flag | Mastercard or Visa | MasterCard |

| Roof | International | International |

| Benefits | This card allows interest-free installment purchases on some items. Check it out on the shelf and pay cheaper on products every day Take more products and pay less with the exclusive Atacadão program | Ease of approval Releases an initial limit of R$ 700.00 Have a longer term for payment of invoices, which reaches 45 days Even with a low score, approval can be done through a simple credit analysis |

Atacadão Card

Firstly, the Atacadão card is ideal for those who buy in large quantities, such as merchants and families.

Just to exemplify, there are 250 stores throughout Brazil and a variety of products that reaches 10,000, characteristics that offer many options to customers.

This means that the customer will always have the option to pay cheaper and take more products, with exclusive Atacadão promotions.

In short, you see the regular price and the differentiated price for card customers on the shelf, so you get discounts and even take more products.

However, it is necessary to undergo a credit analysis to apply for the card, which requires proof of income and delivery of documents to be approved.

Finally, the Atacadão card can also be used for purchases at other establishments, mainly at Atacadão drugstores, where an interest-free installment of up to 10 installments is released for medicines and cosmetics.

Avista Card

The Avista card is known for its quick approval, as it offers an initial limit of R$700.00. In addition, you need to fill out the form on the website and wait for approval.

This financial product can be approved for self-employed or informal workers, and is usually quick to release and without bureaucracy.

In order to be accessible, it offers movement through the application and international flag, being used in thousands of establishments because it has the Mastercard flag, the same one that provides the points program for this option.

Furthermore, it is a broad credit card, with a monthly fee, a chance for the customer to have more time to pay invoices, with a different term compared to other credit cards.

If you are looking for a basic, fast option with a reasonable limit, asking for the Avista card will be beneficial.

What are the advantages of the Atacadão card?

We can point out that the main advantage of the card is to pay cheap every day in any Atacadão store in Brazil, that is, just check the shelf.

At the same time that it offers exclusive discounts for specific products and installments of up to 5 installments without interest in some cases, it is also possible to take more by paying less.

Just to exemplify, this promotion will be highlighted on the shelves and you can pay for 4 and take 5. In addition, check on the website which products have exclusive installments throughout the month.

Finally, you can have your purchases paid in up to 10 interest-free installments at Atacadão drugstores, that is, have an ideal card for market purchases, but also for any other purchase, even in international stores.

What are the advantages of the Avista card?

First of all, the chance to have an Avista card with a low score opens up possibilities for many Brazilians who have a clean name but little financial history, for example.

Therefore, make the request, undergo a quick credit analysis, with an approved limit of R$700.00, paying invoices with a 45-day term, regardless of the amount.

We can highlight that the Avista card has the Mastercard brand. In addition, you can participate in the Mastercard Surpreenda points program, as well as control spending through the application.

Finally, check the availability of this card to enjoy the benefits by paying a low monthly fee.

What are the disadvantages of the Atacadão card?

We point out that the Atacadão card requires a rigorous credit analysis and those with a dirty name are unlikely to get approved, as they will have to consult the credit bureaus.

Therefore, it is an international flag card, however, the customer does not access any advantage club or points program, which may not be interesting for some people.

It is also important to point out that the Atacadão card does not offer interest-free long installments on supermarket products and that discounts vary between specific products in predetermined periods, which are available on the website.

What are the disadvantages of the Avista card?

The availability of information about the Avista card is very limited on the official website, which leaves the customer in doubt about the minimum income requirement and which documents must be presented when applying for the card.

It is also likely that you will experience delays in responding to the request, as a form must be completed on the website for the request. In addition, the customer can order by phone, that is, two ways that can be slower.

Also know that the annuity reaches R$203.88 annually, but it should only be paid when there is an invoice.

Atacadão card or Avista card: which one to choose?

So, did the highlighted information help you decide between the Atacadão card or the Avista card?

In short, both cards have an international credit brand, immediate approval and pre-approved initial limit.

While the Atacadão card offers daily discounts on monthly purchases, the Avista card is ideal for those with a low score.

In this way, the Atacadão card offers loans, payment in installments, division of purchases into interest-free installments, daily discounts and more products for less.

On the other hand, the Avista card gives you 45 days to pay invoices, use the internet, Mastercard Surpreenda program, as well as access to freelancers, informal workers, etc.

Even if you have chosen, take a few minutes to assess your CPF situation, as well as your financial history, if any of these aspects are in trouble, consider another type of card.

If you haven't decided yet, don't worry, as below our team has prepared another comparison for cases like yours, so stay with us.

Nubank Ultraviolet card or Vooz card

Find out details to decide between the Nubank Ultraviolet card or the Vooz card. Both have a digital account and benefits associated with the brand. Check out!

Trending Topics

Inter Consigned Card Review 2021

Check out the Inter Consignado card review and learn about a product full of advantages, with international coverage and no annual fee! Look here!

Keep Reading

How is bank credit analysis done?

Credit analysis is done to assess your consumer profile, that is, if you usually keep your payments up to date. Understand more!

Keep Reading

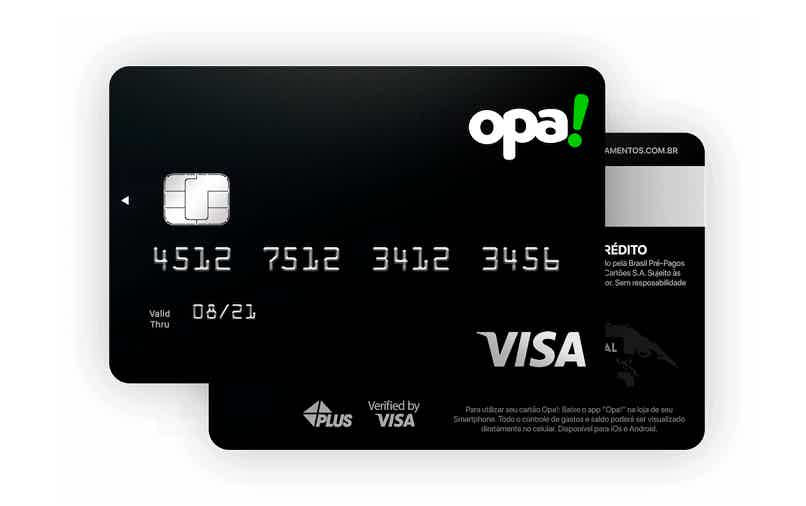

How to apply for the Opa Card! Visa

Oops Card! Visa is a good option for those who are negative, in addition to offering a digital account and exclusive benefits. Check out!

Keep ReadingYou may also like

Discover the current account BPI Age Júnior

Looking for a simple account to start your little one's financial education? So, check out, in the following post, everything about the BPI Age Júnior account and find out if it is what you need.

Keep Reading

Unibanco Personal Credit or Universe Personal Credit: which is better?

At first glance, Unibanco's Personal Credit is very similar to Universo's, as both offer attractive interest rates, amounts of up to €75,000 and extended terms. However, they work differently and we want to show you that from now on so that you can choose what suits your needs. Let's go!

Keep Reading

Discover the best higher education courses for 2021

Do you want to be successful in your professional career? Check here which are the best higher education courses for 2021 and choose yours!

Keep Reading