Cards

Does the Americanas card have an annual fee?

Looking to know the rates charged by the Americanas card? In our post, you will find out about the annuity values and fees of your card, but also all the advantages it offers you. Check out!

Advertisement

Get to know the annuity values and fees of the Americanas card

In this text you will find out about the fees charged for applying for an Americanas credit card. Yes! The Americanas card has an annual fee and charges some fees related to withdrawals, IOF fees or revolving credit. Many people do not know this and believe that because it is a card from a big brand, it would not charge an annuity or fees. However, that's not how it works.

Although the card has exclusive promotions and very good benefits regarding purchases, there are some disadvantages. In this case, charging an annuity would be one of them, given the large offer of cards with zero annuity on the market.

So, to clarify this once and for all, we invite you to follow our content until the end and find out everything about this card!

How to apply for an Americanas card

Apply for the card on the website. Simple, fast and without bureaucracy!

What is the value of the Americanas card annuity?

Unlike other stores that offer cards to their customers and do not charge an annuity for it, the Americanas card has an annuity and some extra fees that the customer must pay when carrying out certain processes.

Anyway, let's talk more in the next topics. Understand now the value of the Americanas card annuity.

The annual fee is 12 installments of R$15.70 or R$188.40. This is the annual amount that must be paid by users of the Lojas Americanas card, regardless of whether they have used the card or not.

In this sense, the customer is not exempt from the annual fee and must also pay other fees over the time the card is used.

Benefits

discounts and promotions

Therefore, because the card is from Americanas, purchases at partner establishments or in the store itself, generate exclusive discounts and promotions with various advantages for the buyer.

additional cards

In addition, we have access to request up to 3 additional cards to use in any way we want and manage the cards through the Americanas website.

rewards program

Remembering that when making purchases with the store card, you can access the rewards program that can generate a very large return on promotions, discounts and exclusive products.

Disadvantages

fee charged

You are not exempt from annuity and must pay annually in 12 installments in the amount of R$15.70, which gives a total of R$188.40.

many tariffs

In addition to the annuity, there are several fees that must be paid, such as withdrawals, IOF tax and other types of charges that are made to the cardholder.

indefinite limit

The limit that the card provides is not fixed, that is, it will change according to the customer's financial analysis.

How does the Americanas card annual fee work?

The Americanas card has an annual fee and charges a series of fees on top of some processes. See what they are:

- Interest rate in installments: 0.99% per month + IOF;

- Revolving credit: 19,99% per month;

- Web Withdrawal and 24-hour Withdrawal: R$13.90;

- Withdrawal interest: 17,99% per month.

These are just some of the fees charged to customers who have a Lojas Americanas card.

But what about the limit? How much limit does Americanas offer its customers? Follow right now!

How much limit does the Americanas card have?

The main question that many people interested in applying for the Americanas card is about the initial limit that comes on the card. However, Americanas works differently in relation to the pre-established limit for the client. In this sense, there is no determined limit value for those who apply for the card.

That is, it is directly linked to the applicant's income. Then, after an analysis carried out by Americanas, the limit that will be made available to the customer is determined.

Therefore, this means that it will depend on your consumer profile, monthly income and other criteria adopted by Americanas. Then, a personalized amount limit is made available for you to use with your card.

Anyway, the Americanas card has an annual fee, but it can offer you a high initial credit limit depending on your income. Access the recommended content and learn how to request yours!

How to apply for an Americanas card

Apply for the card on the website. Simple, fast and without bureaucracy!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to subscribe to The Voice Brasil? See the process

Find out here how you can sign up for The Voice Brasil this year to show your musical talent to Brazil!

Keep Reading

Bradesco Neo Card or Bradesco DIN Card: which one is better?

Be it the Bradesco Neo Card or the Bradesco DIN Card, both offer exclusive offers for those looking for new possibilities. Check out!

Keep Reading

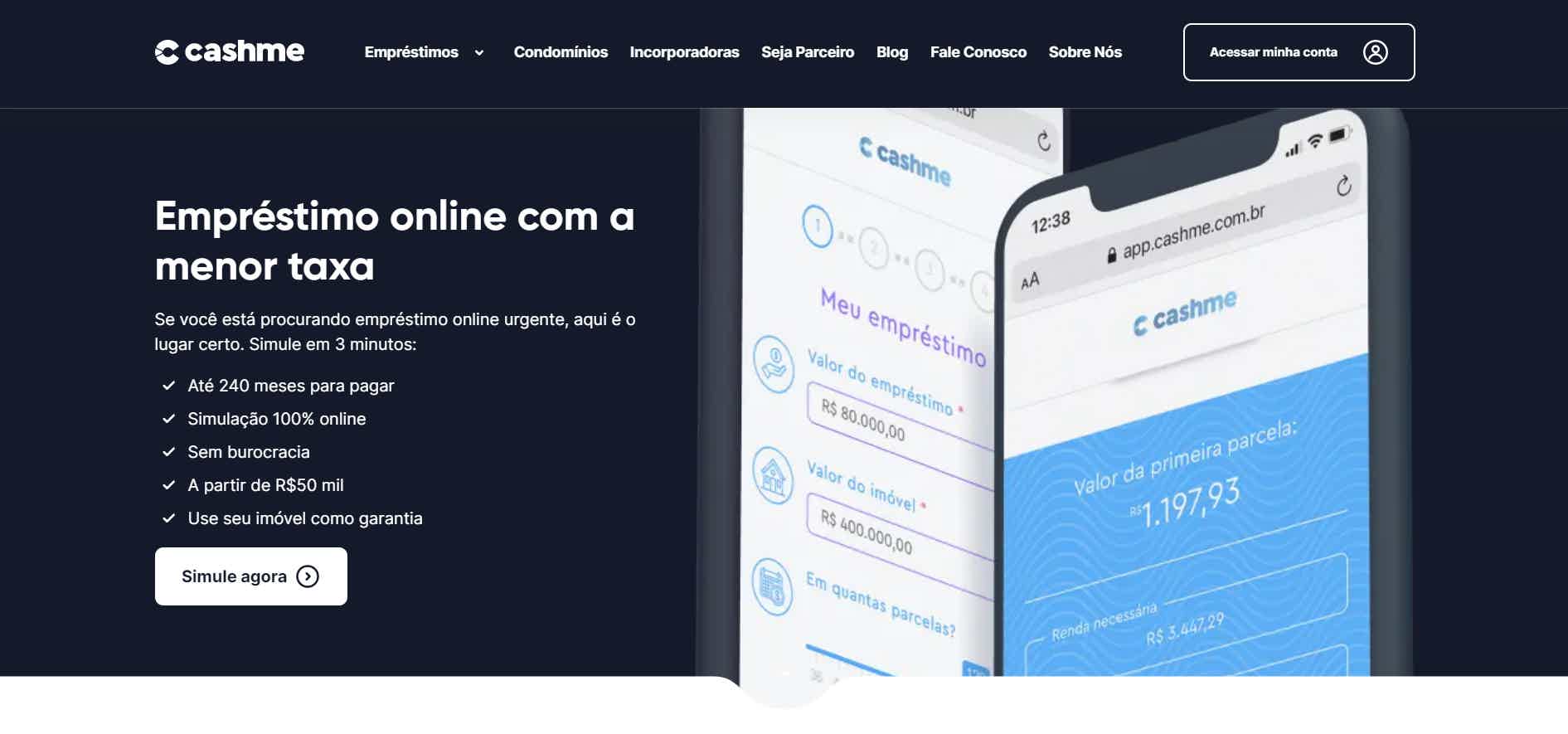

Discover the Cashme personal loan

Get to know the Cashme personal loan and get credit from R$ 50 thousand to pay in up to 240 months with competitive interest rates.

Keep ReadingYou may also like

BPI Zoom credit card: what is BPI Zoom?

BPI Zoom is a Portuguese financial product from Banco BPI. It offers many advantages, such as contactless payment. Do you want to know this card and check out its advantages? So, read the post.

Keep Reading

See how to earn up to 100% profit working for you

Hinode is one of the brands that stand out the most for its resale program, and what you might not know is that this opportunity can guarantee your financial independence, with a bonus of up to 100% of the sales value. For more information on the subject, see below.

Keep Reading

Discover the Social Bank digital account

Want a digital account? Social Bank can be a great alternative to give you more financial autonomy and day-to-day practicality.

Keep Reading