Cards

Alelo Card or Superdigital Card: which is better?

Alelo card or Superdigital card is a complicated choice. First, you should compare the credit modalities, checking the advantages and disadvantages of each one. Then, just choose the one that best suits your needs!

Advertisement

Allele X Superdigital: find out which one to choose

Currently, there are several types of credit available in the market. Some of the options are the Alelo card or the Superdigital card.

In this sense, it can be complicated to apply for the ideal card for you. However, with a quick comparison, it is possible to choose the model that best suits your consumer profile.

First of all, Alelo is a financial solutions company. Founded in 2003 by Banco CBSS, the institution offers several benefits to customers, seeking incentives and financial management.

On the other hand, Superdigital is a fintech that is linked to Grupo Santander. And, just like Alelo, the institution aims to reduce bureaucracy in the financial lives of its clients. Through this account, you can transfer money and make purchases at various establishments.

How to apply for the Alelo Prepaid Card

The Alelo card is aimed at companies that wish to benefit their employees in different ways. Understand!

How to apply for the Superdigital credit card

If you are looking for a card with a digital account that accepts negative payments, the Superdigital card may be ideal. See how to order yours!

| allele | Superdigital | |

| Annuity | R $5.00, if the customer does not use the card within 90 days | Free |

| Flag | allele | MasterCard |

| Roof | National | National and international |

| Benefits | Exclusive discounts at Clube Alelo | No annual fee and no purchase limit |

Allele Card

As previously mentioned, the Alelo card is part of the services delivered by the institution in the same way. Founded in 2003 by Banco CBSS, it specializes in offering benefits by encouraging financial management.

In this way, Alelo's main objective is to facilitate the daily lives of customers, whether small, medium or large companies. The company also delivers benefits to partner establishments, offering Alelo card products.

Above all, the company aims to serve different customer profiles, such as: the HR sector, businessmen and card users. In addition, it is possible to deliver the credit to the company's employees, guaranteeing access to the various benefits of Alelo.

The Alelo card works in prepaid mode, which works just like credit. So every time you use it, the available amount will be discounted. But when the values are not used, they are accumulated for the following months.

Superdigital Card

Fintech Superdigital is linked to Grupo Santander. Thus, the main objective of this card is to simplify the financial life of its users.

However, after opening an account at the institution, it will be possible to transfer money and make purchases at various establishments.

Similar to what occurs in the previous model, when opening an account with Superdigital, customers have access to a prepaid card.

Furthermore, it is considered one of the cards with the highest acceptance rate in Brazil.

Furthermore, when choosing this option between the Alelo card or the Superdigital card, customers have access to the structure of Santander, a financial institution that specializes in personalized management.

What are the advantages of the Alelo card?

First, to choose between the Alelo card or the Superdigital card, the first step is to check what the advantages are. Soon after, it will be possible to compare the models and choose the ideal one for you.

So, check out the main advantages of the Alelo card:

- Discount at partner establishments;

- The collaborator of his company has more financial control;

- Participates in Clube Alelo, which offers up to 80% discount in the main establishments;

- Greater security for your card.

What are the advantages of the Superdigital card?

As well as the previous credit model, checking the advantages of the Alelo card or Superdigital card is the first step in choosing the ideal one for you.

However, below are the main advantages of Superdigital:

- Greater practicality;

- Security and protection against blows;

- Organization in your financial life.

What are the disadvantages of the Alelo card?

Like other types of credit, the Alelo card also has disadvantages, they are:

- Application with limited functions and with some flaws;

- Relatively higher rates than other types of credit.

What are the disadvantages of the Superdigital card?

Just as it is necessary to verify the advantages between the Alelo card and the Superdigital card, the disadvantages must also be visualized.

So check out the disadvantages of the Superdigital card.

However, it is possible to mention only 1, which is the absence of cashback programs!

Alelo Card or Superdigital Card: which one to choose?

Anyway, to choose between the Alelo card or the Superdigital card, take these characteristics into account.

Above all, the choice between Alelo card or Superdigital card must prioritize your needs!

How to apply for the Alelo Prepaid Card

The Alelo card is aimed at companies that wish to benefit their employees in different ways. Understand!

How to apply for the Superdigital credit card

If you are looking for a card with a digital account that accepts negative payments, the Superdigital card may be ideal. See how to order yours!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

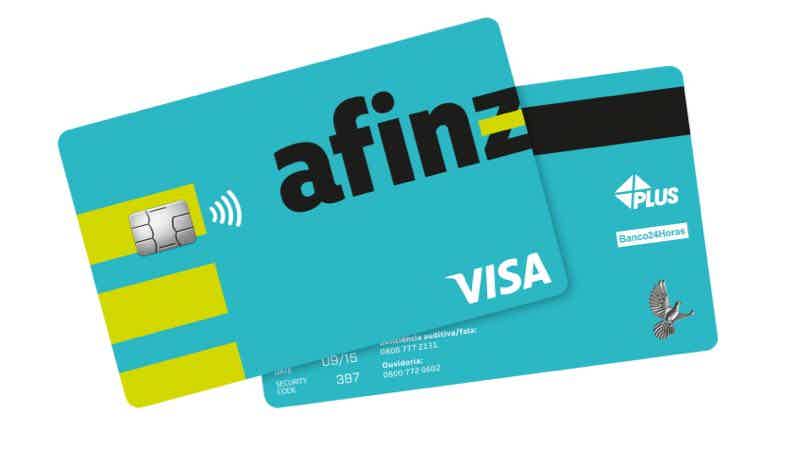

Discover the Afinz credit card

Get to know the Afinz credit card, which is Visa International and has an advantage program. Read on and find out if it's worth it for you. Check out!

Keep Reading

How to make money as an app driver in 2021

Working as an app driver is a great option for anyone looking to earn extra money. See our tips for profiting from the service!

Keep Reading

How to send resume to Renner? check here

Find out in this post how to send your resume to Renner and work in one of the biggest fashion retail companies in the country!

Keep ReadingYou may also like

The best card for you is BTG+ Gold

Do you already know the BTG+ Gold credit card? If not yet, then take the opportunity now to check out the main information about this card with an exempt annual fee.

Keep Reading

App Abastece Lá: see how to buy at the best stores with a discount

How about fueling your car with savings and still accumulating points in the Fuel There program? We explain everything about it, so you know how to use Abastece Aí and all its promotions. Learn more here.

Keep Reading

AliExpress Men's Clothing: purchase with up to 75% OFF

Transform your style with stylish and affordable men's clothing from AliExpress. Discover incredible discounts and renew your wardrobe today! Read until the end to find out how to buy at a discount!

Keep Reading