Cards

Afinz Card or Mercado Pago Card: which is better?

There are similarities between the Afinz card and the Mercado Pago card, such as the Visa brand, international coverage and exclusive payment terms for customers. Therefore, see the comparison below and choose the best card alternative for you.

Advertisement

Afinz x Mercado Pago: find out which one to choose

Initially, the Afinz card or Mercado Pago card are ideal cards for anyone looking for a credit card with credibility and security. On the other hand, they are very different products, because, while Afinz is a conventional credit card, Mercado Pago has an exclusive proposal.

So, in this text, we will show you the positive points, as well as the negative points of these cards and how they can bring more comfort to your day to day. Check out!

How to apply for the Afinz card

Do you want to learn how to apply for the Afinz card, ideal for merchants and with a spending control app? So, read this post to learn step by step!

How to apply for the Mercado Pago card

Find out how to apply for the Mercado Pago card with no annual fee, with immediate approval and interest-free installments of up to 18 purchases. Check out!

| Afinz Card | Mercado Pago Card | |

| Minimum Income | not informed | not informed |

| Annuity | R$ 227.88 | Exempt |

| Flag | Visa | Visa |

| Roof | International | International |

| Benefits | Up to 40 days to pay; Additional cards with 50% discount on the annuity; You Well Program. | Vai de Visa Program; Installment of purchases in up to 18 interest-free installments; Double points in Mercado Pago. |

Afinz Card

If you are looking for a credit card with credibility, security and without bureaucracy, the Afinz card can be a good alternative. This is because it was created together with the Visa brand to provide a unique experience for customers.

Thus, the card has national and international coverage and can be used in several partner establishments within Brazil and in other countries, such as the United States and Portugal, for example.

And, in addition, you can participate in several brand benefits, such as the Vai de Visa program and Visa Passfirst, which, in turn, provide discounts at restaurants, football matches, among others.

In addition, you can control everything that happens with your card through the Afinz application, that is, if someone makes a purchase with your credit card without you knowing, you will immediately be notified in your application about the purchase and can even inform that it was not made by you.

And, still regarding the security of this card, you can pay for your purchases using contactless technology, that is, without having to enter a password, reducing the risk of fraud, theft and loss.

Mercado Pago Card

First, the Mercado Pago card is a financial product created by the Mercado Livre platform to assist customers with purchases made within the platform.

It is important to remember that Mercado Livre is an e-commerce platform so that individuals and companies can buy, sell, pay, advertise and send products over the internet without any bureaucracy and safely.

Thus, the international Mercado Pago credit card allows purchases to be paid in up to 18 installments. And, in addition, as it is a Visa-branded card, you participate in the Vai de Visa program and have access to discounts and special conditions at hotels and restaurants, for example.

Among other advantages, all purchases you make within the platform at Mercado Livre with the Mercado Pago card are worth twice as many points in the Mercado Pontos program. And so, you get several discounts on shipping, QR code payments, subscriptions and several other services.

What are the advantages of the Afinz card?

In fact, Afinz is a credible institution that works with financial products, such as loans, financing and credit cards. The Afinz card, on the other hand, has national and international coverage and the Visa flag.

This means that you can use the card wherever you are and also get discounts with Afinz partners.

Furthermore, if you want to request an additional card for anyone in your family, you can do so with a 50% discount on the annual fee. Just as you can control everything that happens with your card through the Afinz application, you even have access to promotions.

What are the advantages of the Mercado Pago card?

Among the advantages of the Mercado Pago card are the absence of an annuity, because with it you don't have to pay any monthly fee or maintenance.

And, in addition, you can pay your purchases on Mercado Livre in up to 18 interest-free installments. Just as your purchases at Mercado Livre with the card are worth twice as many points in the Mercado Pontos program and you get discounts on freight, QR code payments and subscriptions.

In addition, you have access to the benefits of the Visa Gold flag, such as protection against theft and accidental damage to purchases valid for a period of up to 180 days from the date of purchase, whether in Brazil or in other countries, such as Japan.

And you can also use the debit and credit function on the card, as well as make withdrawals at ATMs. In addition, you can also control all your expenses through the Mercado Pago application.

It is important to say that anyone with a Mercado Pago account can apply for a credit card. This process can be done for free through the brand's application and, in a few days, the card can be approved and sent to your address.

What are the disadvantages of the Afinz card?

Among the disadvantages of the Afinz card is the annuity charge, because there are other cards with annuity exemption. So, instead of taking advantage of a financial product, you could end up going into debt.

And, in addition, it performs credit analysis at credit agencies, thus reducing access for people with restrictions on the CPF and low credit score.

What are the disadvantages of the Mercado Pago card?

At first, the main disadvantage of the card is the limit, because it will be calculated according to the credit score and the customer's CPF situation, that is, if your name is restricted or your score is low, it may not be a good alternative.

Afinz Card or Mercado Pago Card: which one to choose?

So, now that you've seen the two alternatives, which one would be best for you: Afinz card or Mercado Pago card?

In short, both are credit cards for purchases, can be used in national and international establishments and carry the Visa flag, so you just have to check out the characteristics of each one to make the best choice.

On the other hand, if you are still in doubt, don't worry, because in the recommended content below, there is one more comparison for you.

PagBank card or Mercado Pago card

Choosing between the PagBank card or the Mercado Pago card can be a difficult task. After all, both offer international services and benefits to their customers.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Zema loan or BV Financeira loan: which one to choose

If you are in doubt between the Zema Loan or the BV Financeira Loan, see the comparisons here and clear your doubts between them!

Keep Reading

How to apply for the Bradesco Clube Angeloni Visa card

Do you want to know how to contract the Bradesco Clube Angeloni Visa card? In this article we will explain it step by step. See now!

Keep Reading

Discover the Forza Football app

Do you want to follow your favorite team and games in real time? Then the Forza Football app is the ideal option. Learn more here!

Keep ReadingYou may also like

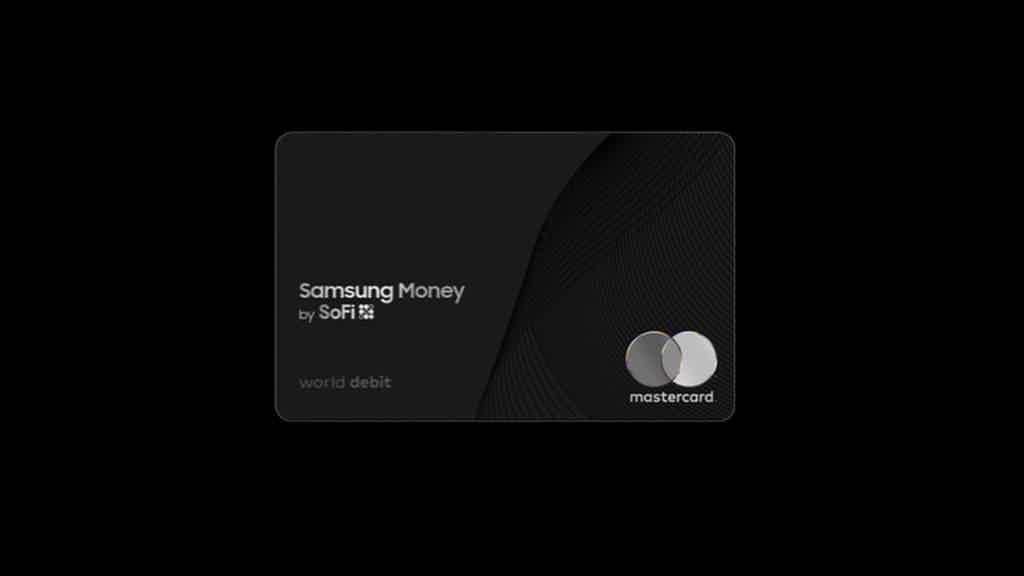

How to apply for Samsung Money card

Now you can have the Samsung Money card, with the Mastercard brand and an exclusive scoring program. Find out how to order yours online!

Keep Reading

Santander Universitário Account + SX Card: what you need

Do you want a university account that offers several benefits and an international credit card with the possibility of waiving the annuity? So, read this post and see what you need to open your Santander Universitário account.

Keep Reading

How to apply for the Caixa ISIC card

Are you a university student in Portugal and want a card with exclusive discounts and benefits? Then apply for the Caixa ISIC card!

Keep Reading