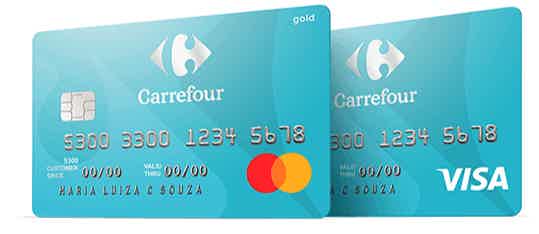

Cards

Carrefour without annuity and exclusive installment plan

The Carrefour card with no annual fee offers all the benefits of a regular card, in addition to exclusive advantages for those who shop at Carrefour establishments. Read on to learn more about this financial product!

Advertisement

Find out about the advantages of this Carrefour card with no annual fee

Over time, using a credit card for most purchases has become commonplace. Nowadays, it is normal for families to pay household bills using lines of credit. For this reason, chains such as Carrefour have created special products designed with these realities in mind. The Carrefour card with no annual fee, has exclusive installments and special discounts at Carrefour stores.

That is, any purchase at Carrefour establishments can be paid in up to 24 installments. Added to discounts on selected products. In today's article, we'll show you all the details about the Carrefour card with no annual fee. Continue reading and see all the benefits!

| Annuity | Exempt if you buy 1x per month in Carrefour stores |

| minimum income | Not Informed |

| Flag | Mastercard or Visa |

| Roof | International |

| Benefits | Exclusive installment plans and discounts at Carrefour stores and websites |

How to apply for the Carrefour card

Find out right now how to apply for the Carrefour card without complications, either through the app or through physical stores, step by step.

Carrefour Card: Full review

From now on, the Carrefour card without annual fee offers special conditions for those who buy at Carrefour establishments. The card is accepted at all Carrefour stores, as well as internationally at any Visa or Mastercard accredited store.

Thus, one of the main advantages of this card is the absence of annuity. That is, with the Carrefour card, you only need to spend it once a month and you are free of the annual fee. However, it is worth noting that the purchase must be made monthly at a Carrefour store. Be it market, drugstore or Carrefour station.

In addition, another special feature is the exclusive installment plan. In short, for selected products purchased in stores or on the Carrefour website, payment in up to 24 installments is available. At Carrefour Drugstores, you can pay in up to 10 interest-free installments. In addition, Carrefour offers exclusive discounts for you to enjoy your purchase even more. See all the details of the Carrefour card without an annual fee, below.

What is the Carrefour credit card limit?

In principle, each customer has a pre-approved credit limit at Carrefour. Therefore, it is necessary to maintain and increase this limit. Therefore, to check the amount of credit available to you on the Carrefour card without an annual fee, just contact the bank. Well, it is possible to check the limit directly through the app, website, Carrefour store terminals or WhatsApp with the virtual assistant.

Carrefour card annuity

Above all, the annual fee for the Carrefour card is 100% free. However, to guarantee the exemption, it is necessary to use the card once a month. Usually, companies ask for a minimum amount. This is not the case with Carrefour. Therefore, it is only necessary to use the card and the annuity is already zeroed.

Advantages of the card

In this sense, the Carrefour card without an annual fee offers exclusive advantages for those who buy in the Carrefour network. See below for some of the benefits below.

- Up to 24 interest-free installments in Carrefour stores;

- More time to pay for fuel at Carrefour stations;

- Installments in up to 10 interest-free installments at Carrefour Drugstores;

- Management through the Carrefour app;

- Exclusive discounts on selected products at Carrefour stores and websites.

Disadvantages of the card

Likewise, the main disadvantages of the Carrefour card without an annual fee are linked to the company itself. This is because many of the exclusive discounts and installments can only be used in the Carrefour network. In this way, the client can be a little limited with the situation.

How long does it take to receive a Carrefour credit card?

First, it is necessary to make a proposal to apply for the Carrefour credit card. Therefore, you need to wait for the company to carry out the credit analysis. In short, if after going through all these steps, you are approved, the card should arrive at the address provided within 20 business days.

How to transfer money from Carrefour card?

First of all, any movement in relation to the Carrefour account can be done directly through the application. In addition, it is possible to withdraw money from the Carrefour account. In addition, you can pay in up to 18 installments and pay the first installment only after 70 days. Likewise, it is still possible to carry out cash withdrawals, installments and even abroad.

Make a Carrefour card: how to make a card online?

In this sense, applying for the Carrefour card without an annual fee online is very simple. Well, through the website, just inform CPF, cell phone and email. Thus, the bank will analyze your situation and understand which line of credit to offer you. Learn more details about the process in the recommended content below.

How to apply for the Carrefour card

Find out right now how to apply for the Carrefour card without complications, either through the app or through physical stores, step by step.

Carrefour Card: how to be approved?

Without a doubt, Carrefour performs a credit analysis based on your history. However, this does not mean that it will be impossible to be approved by the institution. Therefore, credit analysis is determined by several characteristics, both external – such as Serasa – and internal. Also, you can always get in touch to discuss limits. In this sense, it is necessary to talk through the chat in the application or on the numbers:

- 3004 2222 – capitals and metropolitan regions;

- 0800 718 2222 – other regions.

Americanas Card: another credit card option for you

Finally, if you were in doubt whether the Carrefour card is right for you, let us introduce you to the Americanas card. After all, with it, you have a credit card to use anywhere with exclusive benefits.

First, the Americanas card offers cashback and discounts with Ame Digital. That is, in purchases you still earn direct casback with Ame. In addition, it is possible to access exclusive offers from Americanas. Another legal benefit is Mais Limit. Therefore, you can have more credit on installment purchases. That way, it's easier to make some financial dreams come true.

In addition, the Americanas card can be monitored directly by the application. Therefore, it is possible to monitor expenses and understand your financial life properly.

Both the Carrefour and Americanas cards bring exclusive benefits to their customers. Finally, the decision depends a lot on which establishment the customer uses the most. Either Americanas or Carrefour establishments. That way, you just have to choose which one is best for your reality.

| Carrefour Card | Americanas Card | |

| Annuity | Exempt if you buy 1x per month in Carrefour stores | 12x of R$ 15.70 |

| minimum income | Not Informed | Not Informed |

| Flag | Mastercard or Visa | MasterCard |

| Roof | International | International |

| Benefits | Exclusive installment plans and discounts at Carrefour stores and websites | Cashback with Ame, Mais Sorrisos points program and extra credit for installment purchases |

How to apply for an Americanas card

The Americanas card offers exclusive benefit programs, in addition to having an easier credit analysis. Your request can be made online, without leaving your home.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Check out how to have financial independence with a salary above 1500 reais

See here all the functions of a dispatch assistant, how much you earn in this position and where to look for a job in the main regions of the country.

Keep Reading

Nubank Ultraviolet Card or Digio Card: which is better?

Decide between the Nubank Ultravioleta card or the Digio card. Both have international coverage and offer great customer benefits. Check out!

Keep Reading

Afinz Card or Avista Card: which is better?

If you choose between the Afinz card or the Avista card, you will have an international flag, use an application and a low annual fee. Learn more here!

Keep ReadingYou may also like

Discover the Bradesco Marvel card

Do you want to live a unique experience inspired by Marvel movies and also enjoy unique benefits? Discover the Bradesco Marvel card here.

Keep Reading

10 card options with no annual fee 2022

Are you looking for a card with no annual fee and that offers you several benefits? In today's post, we'll give you ten options that will help you when deciding on the ideal card.

Keep Reading

Check out how to get a work visa for Brazil

Are you wanting to move to Brazil to work? We have gathered here all the information you need to know about the work visa for Brazil, such as documentation, values, etc. Continue reading and learn more.

Keep Reading