digital account

5 digital banks for children and teenagers

Digital banks for children have increasingly exclusive benefits, such as a debit card and an app with a programmed allowance function. So, check out 5 benches for little ones in this article.

Advertisement

Discover the exclusive advantages of digital banks for children and teenagers

Families are increasingly looking for the best digital banks for children. This is because nowadays it is increasingly common to teach financial education to children. Because, when taught from a young age, children and teenagers treat money more naturally. This way, they avoid major difficulties with their financial life.

For families, a good way to facilitate this process in education are digital banks for children. These institutions offer exclusive advantages that help a lot with money management.

Banks offer the opportunity to create accounts in children's names, which gives them even more autonomy. Children and teenagers become accustomed to carrying out common everyday tasks, such as transfers, payments and many others.

In addition to having control over your own money and generating more responsible behavior. The young person begins to understand how much everything is worth and creates a sense of economy. In this article, you will learn about digital banking options for children and teenagers to start their financial lives. Let's go!

5 digital banking options for children and teenagers

It is increasingly common for digital banks to offer special options for children and teenagers. The accounts come with features that allow for more financial autonomy, such as making transfers and using a debit card. All of this helps children and teenagers to better organize their personal finances.

Therefore, we have separated the best digital banking options below, check them out!

1. PicPay

Pic Pay is a banking correspondent. It is possible to pay and pay in installments and receive cashback. But, an interesting alternative when we talk about digital banks for children is the digital wallet.

With the wallet, you can deposit money into the account and use it via your debit card. This way, you can control your expenses per month or per week, whichever you prefer.

To use the debit card, you must request the PicPay Card through the app. After that, PicPay carries out a credit analysis to offer the multiple card with the credit function. Check out the details of this digital banking option for children below.

| open rate | Exempt |

| minimum income | not informed |

| rates | Fee of R$6.50 for withdrawals |

| credit card | Yes |

| Benefits | Cashback; Debit and credit card; Control via the app. |

2. Banco Inter

Banco Inter is a digital bank that has exclusive services for children and teenagers. The Inter Kids account is 100% free and is a great option to introduce children to the financial world. In the kids account, the card is a debit card and is in the child's name.

In addition, Inter offers the function of making investments in the account. This way, you can focus your investments on your children’s future. Investments are in fixed income, such as CDB, LCI, LCA and savings, with short and long term options.

| open rate | Exempt |

| minimum income | not informed |

| rates | Exempt |

| credit card | Debit function only |

| Benefits | Debit card; Control via the app; Possibility to invest; Cashback. |

3. Banco Next

Banco Next is Bradesco's digital bank and also has exclusive options for small children. Unlike other banks, the Next Joy account is a feature for Next customers. Account opening is done through the application itself. The intention is to unite parents and children in one place.

Once the account is created, children have access to their own application. You can change the layout, making the game even cooler. Furthermore, the account has some functions that help a lot with the organization, such as programmed allowance and educational tracks.

The trails are activities to help children and teenagers on their financial life journey. They feature games and missions, which encourage young people to continue using the application and controlling their personal finances.

| open rate | Exempt |

| minimum income | not informed |

| rates | Exempt |

| credit card | Debit function only |

| Benefits | Educational trails; Partner discounts; Free transfers between parents and children. |

Is Digital Account worth it?

Those who have a digital account have all the practicality and agility, manage banking services and transfers through the app and more. Find out here!

4. Bank of Brazil

Although Banco do Brasil has great digital options, BB Conta Jovem still needs to be opened in a branch. To open the account, just look for the nearest branch with your CPF, ID and proof of residence.

The presence of a guardian is also required if the young person is under 18 years old. If the teenager is between 16 and 18 years old, they can sign the contract with their guardian. This account option is for those who are between 12 and 21 years old and are not yet at university.

| open rate | Exempt |

| minimum income | not informed |

| rates | not informed |

| credit card | You must be over 16 years old for credit approval |

| Benefits | Participation in the Ponto pra Você program |

5. Bradesco

Bradesco's account for children and teenagers offers spending control and financial education in one place. The Click Conta is a current account, but the balance pays off as if it were a savings account. The account also has a programmed allowance and an exclusive card for the child. Just like Banco do Brasil, the Click Account needs to be opened at a Bradesco branch.

The account is only made for those up to 17 years old. Click Conta is the ideal option for those who want to introduce their children to the world of investments. The child or teenager can set up to 5 goals in the app and understand which financial path they should follow.

| open rate | Exempt |

| minimum income | not informed |

| rates | not informed |

| credit card | Debit function only |

| Benefits | Educational partnerships with CNA, Egali and many others |

How to open a digital bank account for children?

As they are digital banks for children, accounts can be opened online. Most of the time through bank applications. It's quite simple. Just by providing basic information about the child and parents it is possible to have the account. Of those mentioned, only Banco do Brasil and Bradesco accounts must be opened in person.

It is common to have doubts about which bank to choose. Everyone has their advantages and disadvantages, however, the account for children works as a test. So it is more economical to opt for banks with no fees and more educational services, for example.

What documents are needed to open an account?

Documents may vary depending on the bank. However, the most important thing is for the child or teenager to have an ID and CPF, as it is not possible to open an account with a birth certificate.

In the case of physical banks, it is necessary to sign a contract in person. If the young person is under 18, the guardian must be present to sign the contract.

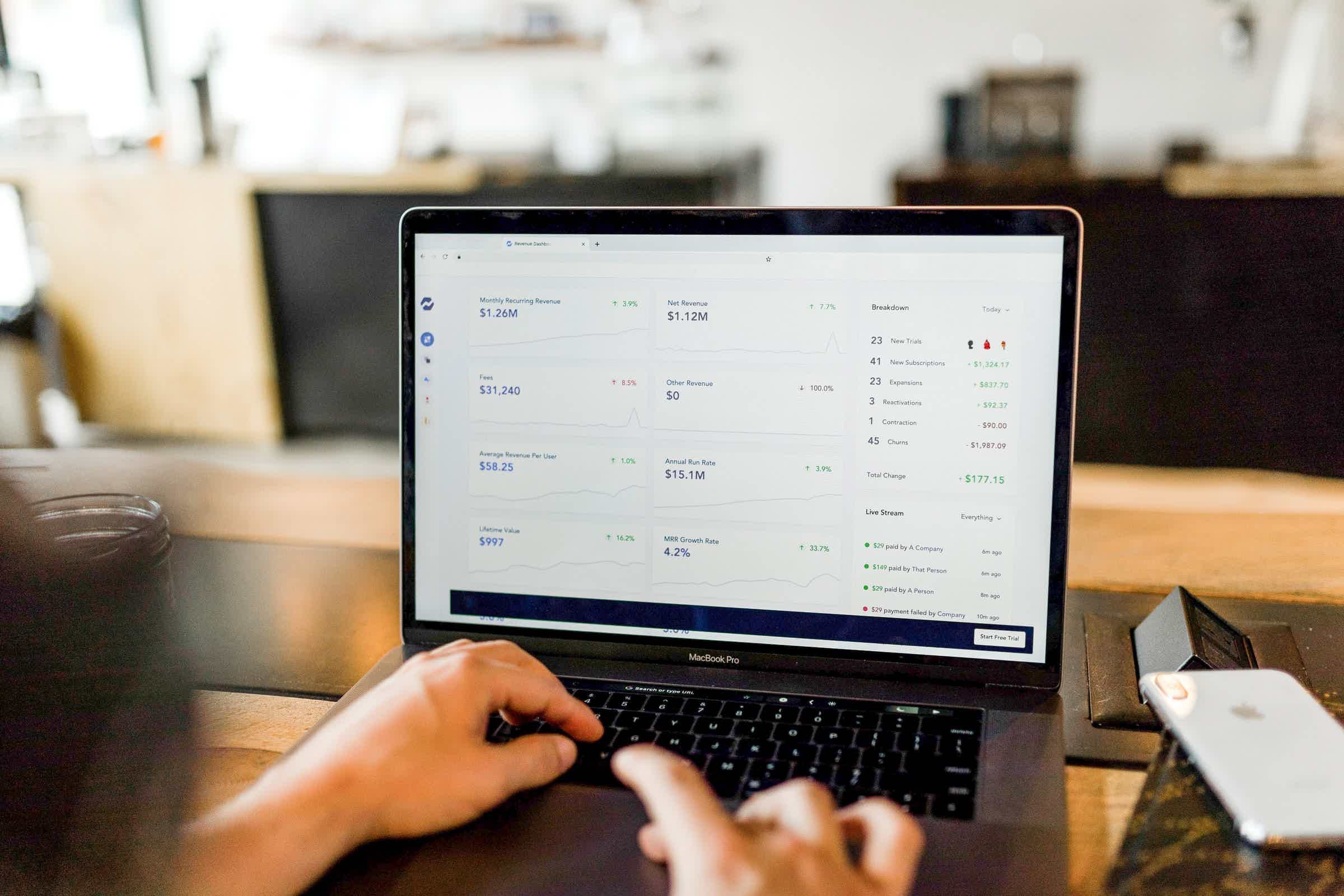

With these digital banking options for children, it is easier to help children and teenagers organize their financial lives. In addition to these, it is also important to keep your expenses organized so as not to get stuck, right? Check out this article for 7 tools to keep your finances under control.

7 personal finance tools

Do you want to organize your financial life, but don't know how to start? So, see 7 personal finance tools that will help you.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to get rid of restrictions on CPF

Want to know how to get rid of CPF restrictions and get your financial situation back to normal? So read this post and check it out!

Keep Reading

How to apply for the Nexoos loan

The Nexoos loan helps you invest in your business with credit without bureaucracy and low interest rates. Want to know how to apply? Read this post and check it out!

Keep Reading

Itaú Empresarial Loan: how it works

The Itaú Empresarial loan offers fast credit and a grace period of up to 90 days to start paying the installments! Want to know more? Check out!

Keep ReadingYou may also like

Cashme loan online: great credit conditions for you

If you need fast cash with different interest rates to catch up on your bills, the Cashme online loan is a great opportunity. To learn more about it, just continue reading.

Keep Reading

7 credit card options for the unemployed

Are you unemployed but need a good credit card? So this post is for you! Check out our credit card tips and information for the unemployed.

Keep Reading

Get to know the Basic Basket Aid benefit

With the Auxílio Cesta Básica benefit, families living in poverty or extreme poverty in Brazil will be able to receive help to buy essential food and personal hygiene items for their family. See more here.

Keep Reading