loans

Bank of Brazil Payroll Loan or C6 Consig Loan: which is better?

Choosing a good payday loan can be a difficult task. Therefore, today we are going to show you all the details of the Banco do Brasil Consignado loan and the C6 Consig loan. Keep reading and discover the best option for you!

Advertisement

Banco do Brasil Consignado x C6 Consig: find out which one to choose

Choosing a payroll loan can be a difficult task. Therefore, today we are going to help you decide between Banco do Brasil Consignado or the C6 Consig loan. Both are great payroll options.

In general, the main difference is that the C6 Consig is a digital option. While BB Consignado is a loan linked to a traditional bank. That way, it depends on your conditions to hire.

In addition, both loans are available to retirees, INSS pensioners and civil servants. Together, BB Consignado was also designed for employees of private companies that have an agreement with Banco do Brasil.

In this sense, continue reading to find out which is the best option between a Banco do Brasil Consignado loan or a C6 Consig loan!

How to apply for a BB Consignado loan

See now how you can apply for a payroll loan from Banco do Brasil!

How to apply for the C6 payroll loan

Learn here the step-by-step process to apply for the C6 Bank loan!

| BB Payroll | C6 Consig | |

| Minimum Income | not informed | not informed |

| Interest rate | not informed | not informed |

| Deadline to pay | Up to 96 months | Uninformed |

| release period | after hiring | after hiring |

| loan amount | depends on the benefit | depends on the benefit |

| Do you accept negatives? | Yes | Yes |

Bank of Brazil Payroll Loan

The payroll loan from Banco do Brasil is a great option for those who are account holders and also for those who are not. The bank offers exclusive conditions for you to get your dreams off the ground or to be able to pay off your debts.

Therefore, with BB Consignado, the installments are fixed and deducted directly from the INSS salary or benefit. With this, you avoid fines and default fees. Together, the bank already has a payment guarantee.

Incidentally, BB Consignado is intended especially for INSS retirees and pensioners, public servants and employees of partner private companies. Therefore, the loan has much lower rates than other types of loan.

Moreover, for those who are account holders, the loan contract can be requested over the internet. Without even having to leave the house. For those who are not account holders, it is necessary to go to a Banco do Brasil branch.

C6 Consig Loan

At first, the C6 Consig loan is a digital payroll loan designed for retirees, pensioners and federal employees. That is, the installments are debited directly from the salary or benefit.

Therefore, the bank is able to offer lower rates in relation to the market. In addition, the amount of the installment does not exceed 35% of the salary. This amount corresponds to the assignable margin available for borrowing.

In addition, the fees and the term to pay are customized. That is, you deliver your documentation to the bank and they analyze your financial history. From there, they offer you a proposal that fits in your pocket.

Incidentally, all stages of hiring can be resolved online. All without having to leave your home. You send the documents, sign the contract, all through your cell phone or your computer. Fast and without bureaucracy.

What are the advantages of the Banco do Brasil Consignado loan?

In general, the BB Payroll loan has great advantages. Starting with the payment term. The credit can be paid in up to 96 months and the installments are monthly and fixed. That way, you don't get lost in planning your budget.

In addition, as the installments are deducted directly from the salary or benefit, the payment is much more practical. Because you don't have to worry about fees or fines for default.

Even automatic debit is one of the reasons why payroll loans have the lowest rates on the market. In this way, the bank already has a certain payment guarantee and does not need to stipulate such high fees.

In addition, Banco do Brasil also offers loan portability. That is, if you already have a payroll loan in progress, you can easily transfer it to BB.

What are the advantages of the C6 Consig loan?

The C6 Consig loan offers several advantages to its customers. First of all, we can mention the fact that the credit is 100% digital. With this, you can solve all pending loan issues from your cell phone or computer.

In addition, C6 performs a personalized credit analysis. That is, you send all your documentation and proof of income and the bank stipulates fair rates for you. Everything for you to have a loan that fits in your pocket.

And because it is an online analysis, the process is much faster than in other traditional credits. Incidentally, the rates offered are lower due to the payment guarantee. Because the installments are debited directly from the customer's salary or benefit.

Furthermore, the installments are fixed and do not increase over time. With that, you don't have to worry about running away from planning your budget and falling into debt again.

Even though it is a digital loan, C6 has bank correspondents spread throughout Brazil. In this way, it is possible to attend in person to make the request or resolve pending matters.

What are the disadvantages of the Banco do Brasil Consignado loan?

In summary, a disadvantage of the Banco do Brasil loan is that if you are not an account holder, there are some extra bureaucracies. For example, those who do not have a bank account need to apply for the payroll loan in person.

In addition, it will be necessary to create a bond with BB to take out the loan. So, if you don't want to opt for the current account, this can be a disadvantage.

What are the disadvantages of the C6 Consig loan?

Basically, the C6 Consig loan has the disadvantage of having an incomplete website. This is because some information is not available on the website. That way, you need to get in touch with experts to find out what offer is available to you.

Furthermore, it is not possible to simulate the C6 Consig loan on the website. As we mentioned, you can only do the simulation by contacting the consultants and sending your documentation.

Bank of Brazil Payroll Loan or C6 Consig Loan: which one to choose?

Finally, both loans have pros and cons. In this sense, just review what you consider essential in a payroll loan to hire. It is worth remembering that BB offers the security of a traditional bank.

While C6 Consig has the practicality and speed of a digital loan. In addition, with C6 Consig you have personalized rates for your financial reality. You can get even lower values.

But for those who are account holders at BB and already have a good relationship with the bank, taking out a loan at Banco do Brasil may be a better alternative. Remember that regardless of the bank you choose, a loan requires research and planning.

Therefore, to help you reflect further, we will show you two more loan options for you to know. See now the Superdigital loan and the Jeitto loan!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to earn miles with the LATAM Pass card: understand the process

Find out in this post how to earn miles with the LATAM Pass card and how to use them to get discounts on your trips!

Keep Reading

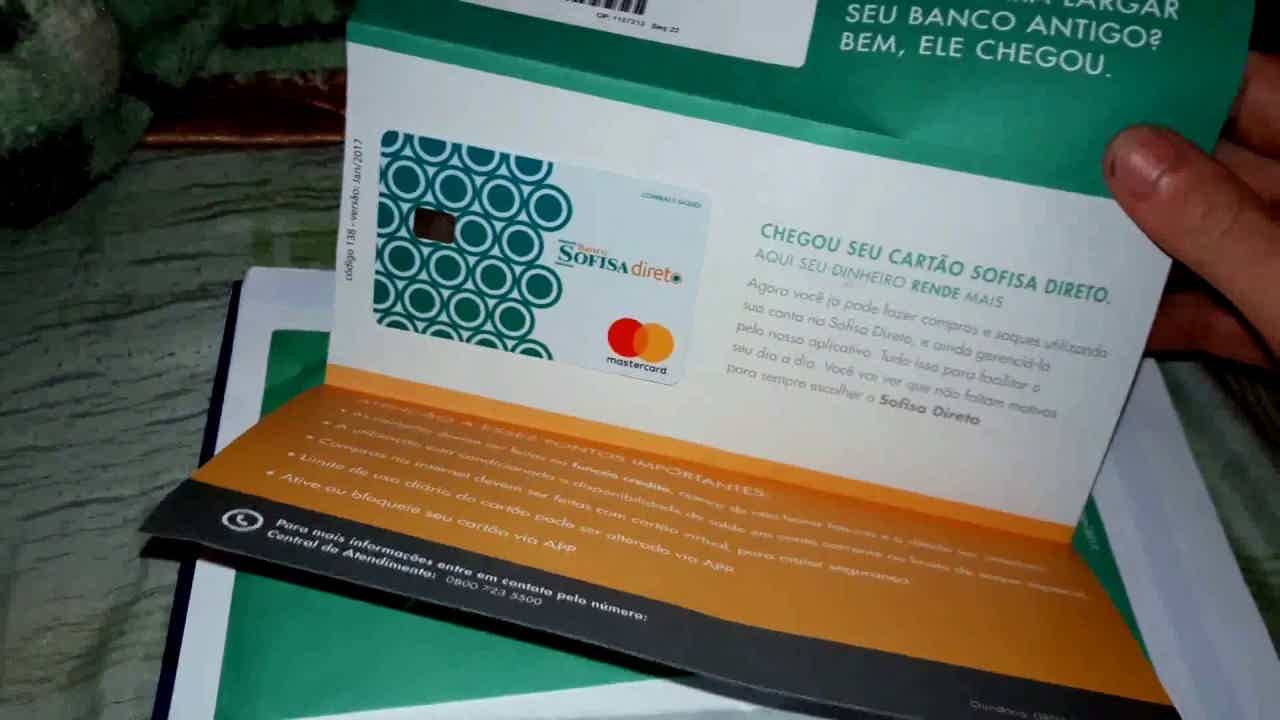

Sofisa credit card: what is Sofisa?

Get to know the Sofisa digital bank and the conditions and exclusive offers of the credit card with international coverage! Check out!

Keep Reading

Miles from the Decolar Santander card: how to convert points into miles?

Find out in this article how you can turn points into miles on the Decolar Santander card and thus have cheaper trips!

Keep ReadingYou may also like

What do I need to apply for LOAS?

If you are over 65 years old, have a disability, and have a low income, you are entitled to BPC! See here how to apply for the benefit.

Keep Reading

How to apply for the BPI Premium card

The BPI Premium card offers many advantages and exclusive discounts. Want to know how to order it? So read our post and check it out!

Keep Reading

Get to know Bcredi Real Estate Financing

Check here everything you need to know before hiring Bcredi real estate financing and find out if it's worth it or not.

Keep Reading