loans

How to advance FGTS through Digio? Know the step by step

With Digio, you can anticipate your birthday withdrawal and access an interest rate of just 1,99% per month! Learn how this is possible in this post!

Advertisement

Access 7 years of your anniversary withdrawal

Did you know that it is possible to take out a loan that does not generate a bill every month? For this, you just need to anticipate the FGTS through Digio!

FGTS anticipation is a new type of credit offered by several banks for you to access money that is already yours, only in advance!

Why receive FGTS through a digital account?

Learn how digital accounts can be good options for you to receive your fund balance!

Thus, you have the convenience of taking out a loan that does not generate bills to pay every month.

But how is this done in practice? And what conditions can you access when anticipating FGTS through Digio? Keep reading this article to find out!

What is the anticipation of Digio's FGTS?

In short, FGTS anticipation is a credit modality that allows you to access future installments of your birthday withdrawal.

Namely, the main difference of this modality to the others is that in anticipation, the payment of the loan is made automatically.

Therefore, the Digio bank will deduct the amount borrowed from your FGTS balance every year.

Thus, instead of withdrawing the resource every year, you can access its entire amount at once and allow the bank to take this amount as a means of repaying the loan.

Therefore, this modality does not generate any bills for you to pay. Here, payment is automatic and you can simply access the amount you need to invest in your projects.

How much does 50 thousand yield in Savings?

Get to know the real profitability of savings and find out how it works!

Who has the right to advance the FGTS?

As much as anticipating FGTS through Digio is a very interesting credit option, it is also necessary to consider that this modality can only be accessed by a specific public.

Therefore, to be able to anticipate the FGTS through Digio, you must be over 18 years old and have at least R$ 400.00 of FGTS balance to withdraw.

In addition, Digio also asks the applicant to have an active bank account so that they can transfer the credit amount.

That way, by meeting these requirements, you can already anticipate your birthday withdrawal and access better credit conditions!

What are the rates and deadlines for anticipating the FGTS through Digio?

In summary, as the FGTS advance payment is made automatically, Digio is able to offer more attractive conditions in this type of credit.

Starting with the interest rate applied, which is lower than on personal loans. By anticipating the FGTS through Digio, you can access a rate of just 1,99% per month.

In addition, by making the anticipation, you can access up to 7 birthday withdrawals and thus manage to have more money in your account.

Finally, another interesting information about the loan is the deadline for releasing the money to you. By anticipating the FGTS through Digio, you can access the amount within 1 business day after hiring!.

Is it worth anticipating FGTS?

Digio's FGTS anticipation conditions are super attractive and already make anyone want to request it!

But, before that, it is interesting that you know if this type of loan is really worth it for your financial life.

That way, you can be more sure that what you are requesting will really help you.

Therefore, we separate below the main positive and negative points of this anticipation for you to analyze carefully and decide if this is the best option.

Benefits

Starting with the advantages, we can see that Digio manages to offer excellent loan conditions and a good hiring experience. Check out more details about the perks below!

Completely online application

First of all, we have to highlight the fact that the loan can be taken out without leaving your home. That way, wherever you are, you can anticipate FGTS through Digio in a simple and practical way.

No bureaucracy

Like a good online loan, FGTS anticipation is a bureaucracy-free option.

Here you can take out the loan directly through the bank's application and thus access the amount you need without worrying about chasing different documents.

Access many parcels

In summary, there are many banks that allow you to anticipate the FGTS. But, many of them allow access to a few plots, and it is possible to find places that offer only 1 plot or only 5.

Therefore, by anticipating the FGTS through Digio, you can access more installments and take advantage of their value to carry out your plans.

Without compromising your budget

In this type of loan, the value of the installments is automatically deducted from your guarantee fund.

That way, you don't have to worry about working harder to pay the loan or depriving your leisure to pay the installments.

With this modality, your current budget is not compromised, and you can access the money you need without sacrificing what you already have.

Available for negatives

Last but not least, the anticipation of the FGTS is fully available for those who are negative.

In this way, those who have difficulty accessing credit in other loans will be able to find the credit they need without the risk of not being approved.

Disadvantages

The advantages of anticipation are really great, but we cannot forget that this modality can also have some negative points, as you know below.

Your FGTS is blocked

The main disadvantage of anticipating the FGTS is that this type of loan leaves your guarantee fund blocked.

This block happens so that the resources that will be used to pay the bank are actually in your FGTS account to pay off the loan.

However, if you need to access this money in the future, you will only be able to withdraw a portion of your fund and not its full amount.

Need to create bank account

Another disadvantage is that it is necessary to create a Digio bank account. Thus, you will need to take one more step to access the credit you need.

Can only be accessed by a restricted audience

Finally, the anticipation of the FGTS can only be accessed by a more restricted public of people.

Thus, those who do not have a FGTS balance or have never worked with a portfolio record may not be able to take out this loan, which offers better conditions.

How to advance FGTS through Digio?

Have you analyzed the pros and cons of prepayment and decided that this loan is right for you? So, now you need to learn how to make this request!

First, you need to go to the FGTS application and join the birthday withdrawal. After doing so, click on “Authorize banks” and search for the Digio bank.

When you find it, select it for the list of banks that can access your FGTS data. This step is necessary for the bank to know your FGTS balance and thus be able to release the credit and redeem the annual payments.

That way, after having authorized the bank, you can proceed to the Digio application, access the credit tab and start requesting your FGTS advance!

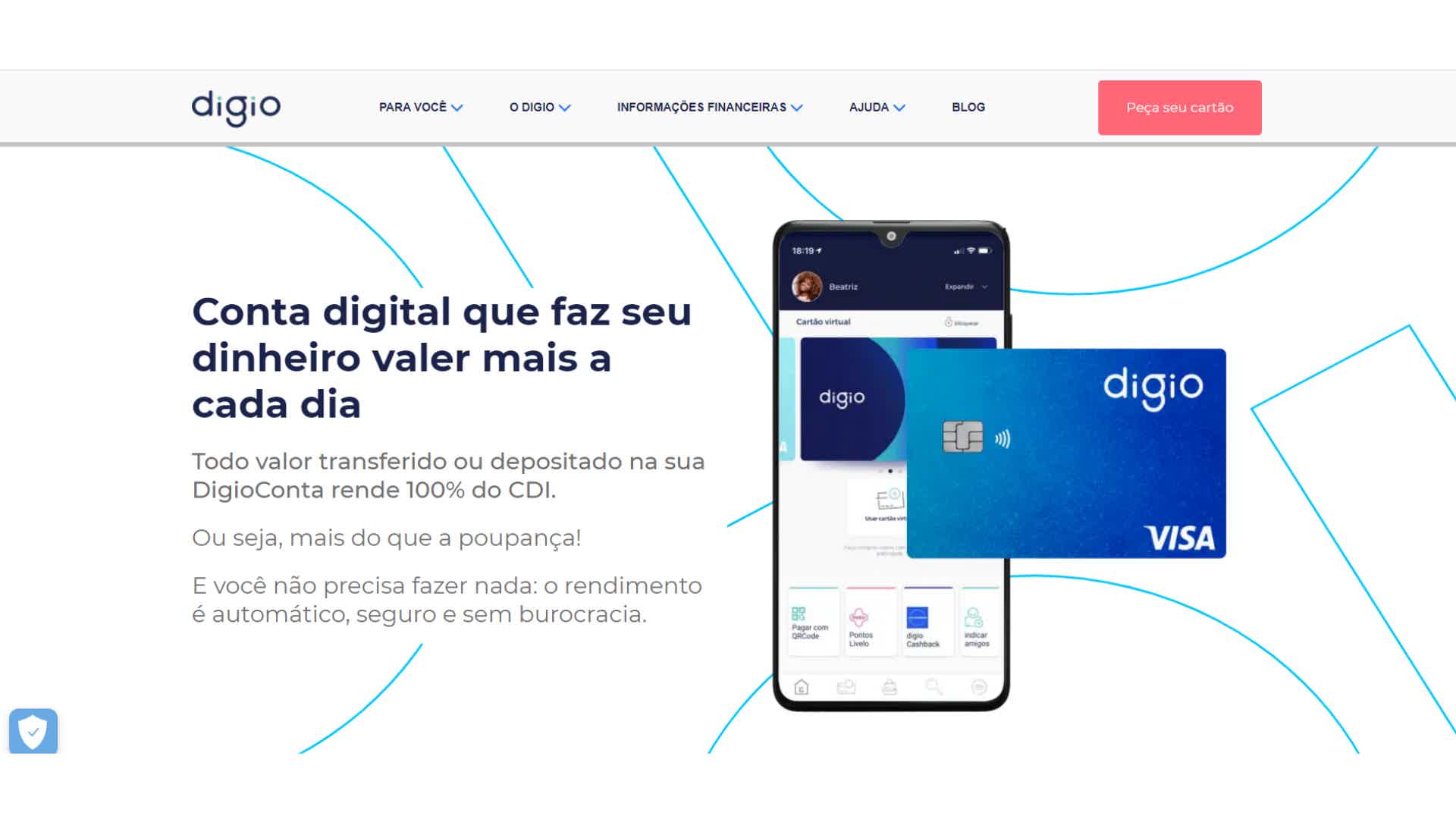

And if you don't have a Digio account yet, you can learn how to create one in the post below!

How to open account in Digio?

Check out the step by step to have an account at this bank and anticipate the FGTS!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know Banco do Brasil real estate credit

Banco do Brasil real estate credit has rates customized for you! Find out about financing here and hire your 100% online now.

Keep Reading

How to avoid attachment of goods by dirty name

If you don't want to have problems with your accounts, find out right now how to avoid seizing goods in a dirty name and get everything back in the green

Keep Reading

Get to know Bradesco real estate credit

Bradesco real estate credit offers financing of up to 80% of the value of the property with interest from 2.99% per year. Check out all the benefits here!

Keep ReadingYou may also like

How to get a card with a limit of R$ 10 thousand?

Most people dream of a high credit card limit. But have you ever stopped to think which is the best bank option for you? Check it out today!

Keep Reading

Cost of living in Portugal: check all the information

Are you thinking of moving to Portugal? Before packing your bags, it is important to assess how much it costs to live in the country to make sure that the expenses will fit your budget. For information on the subject, just continue reading the article.

Keep Reading