loans

How to advance FGTS through BMG? Check it step by step

FGTS anticipation is a credit modality that allows you to access better conditions and receive the money in your account in a short time. Check out in this text how it works to advance FGTS through BMG.

Advertisement

Have up to 10 birthday withdrawal installments in 30 minutes

If you are looking for a loan that has a quick release and low interest rates, it may be a good idea to prepay the FGTS through BMG.

This famous and consolidated Brazilian bank allows workers who have a balance in the guarantee fund to anticipate 10 installments of the birthday withdrawal.

How to request FGTS birthday withdrawal

Learn how to adhere to this form of withdrawal in order to anticipate the FGTS!

In this way, these people can have access to a loan modality with better conditions and that does not compromise their monthly budget.

To learn more about the process of anticipating FGTS through BMG and how it allows you to access credit with better conditions, just continue with us in this article.

What is the anticipation of BMG's FGTS?

Basically, FGTS anticipation is a credit modality offered by banks that allow you to access an amount of your fund from the birthday withdrawal.

Namely, the birthday withdrawal is a resource launched by the guarantee fund a few years ago that allows workers to access a portion of their FGTS balance once a year in the month of their birthday.

In view of this, several banks began to offer a new type of loan, where it offers the total value of the birthday withdrawal installments of 1, 5 and up to 10 years for the worker to access today.

In this way, the bank releases the money to the person and, as a means of payment for the loan, they automatically deduct the amount of the birthday withdrawal every year to pay off the loan.

Thus, workers can access the money they need without having to worry about paying another bill every month, as payment for this type of loan is made automatically between the bank and Caixa.

In this way, banks and financial institutions are able to offer better conditions in this type of loan. Thus, the public can access lower interest rates over a longer payment term.

Who has the right to advance the FGTS?

In summary, the process of anticipating FGTS through BMG offers many advantages to the public. However, this modality is only available to people who meet the following requirements:

- Are over 18 years of age;

- Work or have worked with a formal contract;

- Have a balance in the FGTS to carry out the loan;

- They adhered to the anniversary withdrawal instead of the termination withdrawal.

Therefore, people who meet the requirements listed above can anticipate their FGTS through Banco BMG and access better loan conditions, as you can see below.

What are the rates and deadlines for anticipating the FGTS through BMG?

After all, by anticipating the FGTS through the BMG bank, you can access up to 10 installments of your birthday withdrawal.

This means that you can have access to up to 10 years of the withdrawal amount that you would get in your birthday month.

In addition, this type of loan can offer you low monthly interest. Namely, the BMG bank applies an interest rate from 1.69% per month.

That way, you can access a good credit value with low interest rates.

Finally, by anticipating the FGTS through the BMG bank, you can receive the money in your account within 1 business day. Incidentally, the bank also discloses that you can make the payment within 30 minutes after signing the contract.

Is it worth anticipating FGTS?

So far you could see that the FGTS anticipation is a different type of credit that offers more attractive conditions and that do not harm your monthly budget.

But, despite knowing these and other characteristics, we can still be in doubt if this is an interesting type of credit for our financial life.

Therefore, if you have this doubt at the moment, we have separated below the main advantages and disadvantages of anticipating the FGTS so that you can analyze whether this option is really advantageous.

Benefits

Let's start by looking at the advantages of anticipating the FGTS from Banco BMG. By carrying out this advance, you can receive the money in your account very quickly and access very attractive interest rates.

But these are not the only advantages that this type of loan can offer you. Below, you can learn about three more major advantages of anticipating the FGTS through BMG.

You can take out other lines of credit

First, one of the great advantages of anticipating the FGTS is that this type of credit does not prevent you from accessing other types of loans.

In this way, by anticipating your guarantee fund today, it is still possible to take out a payroll loan, personal, with a guarantee and even finance in the future.

Your budget stays calm

Another great advantage of anticipation is that it is the only type of credit that really does not harm your monthly budget.

As the value of the installments will be automatically deducted from your guarantee fund, you don't have to worry about organizing your finances to fit one more slip.

So you can rest assured and access the money you need without worrying about making the payment later.

You access the lowest interest

Last but not least, by anticipating the FGTS through the BMG bank, you can access much lower interest rates compared to other loan modalities.

In this way, you can save money when applying for this credit, as you will be able to pay less interest.

Disadvantages

Now that you already know the advantages of anticipating your FGTS, it's time to also know the negative points that this line of credit can present for your financial life.

Your FGTS will be blocked

The first major disadvantage of anticipating the FGTS is that when applying for this loan, your guarantee fund may be blocked.

In this way, the amount you contracted today will be blocked in your fund so that you will not be able to access it in the future.

That way, if an emergency happens and you need the amount of your guarantee fund, you will only be able to access a portion of that amount that was not blocked due to the loan.

Need to create account to access special rates

Another disadvantage of making the FGTS advance through the BMG bank is that the bank offers special rates for its customers.

That way, if you want to access an even lower interest rate, you will need to create a bank account to get a better credit condition.

Therefore, this practice represents one more step that you will need to do in your loan, which can make it a more bureaucratic process.

Restricted loan type

Finally, the last major disadvantage of anticipation is that it can only be accessed by a more restricted audience.

Therefore, people who have never worked formally or who do not have a balance in the FGTS cannot take out this loan and access the best conditions it offers.

How to advance FGTS through BMG?

In summary, the process of advancing your FGTS through Banco BMG, despite being a restricted credit modality that blocks your fund, can still be worthwhile when you really need the money.

Therefore, if you have analyzed the pros and cons of this loan and want to apply for it, you need to learn how to apply.

The first step to anticipate the FGTS through the BMG bank is to access the Fundo de Garantia application and join the birthday withdrawal.

By doing so, you can also authorize the BMG bank to consult your FGTS data. Only then will the bank be able to release the credit for you.

After carrying out this small operation, you can go to the official channels of Banco BMG to officially request the advance payment of the FGTS.

For this, the bank offers several different channels where you can access this loan. You can request through the website, through the application if you are a customer or through WhatsApp and company telephones.

Thus, when entering any of these channels, you will be able to make a simulation of the credit that you can access and, thus, start taking out the loan by passing on your personal data to the bank to carry out the credit analysis.

This way, Banco BMG will answer you in a few days if the analysis was approved or not. If so, you can sign the loan agreement and wait for the money to be released into your account.

On the other hand, if you want to learn more about the loan application via WhatsApp, check out the recommended content below.

BMG WhatsApp loan

See how you can advance your FGTS and apply for other loans from a conversation with the bank!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

7 Main questions about the Access card

Do you know how to apply for Access card? Do you know how to recover the password? Today we are going to answer the main questions about the Access card. Check out!

Keep Reading

Cidadania4U app: Get your Italian citizenship without bureaucracy

The Cidadania4U Application: Your essential tool to simplify the process of obtaining Italian citizenship.

Keep Reading

How to subscribe to 1001 Questions? See the process

Find out how to sign up for 1001 Questions to be on TV and still have a chance to take home the prize of R$ 20k!

Keep ReadingYou may also like

Discover the Chase Sapphire Reserve Credit Card

Many benefits and perks. Lots of bonuses, points and even spending rewards. This is the Chase Sapphire Reserve Card. Learn more about the world of advantages it offers here.

Keep Reading

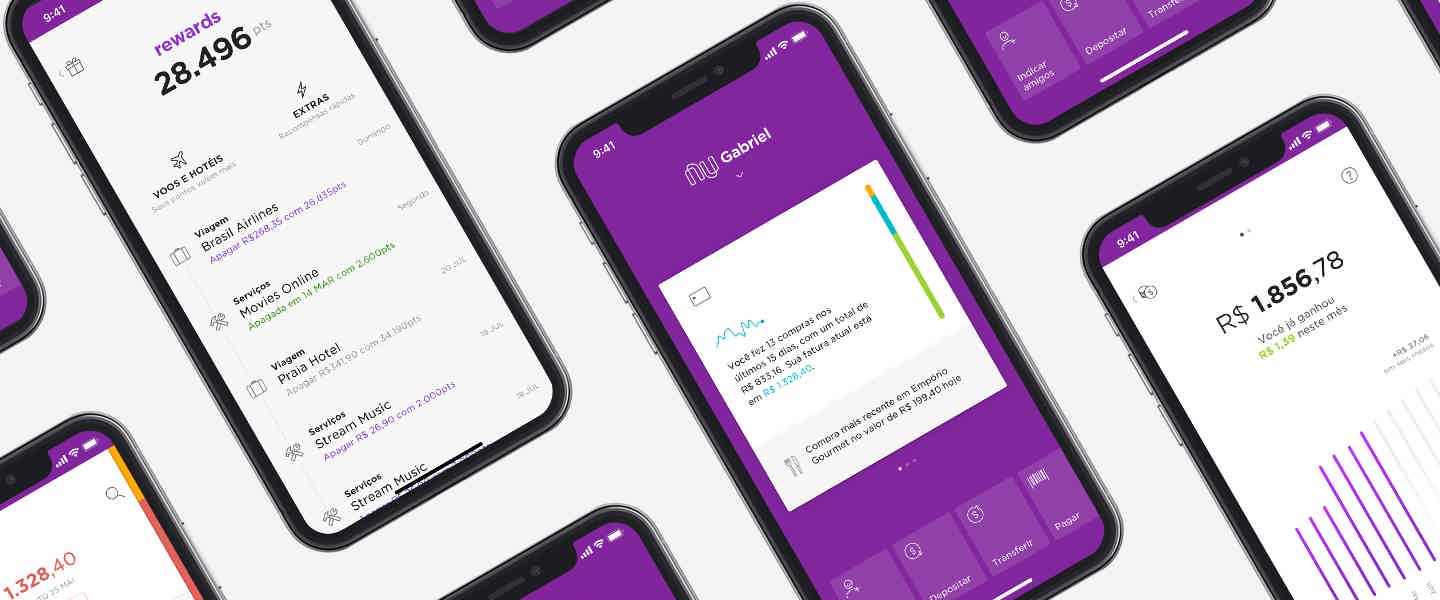

How to anticipate Nubank invoice?

Nubank is one of the best known banks in Brazil and has been winning the hearts of many customers every day. However, when using a credit card, there are still doubts as to whether there is a way to anticipate a Nubank invoice through the app and how this process works. Curious to find out more? Continue with us throughout the post!

Keep Reading

Get to know the Claro Smartcred pre-approved loan

The Claro pre-approved loan is a good option for those who need urgent cash with a hassle-free process and 100% online.

Keep Reading