Cards

Afinz Card or BTG+ Card: which is better?

While one of the alternatives is ideal for anyone looking for a discounted card at various companies, including doctors' offices. The other was made for those looking for investments. So, see the comparison between the Afinz card or the BTG+ card and choose the best option.

Advertisement

Afinz x BTG+: find out which one to choose

It is undeniable that it is not possible to have access to all the credit cards available on the market, but we can get to know each one of them and choose the best option according to our current financial situation and the advantages of the card. That's why, today, we're going to help you choose between the Afinz card or the BTG+ card.

So, continue reading to find out about the features, as well as the advantages and disadvantages of these two cards. Let's go!

How to apply for the Afinz card

Do you want to learn how to apply for the Afinz card with an app and discounts on appointments? So, read this post to learn step by step!

How to apply for BTG+ credit cards?

Do you want to know how to apply for BTG+ credit cards and have one of the best cashback programs on the market? So, know that you are in the right place!

| Afinz Card | BTG+ card | |

| Minimum Income | not informed | not informed |

| Annuity | R$ 227.88 | Exempt (Basic Option) |

| Flag | Visa | MasterCard |

| Roof | International | International |

| Benefits | Up to 40 days to pay Additional cards with 50% annual fee discount You Well Program | Invest+ program (optional) Withdrawals on the Banco24Horas network Mastercard Surprise Program |

Afinz Card

If you are looking for a credit card with advantages that can even help you save money, you have found the best alternative. That's because, with the Afinz card, you can get discounts on exams, medications and even online courses in education.

This happens because Afinz has the Você Bem Program and, through it, offers discounts at several partner companies in the health and education area, aiming to provide quality service to customers who find a unique experience at Afinz.

And, in addition, the card has international coverage, that is, you can travel outside Brazil and continue using Afinz services, as well as guaranteeing participation in the benefits of the Visa flag, which is also accepted in several countries.

So, with the Afinz card you can have several advantages in just one financial product. Continue reading to find out more information.

BTG+ card

First, the BTG+ card is issued by the BTG+ bank, so the institution issues three models of BTG+ cards, namely: BTG+ Black card and BTG+ Opção Avançada card, in both the annuity is charged and the BTG+ Opção Básica card, which is the card we will talk about around here and, which does not charge annuity.

So, as we mentioned, the BTG+ Basic Option card does not charge an annual fee. That way, you don't have to worry about paying a fee to maintain the card's services, however, it has revolving interest of around 10% per month.

And, in addition, like the other BTG+ cards, it has international coverage, that is, you can make purchases in Brazil and in other countries, as well as make payments, financial transfers, among other services.

In addition, the card has the Mastercard brand, which is the most accepted in the world, and when you register your card in the Mastercard Surpreenda program, you earn 1 point whenever you use it to make purchases, regardless of the amount. And from 5 points, you can exchange for rewards.

What are the advantages of the Afinz card?

Among the advantages of the Afinz card are the international Visa flag, with which you can make purchases anywhere in the world. Furthermore, you can participate in programs such as Vai de Visa, as well as enjoy other benefits, such as purchase and price protection, travel insurance and Visa 24-hour assistance.

And, in addition, you also get 50% discount on the annuity on the additional cards you order, as well as you can also pay your purchases in as many installments as you want, bringing more security to your finances.

In addition, it also participates in the Você Bem Program, which offers discounts on various education and health services for you to take advantage of and save money on.

What are the advantages of the BTG+ card?

So, let's talk about the advantages of the BTG+ Basic Option card. First, you have the BTG+ bank application and through it you can request an increase in the card limit, as well as consult your invoice, unblock your card and carry out your transactions.

And, in addition, the card also accepts approximation payments and you can use the virtual card even before receiving the physical version of the plastic. Also, remembering that you don't pay an annuity and you don't even need to prove a minimum income to access the card and services.

However, you can participate in the Invest+ Program in which part of your expenses are transformed into investments. But, opting for the program in the basic version, a monthly fee will be charged. That is, the annuity is no longer exempt and you will have to pay R$ 30.00 per month.

What are the disadvantages of the Afinz card?

Among the disadvantages of the Afinz card are the annuity charge in the amount of R$227.88 and the lack of possibility of exemption from this amount.

Just as there is a requirement that there is no restriction on the CPF in credit protection agencies, so if you are negative, look for other card options available on the market.

What are the disadvantages of the BTG+ card?

Still talking about the BTG+ card, let's mention the disadvantage. First, the disadvantage of the BTG+ Basic Option card is the annual fee charged if you opt for the Invest+ program.

And, moreover, if your money is stuck in the account it will not yield, that is, it is necessary to make bank transactions so that the benefit can be worthwhile.

Furthermore, despite having the basic version, the BTG+ bank performs a credit analysis before approving the card application.

Afinz Card or BTG+ Card: which one to choose?

First of all, now that you know the characteristics, advantages and disadvantages of the Afinz card or the BTG+ card, you can carefully analyze them and choose which of the two cards best meets your expectations. In addition, both have an international flag and exclusive benefits.

On the other hand, if you still haven't managed to make your choice, you don't have to worry, because in the recommended content below there is another comparison between cards. Check out!

Access card or BTG+ card: which one to choose?

While one of the options is ideal for those with a dirty name, the other was made for those thinking about investing in a large bank. Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

BB Credit Credit: what it is and how it works

With BB Crediário you can finance various services and goods and only start paying after 59 days. Want to know more? Check it out here!

Keep Reading

What is inflation and how does it impact your finances?

Do you know what inflation is and how it impacts your finances? Today we will explain to you about this phenomenon and give you other useful tips! Check out!

Keep Reading

Passaí Card or VestCasa Card: which is better?

If you are in doubt about which card to choose, understand the comparisons between the passai card and the vestcasa card. Look here!

Keep ReadingYou may also like

Discover the EuroBic Gold credit card

The EuroBic Gold credit card offers many advantages, such as exclusive free insurance and contactless payment. In addition, it is ideal for everyday shopping. Do you want to know more about him? So read this post and check it out!

Keep Reading

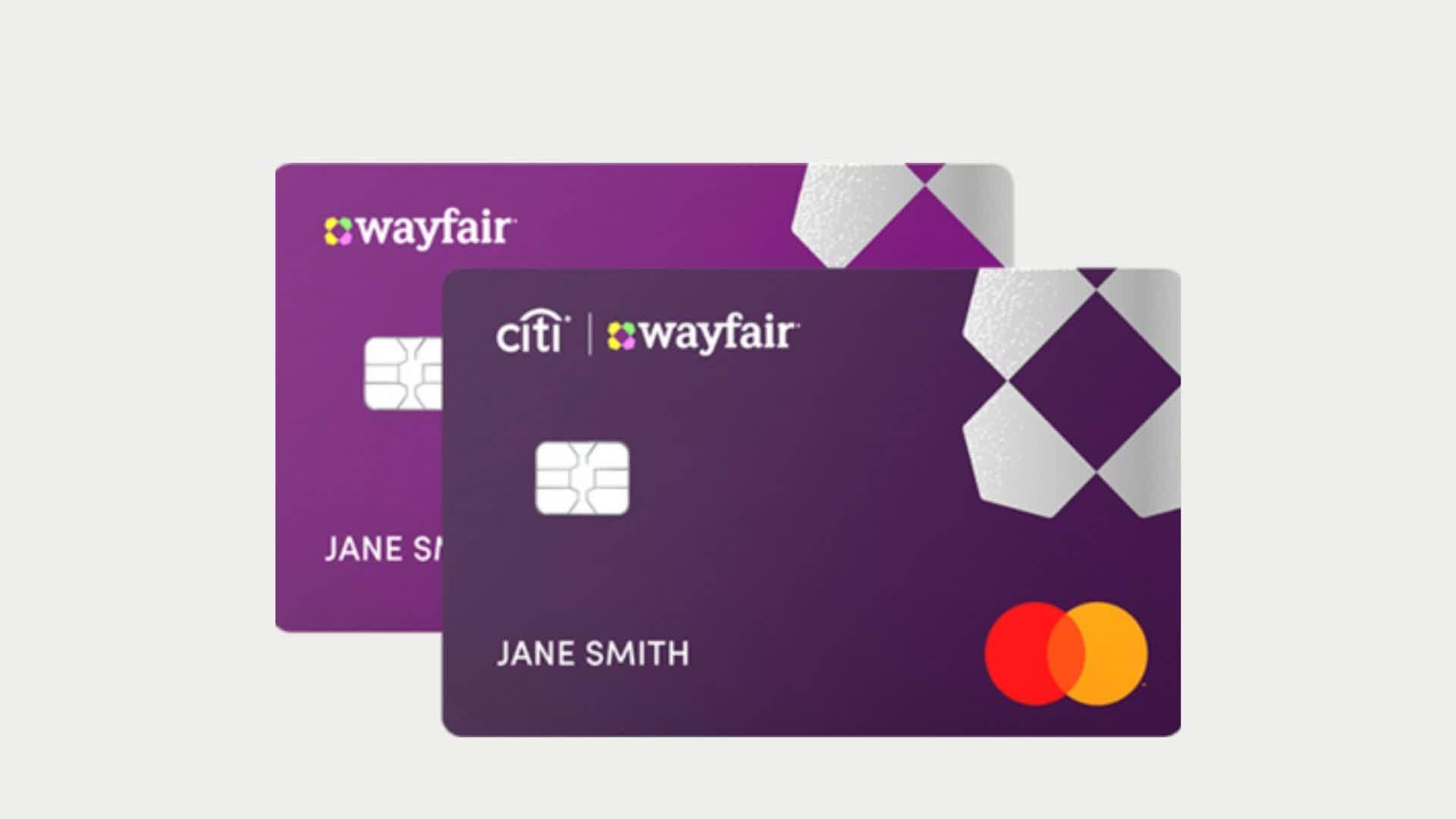

Discover the Wayfair credit card

Wayfair offers a wide range of furniture in its store and in the brand's others. Customers can even get more out of deals with the Wayfair credit card. Find out more about this financial product below.

Keep Reading

7 best digital accounts in Portugal in 2021

Do you want to be more practical on a daily basis and have banking services 24 hours a day? So, get to know the best digital accounts in Portugal and choose the one that seems most interesting to you!

Keep Reading