loans

Get to know the loan Auxílio Brasil Meu Tudo

With this loan you can access low interest rates, a good payment term and the possibility of repaying your loan within two years! Learn more here.

Advertisement

Borrow up to R$ 2,400.00 with this finance company

The Auxílio Brasil Meu Tudo loan is an interesting credit option for anyone who is a beneficiary of the program and would like to access extra money to carry out their projects!

With this loan, you can access the lowest interest rates and still have a good term to pay it off.

| Minimum Income | not informed |

| Interest rate | From 3,39% per month |

| Deadline to pay | Up to 24 months |

| release period | Up to 2 business days |

| loan amount | At most R$ 2,400.00 |

| Do you accept negatives? | Uninformed |

| Benefits | Online 100% application low interest quick release |

How to apply for a loan Auxílio Brasil Meu Tudo

See here how applying for this loan works in practice.

Furthermore, the loan can be quickly released into your account, allowing you to use the money in a short time.

Therefore, in this post you will learn more about the Auxílio Brasil Meu Tudo loan and see how it works and what conditions it can offer.

How does the Auxílio Brasil Meu Tudo loan work?

In short, the Auxílio Brasil Meu Tudo loan works similarly to a payroll loan.

That way, you take out the loan and when it comes time to make the payment, Meu Tudo will automatically deduct the value of the portion of the benefit you receive from the government.

But, so that you still have plenty of money to use in the month, Meu Tudo deducts only the equivalent of 40% from the value of your benefit.

In this way, those who receive aid of R$ 400.00 will be able to access installments of only R$ 160.00.

What is the loan limit?

So, with the Auxílio Brasil Meu Tudo loan, you can access a good amount of credit to use!

Namely, the loan amounts that the platform offers to the public start at R$ 200.00, reaching a maximum of R$ 2,400.00.

Who is the loan for?

This Meu Tudo loan modality is available to anyone who is receiving the Auxílio Brasil benefit.

In this way, if your family receives the benefit, it is already possible for you to access the loan and apply for it from that finance company.

Loan Assistance Brazil Meu Is everything worth it?

After knowing the main characteristics of the Auxílio Brasil Meu Tudo loan and how it works, many people can now be excited to apply for the loan!

However, before taking this action, it is interesting to know the pros and cons of this credit option to be sure that you are applying for a loan that will be good for your financial life.

Therefore, to help you with this, we have separated below the main advantages and disadvantages of this credit option for you to know!

Benefits

In short, the Auxílio Brasil Meu Tudo loan can offer you great benefits. So from there you can:

- Access lower interest rates;

- Receive money quickly in your account;

- Have low installments every month;

- More chances of approval.

In addition, as the payment of the loan installment is made automatically, you don't even have to worry about making the payment.

Thus, you manage to have more practicality in your daily life and time to carry out your plans.

Disadvantages

As much as the Auxílio Brasil Meu Tudo loan has great benefits, we cannot deny that this operation also has some negative points.

First, there is the fact that the credit released is a low amount. Nowadays, we can find payroll loans that grant a higher credit value.

In addition, if you stop receiving the Auxílio Brasil benefit, it will still be necessary to continue paying the installments until the loan is paid off.

How to apply for a loan called “Auxílio Brasil Meu Tudo”?

If, after analyzing the pros and cons of the Auxílio Brasil Meu Tudo loan, you decide to apply for it, know that the process itself is very simple.

Namely, the loan request can be made through the official website of the finance company, where you carry out all the contracting steps and manage to receive the money quickly in your account.

Therefore, to learn more about the application process and learn how to apply for the Auxílio Brasil Meu Tudo loan, you can check the following post that shows everything about applying for this credit!

How to apply for a loan Auxílio Brasil Meu Tudo

Learn here how to access this credit without leaving home!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Havan card

Accepted at all Havan stores in Brazil, the Havan card offers benefits such as zero annuity and shopping facilities. See how to apply!

Keep Reading

How to settle debt from R$50 reais

Do you know how to settle debt from R$50 reais? You need to get organized and you can check Serasa's offers. Check out more about it!

Keep Reading

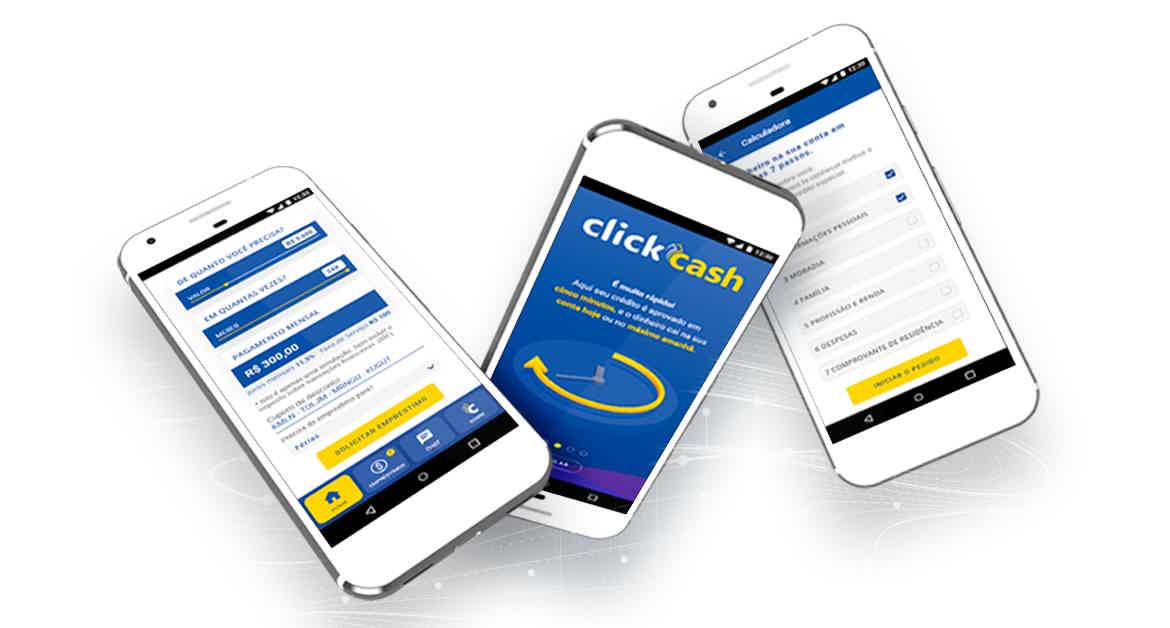

Click Cash personal loan: what it is and how it works

The Click Cash personal loan is the perfect line of credit for those who need financial assistance without bureaucracy. Want to know more? Check out!

Keep ReadingYou may also like

7 card options for salaried employees 2021

If you are salaried and looking for a functional card? Compare here the characteristics, advantages, disadvantages and credit evaluation criteria of the best financial product options on the market. So you can find the card that makes sense for you.

Keep Reading

TAP Miles&Go Credit Card: get benefits on everyday purchases while accumulating miles

Get the TAP Miles&Go Credit Card and transform your daily purchases into airline miles. Discover how you can travel economically and in style with ease. Find out more now!

Keep Reading

How to open a Best Ordained current account

The Best Ordenado current account is a complete option to keep your money safe and earning more and more. To learn how to open and take advantage of free intrabank transfers and debit card, read on and check it out!

Keep Reading