loans

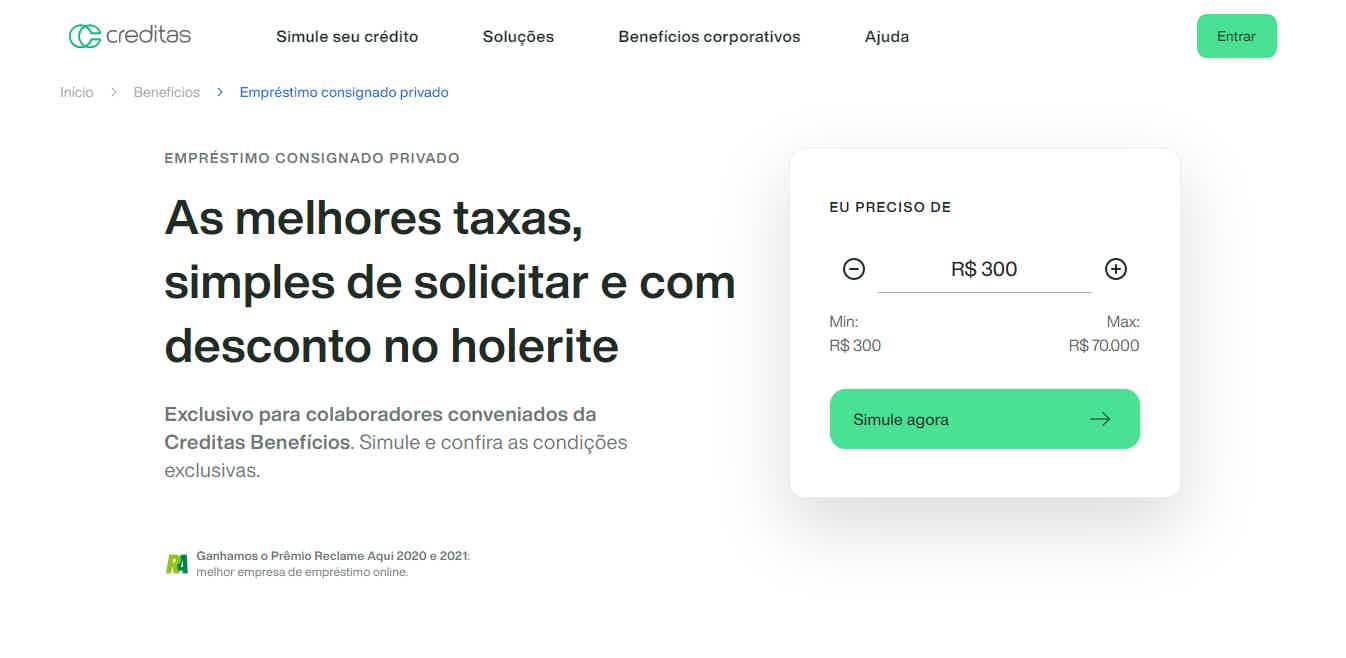

Discover the Creditas payroll loan

With this loan, you can access low interest rates and have up to 5 years to pay off a loan with fixed installments so you don't have to worry about paying off every month. Learn more about this credit here.

Advertisement

Access the best rates and get approved even if you have a negative rating

If you are a salaried employee at a company affiliated with Creditas Benefícios, you can have access to credit with better payment conditions and low interest rates.

This is the Creditas payroll loan that allows you to have access to up to R$$ 70 thousand in credit that you can pay in fixed installments in up to 60 months.

| Minimum Income | not informed |

| Interest rate | Starting at 1,49% am |

| Deadline to pay | Up to 60 months |

| release period | Within 5 business days |

| loan amount | Up to R$ 70 thousand |

| Do you accept negatives? | Yes |

| Benefits | Online 100% application fixed installments |

How to apply for a Creditas payroll loan

Request via the app, phone and website in a very quick and easy way!

With this option, you have even more convenience, since you won't have to pay another bill every month. Thus, with the loan, the value of the installments is automatically deducted from your salary, preventing you from defaulting on your payments!

Therefore, in this post you will learn more about the Creditas payroll loan and see how this option can be interesting for your financial life!

How does the Creditas payroll loan work?

First of all, it is important to understand how a Creditas payroll loan works in practice!

Therefore, this type of credit was created especially for those who work as CLT employees and whose company is accredited by the financial institution.

In this way, from this loan, these people can request a certain amount of credit.

Therefore, after formalizing the transaction, the value of the installments will be automatically deducted from the paycheck, salary slip or benefit that the person receives.

Furthermore, as the Creditas payroll loan is made for people with a fixed income, it is possible to access better interest and term conditions, since the person's salary is used as payment guarantee.

And here you don't need to worry that the value of the installments won't consume your entire salary! According to Law No. 10,820, payroll loans can only have installments worth up to 35% of the applicant's salary.

This way, you know that only a small portion of your income is compromised and that you will still be able to use your salary for your other financial responsibilities.

What is the loan limit?

Namely, the credit limit that the Creditas payroll loan offers to the public is R$70,000, while the minimum that can be borrowed is R$300.00.

However, the release of this amount will depend solely on the credit analysis that the financial institution will carry out on your profile.

Who is the loan for?

Initially, payroll loans were made especially for retirees, INSS pensioners and salaried workers. However, Creditas has a special criterion for this.

Therefore, to apply for a Creditas payroll loan, your company must be affiliated with the Creditas Benefits program so that the credit can be released.

Is a Creditas payroll loan worth it?

At first, after learning a little more about the Creditas payroll loan, it is common to have doubts about whether this is really the best option.

After all, the loan has attractive payment terms and can offer low interest rates. But is it really a good idea to apply for it?

Therefore, to find out, it is necessary to know the main positive and negative points of this solution!

Benefits

Initially, the Creditas payroll loan can surprise you and offers an interesting range of benefits, such as:

- Fixed installments that consume up to 35% of the salary;

- Fully online application;

- Approves credit for those with bad credit;

- It has a low interest rate;

- Allows you to pay in up to 5 years.

In addition to all this, when you take out a Creditas payroll loan, you also access Creditas Benefícios, which is an application designed for you to manage all the benefits you receive from your company, from health insurance to VR!

Disadvantages

As much as the Creditas payroll loan has great positive points, we cannot forget that it also has some disadvantages.

Firstly, there is the fact that the loan is only available to those who work in a company that has an agreement with Creditas Benefícios.

Therefore, if your company does not have it, it will be necessary to go through this additional process of convincing the company's management to implement this solution, which can make the request more bureaucratic.

Furthermore, Creditas does not offer any grace period to start paying the first installment, an item that we can find in other payroll loan options.

How to get a Creditas payroll loan?

Namely, you can simulate taking out credit through several different channels that the financial institution makes available.

But, to find out in detail how to apply for a Creditas payroll loan, just check out the post below which shows a complete step-by-step guide.

How to apply for a Creditas payroll loan

Apply online for 100% to access the best credit conditions!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to get miles with the Nubank Ultravioleta card: understand the process

Find out in this post how to earn miles with the Nubank Ultravioleta card and what travel benefits this card offers!

Keep Reading

Azul Viagens app: learn how to buy cheap tickets and accommodation

Find out how to download the Azul Viagens app, check out all the services and how to use your points to get discounts on tickets.

Keep Reading

Credit card for teenagers: get to know the allowance card

Check out the 7 best credit cards for teenagers and see how this allowance card can help your child's financial education.

Keep ReadingYou may also like

Meet Upwork Brasil: how to make money as a freelancer

Have you ever thought about working as a freelancer through a secure platform to earn money on the internet? That's what Upwork Brasil can provide you. Read the article and learn more.

Keep Reading

Submarino Card or Muffato Card: which is better?

Submarino's credit card has the Mastercard brand and allows purchases throughout Brazil. Meanwhile, the Muffato card is for purchases at the group's stores and has incredible discounts. Discover in the post below more differences between them and choose your favorite.

Keep Reading

BB Multimercado Carbon Credit: learn more about it!

When you invest your money in the BB Multimercado Crédito de Carbono investment fund, you pay the management fee and then you can profit from the appreciation of the share. Learn more about this type of investment here.

Keep Reading