Cards

Discover the Sicoob Cabal Gold credit card

The Sicoob Cabal Gold card made for national purchases allows you to accumulate points and also have up to 40 days to start paying your invoice. Continue reading and check out all about it.

Advertisement

National card with exclusive points program

We all know that having a credit card is very important for your finances, as it makes it easier for you to access different products and services. And among so many options that exist, today you will learn more about the Sicoob Cabal Gold credit card.

This card allows you to keep your financial life stable and access very interesting benefits if you are a member of the cooperative.

| Annuity | not informed |

| minimum income | not informed |

| Flag | cabal |

| Roof | National |

| Benefits | Up to 40 days to pay the invoice Sicoob awards Withdrawals in the credit function |

How to apply for the Sicoob Cabal Gold card

See here how to apply for this card and take advantage of the exclusive points program.

In short, with it, you can make withdrawals in the credit function and you can request additional cards to use with whom you trust the most!

Therefore, in this article you will learn more about the Sicoob Cabal Gold credit card, its advantages and how to apply. Follow!

Main features of Sicoob Cabal Gold

First of all, the Sicoob Cabal Gold credit card has very interesting features for you to know. One of them is its points program where all purchases made on credit generate points that can be exchanged.

Thus, with each purchase made with the card, you can exchange the points for airline miles, products, more invoice credit, travel packages, among other benefits.

In addition, the card offers its users a longer period to start paying their bill. With the Sicoob Cabal Gold credit card, you can start paying within 40 days.

Another interesting feature of the card is that it allows you to pay your invoice in up to 12 installments and you can even make withdrawals using the credit function. This can be done on the Banco24Horas network or you can request withdrawals in installments at the cooperative.

Finally, the credit card allows you to enjoy its features with friends, co-workers or family members. Here you can order additional cards and choose the limit for each of them.

Who the card is for

In short, to have access to the Sicoob Cabal Gold credit card, you must be a Sicoob customer. As he belongs to a cooperative, only its members can access his credit card.

Therefore, it is important to check how to become a member, if you are not already, in order to apply for this card.

Is the Sicoob Cabal Gold credit card worth it?

Certainly knowing the pros and cons of a card is the best way to know if it is an option that fits your life.

Therefore, we separate below the main positive and negative points of the Sicoob Cabal Gold credit card for you to choose wisely.

Benefits

First, among the advantages of the Sicoob Cabal Gold card, we can highlight its points program, which allows you to always be earning when making purchases using the credit function.

In addition, we managed to find other advantages in their additional cards. In addition to being able to share the benefits of the card with another person, it is also possible to determine their credit limit and check the transactions made.

Finally, making withdrawals in installments using the credit function is also a great advantage of the card, which is rarely found in other options on the market.

Disadvantages

Despite the advantages, the Sicoob Cabal Gold credit card also has some negative points that should be considered before applying for the card.

The first is the fact that the card is only available to those who are members of the cooperative. Thus, those who do not have this association cannot access the same benefits.

In addition, in the card application process, a credit analysis is carried out to better understand your profile and thus approve the card. This process may end up not approving some people according to their financial behavior.

Finally, despite allowing withdrawals in installments, it is important to consider that these resources have built-in interest. Therefore, you will have access to the money, but you will have to pay more than the amount you withdraw.

How to make a Sicoob Cabal Gold credit card?

In summary, the Sicoob Cabal Gold credit card is a good option if you want to make domestic purchases and have access to some differentiated benefits that are not always found in other cards.

Therefore, if you are a member of the cooperative and would like to have access to this card, check in the post below how the card application process works in the main channels.

How to apply for the Sicoob Cabal Gold card

See here how to apply for this card and take advantage of the exclusive points program.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Review Card Banco Inter Mastercard Internacional 2021

See the review Banco Inter Mastercard Internacional card with versatile application, debit and credit card and no annual fee.

Keep Reading

Zema loan or Alfa Financeira: which one to choose

Choosing between Zema Personal Loan or Alfa Financeira is difficult, mainly because each one has its own advantages. Check out!

Keep Reading

Find out about the Single Mother Assistance benefit

The Single Mother Aid benefit promises to pay R$1,200 to families who meet the requirements. See this article for details on this benefit!

Keep ReadingYou may also like

What is the best investment platform in 2022?

The world of investments is becoming more and more accessible and nowadays, we have many options to take care of our money. However, choosing the best investment platform can be a difficult task without the right guidance. With that in mind, we've put together 6 complete options for investment platforms for you to discover today. Let's go?

Keep Reading

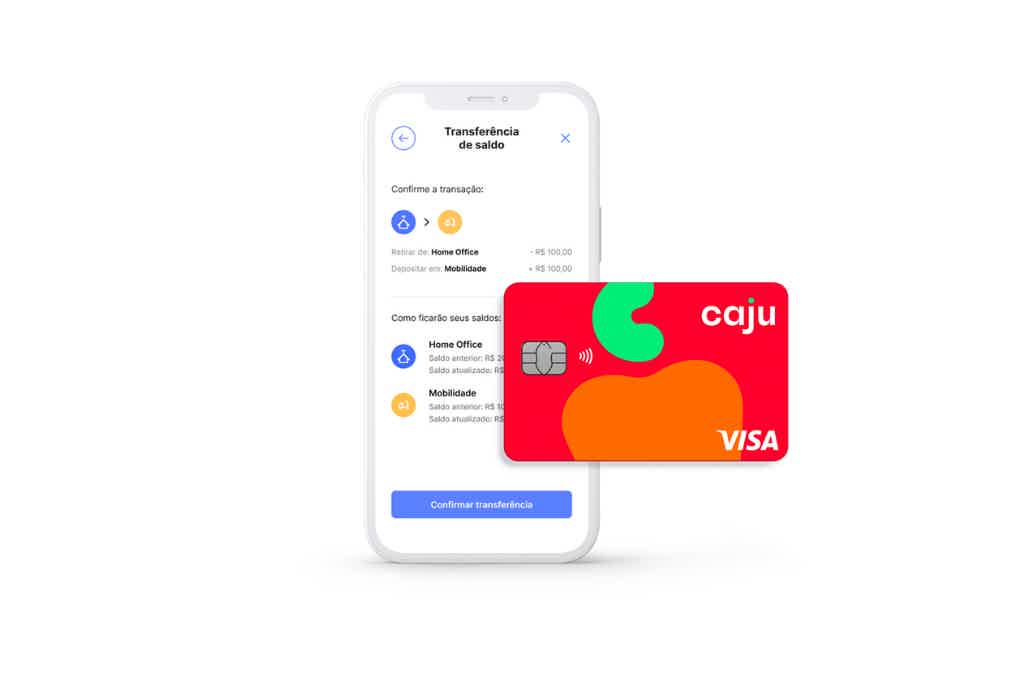

How to apply for the cash card

The Caju card is national with the Visa flag, so it is a complete option to unify the benefits of your employees. Plus, it's free and accepted in thousands of places. To find out how to apply, just continue reading below!

Keep Reading

Banco Inter promotion should award customers up to R$77 thousand

With Banco Inter's promotion, its customers participate in monthly sweepstakes for amazing products such as smartphones, notebooks, and cash prizes. Thus, to participate, customers only need to carry out transactions with values above R$100.00 to win lucky numbers.

Keep Reading