digital account

Discover the MuPay digital account

If you want to get discounts on your next purchases made on the Muffato network, receive cashback and see your money go, you need to know the MuPay digital account. So, read on and check it out!

Advertisement

MuPay digital account: your market purchases are now easier

Have you ever thought how nice it would be to be able to do your normal shopping at the supermarket and earn cash back on your purchase? With the MuPay digital account this is totally possible.

The account was created by Grupo Muffato, which is known for being the fourth largest supermarket chain in Brazil.

With the launch of the account, you can access the main features of a common digital account with some benefits that only the network offers!

| open rate | Exempt |

| minimum income | not informed |

| rates | TED/DOC transfer: R$ 3.00 Withdrawal: R$ 7.00 Ticket issue: R$ 1.70 |

| credit card | only virtual |

| Benefits | Cashback on market purchases Earn your purchase change on the account Access discounts and free shipping on the network's virtual store |

How to open a MuPay digital account

Find out here how you can access this account to get all its benefits.

In addition to cashback on purchases made on the network, account holders also have access to a Visa debit card and a virtual credit card to access the benefits of buying on the network.

Did you like this option and want to know everything about it? So, check out the main features of this account in the post below!

Main features of MuPay

In summary, MuPay is a brand created by Grupo Muffato to offer a digital account with special benefits.

This account can be used both by those who usually shop at the supermarket chain and by those who want to shop at other establishments.

By having the digital account, the account holder can access basic services that every account has. Thus, it is possible to make transfers, pay and make deposits by bank slip.

It is also possible to withdraw money both at the Super Muffato and Max Atacadista stores and at the Banco24Horas chains.

However, the account offers some additional benefits such as exclusive discounts at the store and cashback of R$ 10 on the first purchase with a value above R$ 100. And the most interesting thing is that the benefit is applied in the network's physical and virtual stores.

Finally, the account also has a virtual credit card for you to make your purchases without major problems.

For whom the digital account is indicated

At first, the MuPay digital account is a great option for those who usually make their market purchases on the Muffato network.

The account offers several benefits for those who buy with the account's card on the network, such as cashback and discounts on purchases.

But, in general, the MuPay account can be used by anyone who wants to use a digital account and has enjoyed this option.

What is the limit of the MuPay digital account?

Namely, the Mupay digital account provides account holders with the option of having a debit card. Thus, it is possible to pass market purchases from it.

However, the card that the account offers is in debit mode. Therefore, to be able to use the card, you must have a balance in your account to be able to make purchases.

In this way, the MuPay digital account does not offer a limit to its account holders to use the digital account.

Is MuPay digital account worth it?

To find out if this digital account is a good option for you, you need to closely analyze all the positives and negatives it has to offer.

Therefore, below we separate the main advantages and disadvantages that the account has so that you can know if it is the best option for your financial life.

Benefits

Among the main advantages of the MuPay digital account is the fact that you can earn cashback on your purchases made at the supermarket chain. So you can always earn a little bit when shopping.

But this is not the only advantage of the account. She still manages to make her money pay off every month and for her it is possible to transfer her change of coins to the account, where it can also be earning.

In addition, when shopping at the Supermercado Muffato virtual store, you can get free shipping on your purchases over R$ 50.

Finally, the digital account can still be created without queues and then everything can be resolved from your application.

Disadvantages

As much as the MuPay digital account has great advantages, it also has some negative points that need to be taken into account.

The first is the fact that the account has fees for basic services, such as withdrawals and transfers. Generally, in other digital accounts, these fees are not found.

In addition, the fact that the account offers a virtual credit card is also a negative point, since it would be more interesting to be able to access a physical card and, thus, to pay your purchases everywhere without major problems.

How to make a MuPay digital account?

In summary, the MuPay digital account is a great option for those who shop at the Grupo Muffato supermarket chain. From there, you can access several discounts on purchases that are very interesting.

Therefore, if you liked this option and would like to open your MuPay digital account, just check the following content that has a complete step-by-step to open the account.

How to open a MuPay digital account

Find out here how you can access this account to get all its benefits.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for Bradesco Reforma

If you dream of renovating your home, Bradesco Reforma Imóveis may be the ideal line of credit for you! Check here how to apply.

Keep Reading

10 apps to save at the supermarket

Can you imagine what your finances would be like if you managed to save money at the supermarket? In addition to money, you can save time. see how

Keep Reading

INSS 2021 payroll loan fraud: how it happens

Do you know what INSS payroll loan fraud is? Because today we're going to tell you how it works and what to do to protect yourself!

Keep ReadingYou may also like

How to invest in CDB credit card C6 Bank

Did you know that, with C6 Bank's CDB, at the same time that you invest, you can also increase your credit card limit? Well that's right! To find out how to apply your money and count on this extra benefit, follow the article below.

Keep Reading

Provisional Measure approves FIES debt renegotiation

With the new Provisional Measure, students who were in arrears with the payment of FIES tuition can get their debt renegotiated. Just contact Banco do Brasil or Caixa Econômica Federal to do the simulation.

Keep Reading

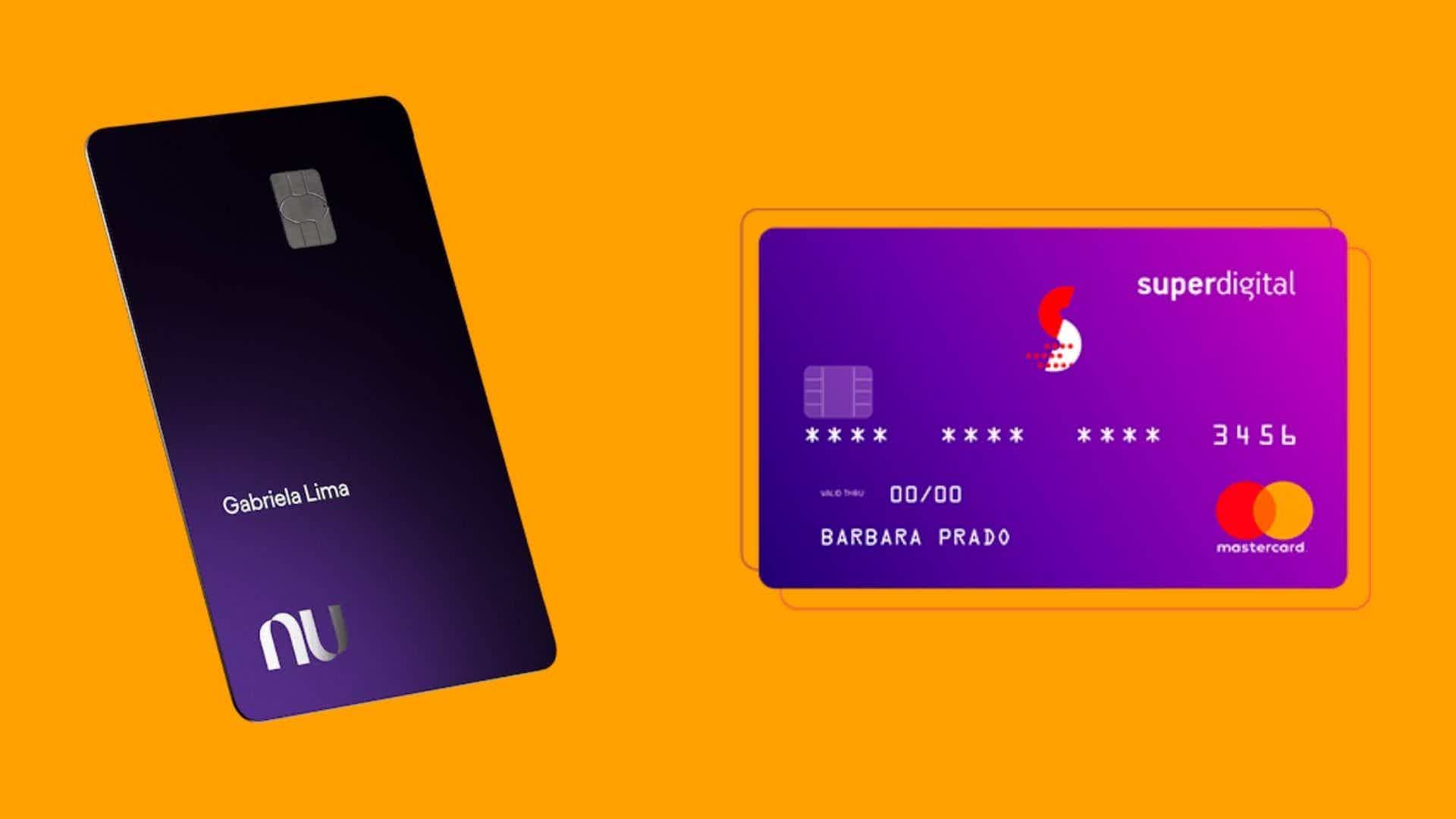

Nubank Ultraviolet Card or Superdigital Card: which is better?

Among the credit card options on the market, many offer exclusive advantages and varied conditions. Some are more demanding, and others not so much. In that case, what might be the best option: Nubank Ultraviolet card or Superdigital card? Find out here!

Keep Reading