loans

How to apply for the Agile loan

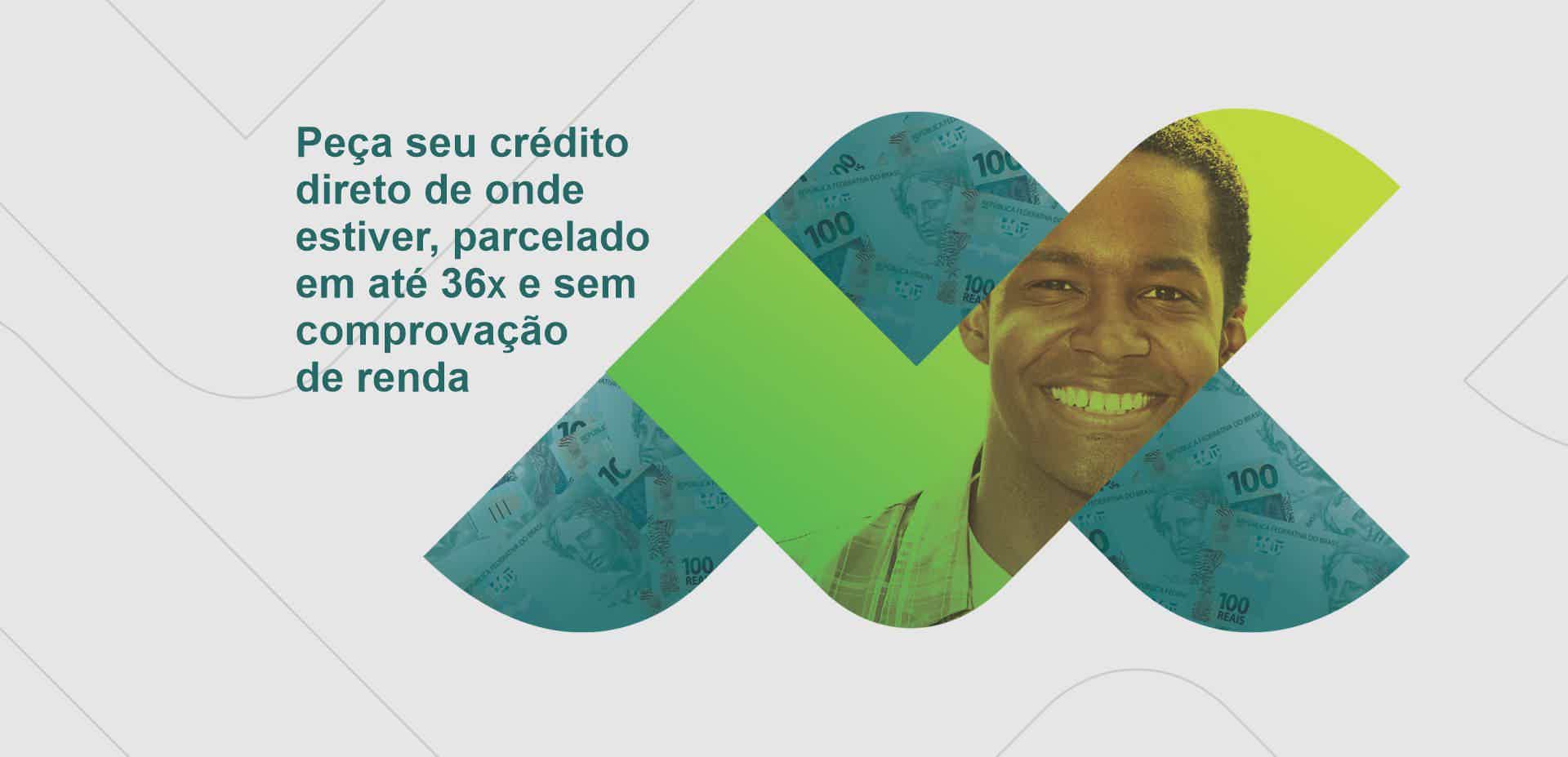

Did you know that with Ágil you can apply for a loan without proof of income and without bureaucracy? Incidentally, you can request by phone, WhatsApp and even app. Check out!

Advertisement

Agile: request money quickly and without bureaucracy from wherever you are

First, there are very simple ways to apply for a loan, but Ágil decided to simplify it even more by allowing you to apply via WhatsApp, phone and even an app. Thus, you can enjoy all the benefits that the company offers with the Agile loan.

Do you want to learn how to apply for an Agile loan quickly and safely? So check it out!

Order online

To apply for the Agile loan, you can go to the institution's website and thus see all the channels where the loan application is available. However, on the official website it is not possible to make the request.

Request via phone

So, you can request it via telephone on 0800 573 6600 or via WhatsApp +55 (35) 3573 6600. This way, you can clear all your doubts and take out the loan.

Request by app

To request it through the app, just install the Ágil app, available for Android and iOS, and follow the step-by-step instructions given by the app.

SuperSim loan or Agile loan: which one to choose?

Initially, Ágil is a great option for those looking for a loan without any bureaucracy and without proof of minimum income. On the other hand, SuperSim has a loan with a term of up to 12 months to pay and interest from 12.5% per month.

In addition, hiring is completely online and very simple, so you don't have to worry about bureaucratic issues. So, see the details below and understand which works best for your reality.

| SuperSim | Agile | |

| Minimum Income | not informed | not required |

| Interest rate | From 12.5% per month | not informed |

| Deadline to pay | Up to 12 months | Up to 36 months |

| Where to use the credit | Pay the bills pay off debts | Pay the bills pay off debts |

| Benefits | accept negatives Money released in up to 30 minutes | quick release You don't even have to go to a bank branch. |

How to apply for SuperSim loan

If you're interested in the SuperSim loan, but don't know how to apply for it, don't worry, it's time to find out everything step by step.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Check out how to earn extra income selling beauty products

Make your income now! Check out how much an O Boticário reseller earns and find out what the day-to-day life of those who work with the brand is like.

Keep Reading

Agibank loan or SIM loan: which is better?

Do you want loans with the lowest interest rates on the market, in addition to flexible payment terms? So get to know the Agibank loan or SIM loan.

Keep Reading

Best travel apps: see the options!

See which are the best travel apps for you, discover all the services and differences between them. See more details here!

Keep ReadingYou may also like

Miles & More Classic Credit Card: What is Miles & More Classic?

The Miles & More Classic credit card offers a great miles program as well as exclusive partner discounts. Do you want to know more about him? So read our post and check it out!

Keep Reading

See how to get a loan of up to R$100 thousand at Caixa even with a dirty name!

A secured loan can be an excellent way out for those who need money and are negative. So, Caixa offers up to R$100 thousand in the modality, with immediate credit to the account after hiring! Learn more here.

Keep Reading

Online Bradesco Elo Internacional Card: up to 40 days without interest

Discover the Bradesco Elo Internacional card online. It can be quite interesting for anyone who wants a practical product with good benefits, such as exemption from the first annuity and discounts with partners. Interested? Read on!

Keep Reading