loans

Discover the Bradesco payroll loan

With Bradesco consignado, you can take out a loan even if you are not a current account holder and enjoy the same conditions as a customer of the institution. In addition, the first installment is only due in 120 days and you have up to 8 years to pay. Are you interested? Check it out!

Advertisement

Bradesco payroll loan: intended for INSS retirees and pensioners, employees of private companies and public servants

Despite the good banking options on the market, it is not always easy to find an institution that offers a good loan proposal. With that in mind, we will introduce you to Bradesco consignado.

It is a loan with very low interest rates compared to other banks, in addition to a term of up to 8 years to repay the credit.

| Minimum Income | not informed |

| Interest rate | From 2,14% per month |

| Deadline to pay | Up to 96 months |

| release period | after hiring |

| loan amount | Uninformed |

| Do you accept negatives? | Yes |

| Benefits | Up to 120 days to start paying Reduced interest rates |

How to apply for a Bradesco payroll loan

Learn how to apply for a Bradesco payroll loan and start paying in just 120 days. Check it out!

In this sense, Bradesco has unique rates and conditions for both current and non-current account holders. In this article, you will learn more about the loan, as well as its advantages and disadvantages. Check it out!

Discover the Bradesco Elo Mais card

Check here everything about the Bradesco Elo Mais card and enjoy its benefits.

How does the Bradesco personal loan work?

Firstly, the payroll loan is a type of credit intended for workers who can prove their ability to pay, that is, retirees and pensioners, employees of private companies and public servants.

In this sense, the consignable margin can be used for loans and requests for a consignment card.

So, it works like this: the INSS beneficiary, employee or civil servant will have the loan amount discounted from their salary or benefit payment before receiving it.

Furthermore, it is important to emphasize that this is also the answer to the best interest rates on the market for payroll loans, as the chances of default are practically non-existent.

What is the limit for the Bradesco personal loan?

Therefore, the maximum limit takes into account the assignable margin, so the loan installments cannot exceed 30% of the client's monthly income. Therefore, the limit value can only be identified in the simulation and contracting of the financial product.

Bradesco consigned benefits

Among the advantages of the loan, you have up to 120 days to pay the first installment and up to 8 years to pay off the loan.

And, what's more, even if you don't have a checking account, you can take out a payroll loan by simply going to your nearest branch. On the other hand, if you already have a checking account, you can do the entire process without any bureaucracy, completely online.

In fact, regarding interest, rates start at 2.14% per month and you can also count on agility in credit analysis and release of funds after registration. In addition, rates are customized according to the agreements, so everything is more personalized for you!

Another advantage is that you can also transfer credit from another institution to Bradesco and thus enjoy all the benefits.

So, with so many advantages, you can imagine the reasons that make Bradesco one of the largest institutions in Brazil, right?

Main features of Bradesco consignment

So, Bradesco Consignado is a line of credit that has lower interest rates and the installments are discounted directly from the payroll.

In this sense, to receive the loan you need to be insured by the INSS, a public employee and a member of partner private companies.

Who the loan is for

Initially, the loan is intended for employees of private companies, retirees and INSS pensioners who receive or do not receive the benefit from Bradesco, as well as public servants. Therefore, if you fall into this group of people, you can apply even if you are not a current account holder.

How to get a Bradesco personal loan?

Firstly, to take out a Bradesco payroll loan, you do not need to be a Bradesco account holder, just go to the nearest Bradesco branch and take out the loan.

On the other hand, if you are a current account holder, you can sign up through Bradesco Celular, Internet Banking, Bradesco ATMs, Banco24Horas, Bradesco Expresso and branches. So, click on the recommended content below to learn the step by step.

How to apply for a Bradesco payroll loan

Learn how to apply for a Bradesco payroll loan and pay it back in up to 8 years. Check it out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to be a 99 driver: check the requirements

Check out in this post how to register to be a 99 driver and also find out how much this professional can earn in a month!

Keep Reading

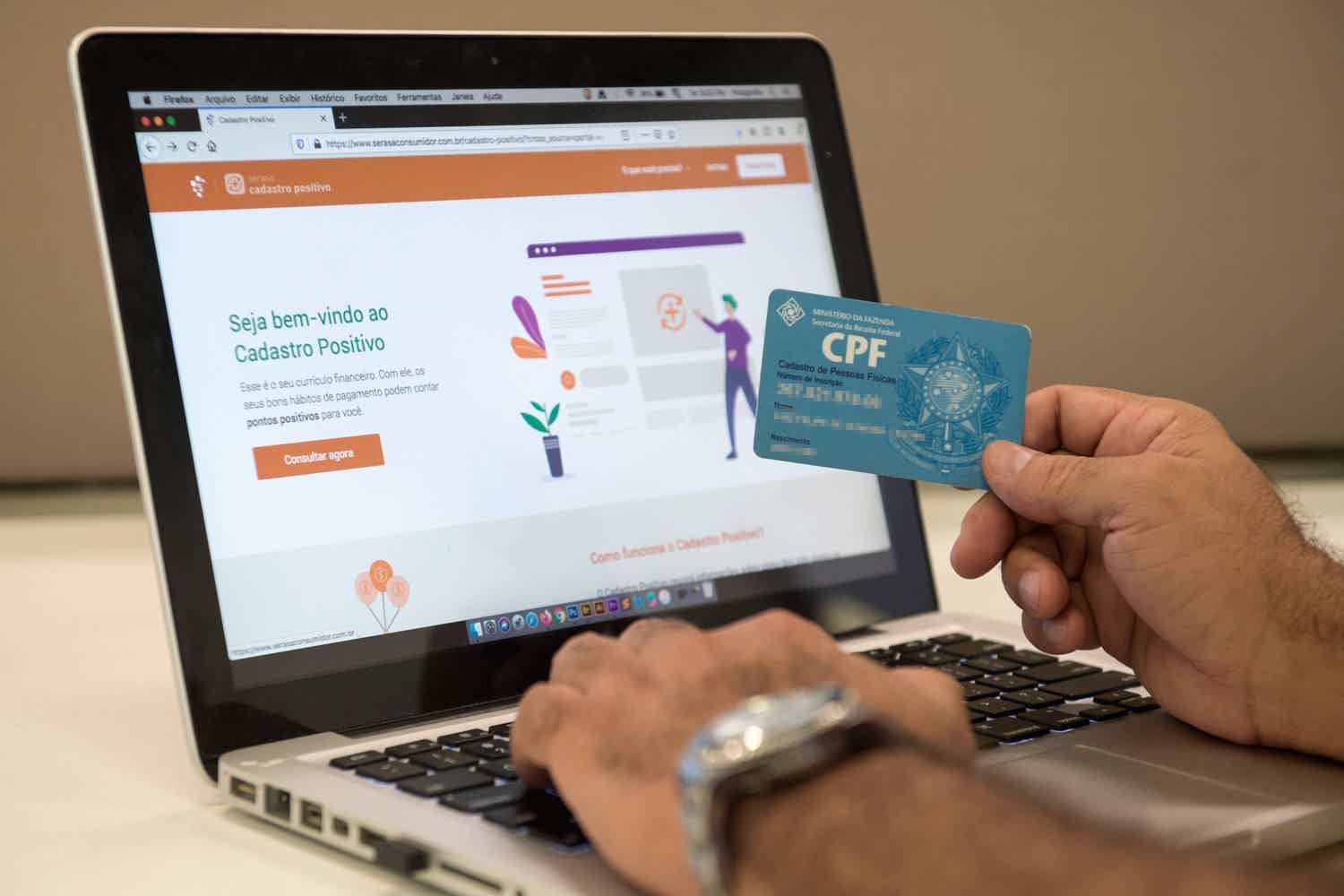

Monitoring CPF: how important is it for you?

Did you know that monitoring your CPF is important to protect your anti-fraud data? See why and how to monitor your data and avoid fraud

Keep Reading

NASCAR MOBILE: how to use the app to follow the races

NASCAR MOBILE: The essential app for racing fans, with live streams, real-time stats and in-depth analysis.

Keep ReadingYou may also like

Nubank or Inter account: which is the best digital account?

Choosing a good digital account to take care of and manage our finances can be a difficult task, as we currently have so many options. However, two alternatives that bring many benefits to customers and are zero annuity and abusive fees are the Nubank or Inter account. Do you want to know more about the two accounts and a comparison of their main features? Continue with us throughout the post!

Keep Reading

Discover the BK Mini current account

Are you looking for a current account for your child and don't know where to start? Then check out, in the following post, how BK Mini works, the Bankinter account for minors between 0 and 17 years old that does not charge a maintenance fee.

Keep Reading

Stratus Rewards Visa White Credit Card: How It Works

Do you know the world's first white credit card? And do you know how exclusive it is? No? So, follow here for more details and discover one of the most exclusive cards in the world.

Keep Reading