loans

Discover the Itaú payroll loan

In this article, we will introduce you to Itaú payroll. With it, you have up to 90 days to start paying, direct payroll deduction and reduced interest. Check out!

Advertisement

Itaú Consigned Loan: up to 90 days to start paying with reduced interest rates

To take out a payroll loan, you need to do a lot of research among the options available on the market, in addition to knowing if you meet all the requirements. With that in mind, we are going to introduce you to Itaú payroll, which is a great option for anyone who wants a loan offered by a traditional bank.

| Minimum Income | not informed |

| Interest rate | not informed |

| Deadline to pay | Uninformed |

| release period | Uninformed |

| loan amount | Uninformed |

| Do you accept negatives? | Yes |

| Benefits | Up to 90 days to start paying Reduced interest rates |

How to apply for an Itaú payroll loan

Learn how to apply for the Itaú payroll loan and start paying in 90 days. Check out!

And, in addition, Itaú has unique rates and conditions for account holders. In this article, you will get to know better about the loan in addition to the advantages and disadvantages and find out if it is a viable option for you. Check out!

Loan with FGTS Itaú guarantee: how to do it

Find out here how to get money with the loan with FGTS guarantee from Itaú bank.

How does the Itaú payroll loan work?

First, Itaú payroll is a loan intended for account holders at the institution with lower interest rates than other loan options.

This is because the payment is made in fixed installments every month, debited directly from the payroll. Incidentally, the loan is subject to credit analysis and pre-approved limit release.

Thus, Itaú will analyze your financial behavior before releasing the limit. In this case, you can consult directly in the Itaú application!

What is the limit of the Itaú payroll loan?

Then, according to the institution itself, an analysis of the financial behavior of the account holder is carried out and, thus, the amounts are released, that is, it will depend on the history of each client.

Itaú Payroll Advantages

Among the advantages, Itaú payroll offers very interesting benefits for account holders. To begin with, the installments are deducted directly from the salary or benefit, so you don't run the risk of being in default with the bank.

And, in addition, it also has reduced and fixed interest rates, that is, they do not increase over time.

Also, you have up to 90 days to start paying off your loan. That way, you can plan financially to pay off the requested loan.

Thus, among other advantages, the bank also allows you to choose the amount of the installments and you can also anticipate as many installments as you want or even pay off the loan before the indicated deadline.

Main features of Itaú payroll loan

First, Itaú payroll is intended for public servants and employees of companies with a formal contract and the institutions or companies must be associated with Itaú.

In this sense, you will save a lot, as interest rates are much lower.

In this way, you need to enter your Itaú application to check if you have a pre-approved limit and also to simulate the offers. In this case, if you already have one, you must use digital channels or go to a nearest branch in person to take out the loan!

Regarding the installments, they are fixed and in accordance with your salary or benefit, so they do not increase over time and help you maintain an organized financial life!

Who the loan is for

Incidentally, as it is a payroll loan in which the payment is deducted from the payroll, this loan is indicated for public servants and employees of private companies with a formal contract. In addition, institutions or companies must have an agreement with Itaú.

In this sense, if you fit into this group or wish to obtain more information on how to become an account holder, please contact Itaú. So, you can start planning now!

How to make an Itaú payroll loan?

To get Itaú payroll, you need to be an Itaú account holder and have a pre-approved limit. So, you enter the Itaú application to find out if you already have a pre-approved limit and if you do, you must go to the nearest agency or access the digital channels.

So, to learn step-by-step how to apply for the loan, click on the recommended content below!

How to apply for an Itaú payroll loan

Learn how to apply for the Itaú Consignado loan and start paying in just 90 days with reduced interest rates. Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the credit loan

Do you want to learn how to apply for a Crefaz loan with extended terms, quick release and two payment options? Then read on!

Keep Reading

Discover the Natura Pay digital account

Check out in this post the main advantages of being a Natura Pay account, how to get paid for your sales safely.

Keep Reading

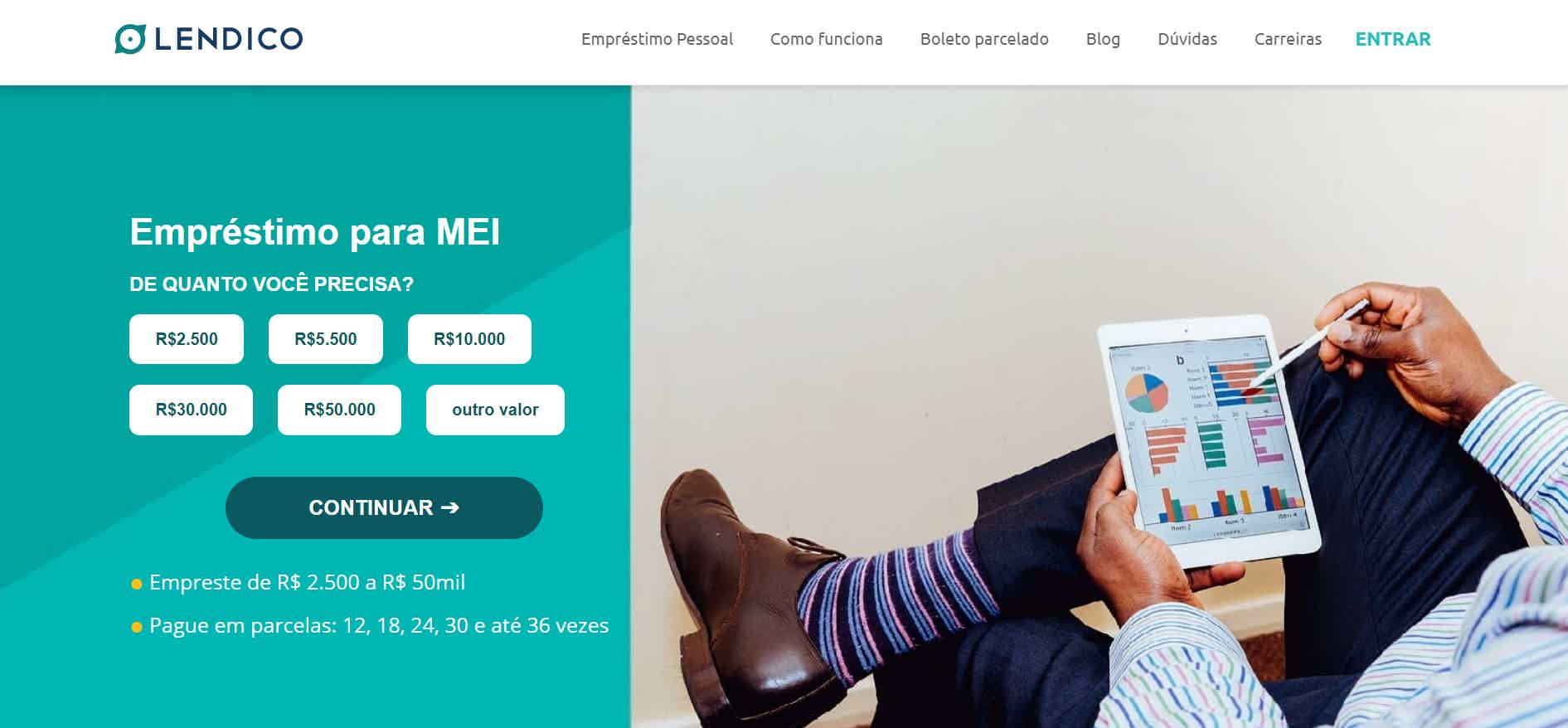

How to apply for the Lendico microentrepreneur loan

The Lendico micro-entrepreneur loan can be fundamental when it comes to boosting your business. See how to order yours here!

Keep ReadingYou may also like

How to get Parental Benefit

Parental Allowance helps parents and guardians maintain their income during their child's birth leave. To find out how to get Parental Allowance and make the most of it, read on.

Keep Reading

Registration open for The Wall 2022

The Wall game is now on the Domingão com Huck program, but the dispute remains the same. A pair of players must answer questions and get lucky to leave the program with a jackpot! Understand how to register.

Keep Reading

Get to know the Ativa Investimentos brokerage

With an Ativa Investimentos brokerage account, you can invest in stocks, ETFs, FIIs and various fixed income securities. Also, some have ZERO brokerage! Learn more in the post below.

Keep Reading