digital account

How to open Nubank account

Learn how to open a Nubank account through the app or website and even see a comparison with the Santander account to find out which is the best option for you! Check out!

Advertisement

Nubank Account: Pix and unlimited transfers, app to control spending and annuity exemption

For those looking for security, practicality and a digital account that offers a credit card with no annual fee, international coverage and even being able to control all movements through the application, the Nubank account is the best option!

In this article, you will learn how to open the account and decide if it is the best option for you or not! Check out!

open online

There are no secrets to opening an account online, because you just have to follow the requirements, such as being over 18 years old, residing in Brazil and having unrestricted CPF.

After that, you must enter the official Nubank website and follow the steps to open the account. So, fill in your personal data and wait.

According to the institution, in a few moments you will have the answer to your request!

open via phone

Unfortunately, it is not possible to open the account via telephone, but you can contact the institution through the number: 0800 608 6236.

Also, the institution operates 24 hours a day, every day of the week and through this number you can clear all your doubts.

open by application

To open an account through the app, just install the Nubank app on your mobile device, available for Android and iOS, and follow the steps below.

Then, fill in your personal data, place the requested photo and wait for the account to be released! Okay, now just start using your account!

Santander account or Nubank account: which one to choose?

Initially, you knew all the information about the Nubank account, but if it is still not what you are looking for, do not worry, as there are other digital accounts available such as the Santander account. So, check out an informative table below!

| Santander account | Nubank account | |

| Minimum Income | not informed | not informed |

| Monthly cost | R$24 per month Exempt if you receive R$ 1,000 and pay a bill on digital channels per month | Exempt |

| credit card | Yes | Yes |

| Benefits | Unlimited withdrawals and transfers In addition, the possibility of exemption from monthly fees | free transfers Nubank Rewards |

How to open Santander account

Enjoy the Santander account with unlimited transfers and withdrawals, as well as a credit card with no annual fee under conditions. Also, open a free account.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Download now an app that takes a picture when you make a mistake in the password and protect your cell phone

Protect your privacy with the app that takes a picture every time someone misses the password. Download now and keep your personal data safe.

Keep Reading

Discover Balaroti Financing

Find out about Balaroti financing and how it can help you buy those building materials and pay for the services you need! Check out!

Keep Reading

Federal, state and municipal competition: what are they and how to choose?

Find out in this post the main difference between the federal, state and municipal contest and learn how to choose between each one of them!

Keep ReadingYou may also like

Discover the BBVA Maisblue current account

Have you just turned 18 and want a simple, complete and low commission account for yourself? If so, take the opportunity to learn about and discover the benefits of the BBVA Maisblue current account, below.

Keep Reading

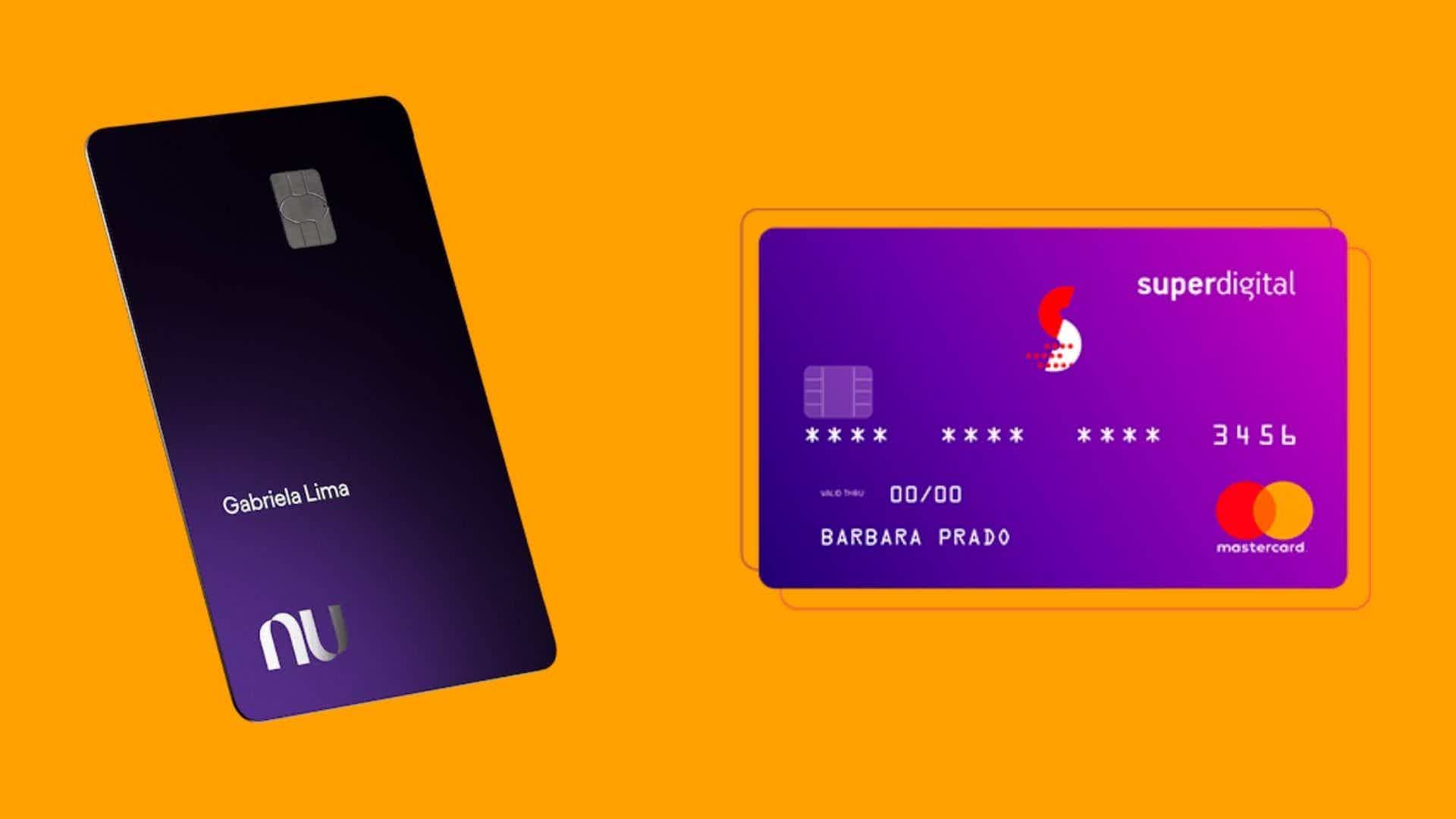

Nubank Ultraviolet Card or Superdigital Card: which is better?

Among the credit card options on the market, many offer exclusive advantages and varied conditions. Some are more demanding, and others not so much. In that case, what might be the best option: Nubank Ultraviolet card or Superdigital card? Find out here!

Keep Reading

See how to pay Netflix monthly fee using PicPay

Users of the Netflix streaming platform and the PicPay digital wallet can now pay the video service monthly fee directly through the fintech app. And the best: earn cashback with every payment you make! Understand.

Keep Reading