loans

BxBlue Consigned Loan or C6 Consig Loan: which is better?

If you want to take out the best payroll loan available, let us help you. Today you will get to know BxBlue and also C6 Consignado. Both offer excellent payroll conditions and lower rates than the market. Read on to find out everything!

Advertisement

BxBlue Consigned x C6 Consig: find out which one to choose

Choosing the best loan is not an easy task. You have to think about many things like interest, amounts, etc. That's why today we're going to help you decide between a BxBlue loan or a C6 Consig loan.

BxBlue is a platform that has several partners and offers the best credit conditions on the market. Therefore, you can compare different interest rates and different terms.

C6 Consig is C6 Bank's payroll loan. In that sense, they offer a digital 100% loan with rates tailored to your financial reality. In addition to lower rates than common lines of credit.

In this way, we will show you all the pros and cons of these two payroll loans. Continue reading to find out more.

| BxBlue Consigned | C6 Consig | |

| Minimum Income | Minimum wage | Minimum wage |

| Interest rate | From 1,30% per month | Customized |

| Deadline to pay | Up to 84 times | Depends on credit analysis |

| release period | after hiring | Uninformed |

| loan amount | Up to R$500 thousand depending on the institution | depends on the benefit |

| Do you accept negatives? | Yes | Yes |

BxBlue Payroll Loan

In general, like most payroll loans, BxBlue is intended for INSS retirees and pensioners. In addition, the loan is also available for civil servants. Both federal, state and municipal.

By the way, BxBlue also offers payroll loans to workers with a formal contract in private companies. Therefore, the loan is aimed at a slightly broader audience.

As it is an intermediary platform for other companies, you can search for loans from several companies. As a result, BxBlue fees end up being much lower than other credits.

In addition, the installments are deducted directly from the salary and benefit. Therefore, the bank knows that there is a low risk of default. In this way, you can offer much better interest rates.

In addition, BxBlue also accepts negatives. That is, a great option to hire and finally get out of the red.

C6 Consig Loan

The C6 Consig Loan is C6 Bank's payroll loan. Therefore, it is intended exclusively for retirees, INSS pensioners and federal servants. Incidentally, the credit amount is always proportional to salary and benefit.

This is called assignable margin. That is, the amount that each one has available to convert into a loan. Because the installments are automatically debited from the INSS salary or benefit.

In this sense, installments are fixed. As well as interest rates. Therefore, they do not increase with time. That is, a great option for those who want to use the loan to pay off debts.

In fact, C6 Consig performs a personalized credit analysis for each customer. In this way, interest and installments are stipulated according to what you can afford. In order not to have a loan that further increases your debts.

Finally, taking out the C6 Consig loan is very simple. That's because the process can be done completely online. Just contact the team of experts and send the necessary documentation.

What are the advantages of the BxBlue Payroll Loan?

When we talk about advantages, BxBlue has some good conditions for its customers. First, we can mention that the loan is available for negatives. Therefore, you can hire even if you are in the red.

In addition, BxBlue is completely online credit. In this way, you avoid various bureaucracies such as long queues at banks. Also, because it is online, the whole process is resolved from your home and much faster.

BxBlue also offers payroll loans without the need for a guarantor or collateral. This happens because the installments are debited directly from the salary or benefit. Therefore, the bank has a greater guarantee of payment.

By the way, speaking of installments, it is worth saying that the installments are pre-fixed. Along with interest rates. All amounts remain the same from the date of hire. That way, you don't get financially disorganized.

What are the advantages of the C6 Consig loan?

To begin with, C6 Consig is a completely digital loan. Therefore, it has no bureaucracy and aims to offer a quick hiring. Therefore, you can apply for both mobile and computer.

In addition, a great advantage of C6 Consig is the credit analysis. Because the analysis is 100% customized. That is, you send your documentation and the bank stipulates an offer that fits in your pocket.

In this way, the installments are fixed and do not increase over time. Thus, you contract your loan without having to disorganize your financial life.

Finally, for those who prefer to resolve financial issues in person, C6 offers this option. In short, the bank has several banking correspondents available throughout Brazil. Just find the agency closest to you.

What are the disadvantages of the BxBlue Payroll Loan?

In terms of disadvantages of BxBlue, we can mention that for those who want a loan directly from the company, this is not an option. That's because BxBlue is just an intermediary that connects you with banks.

Therefore, the paying sources are different. However, this does not make the service unreliable. It's just a personal question to be thought through by each person or family.

What are the disadvantages of the C6 Consig loan?

C6 Consig has the disadvantage of not having much information on the website. For example, interest rates are not announced right away. You need to send your documentation to one of the consultants, to then receive what your fees would be.

In addition, the bank also does not carry out the credit simulation on the website. It is also necessary to contact the bank by phone. All this can delay the application process a little.

BxBlue Consigned loan or C6 Consig loan: which one to choose?

Finally, both BxBlue Consigned Loan or C6 Consig loan offer great options for their customers. That way, just consult the two options to understand which might be best for you.

It is worth remembering that BxBlue is a platform that brings together the best payroll options on the market. There, you can take out a loan even if it is negative and without having to go through a guarantor.

C6 Consignado is a digital 100% loan that offers personalized rates for each customer. Therefore, the bank thoroughly analyzes your case and stipulates fees and amounts that fit in your pocket.

Therefore, if you are still in doubt, we will show you two more loan options. See now in this other article the comparison between the Inter Consignado loan and the C6 Consig loan!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Learn how to earn 30% profit without leaving home

Understand everything about the everyday life of the Quem Disse Berenice reseller and find out how much commission you can earn on each sale.

Keep Reading

Lambus app: learn how to plan cheap trips

Discover all the services provided by Lambus and see if it really pays to use this application to plan your trip.

Keep Reading

Pix with a credit card: how does it work and what are the options?

Check out all the Pix options with a credit card here, understand all the fees charged and whether it's safe to Pix on credit.

Keep ReadingYou may also like

Discover the 7 professions with the highest income in Brazil

The Federal Revenue released its report on professions with the highest income in 2020. Among them are professionals from the public and private sectors. Understand here how much they earn!

Keep Reading

Which digital bank allows account for minors?

With a digital bank with an account for minors, you encourage your child to seek more financial education and teach them to handle money more consciously. Read the post and understand more about it.

Keep Reading

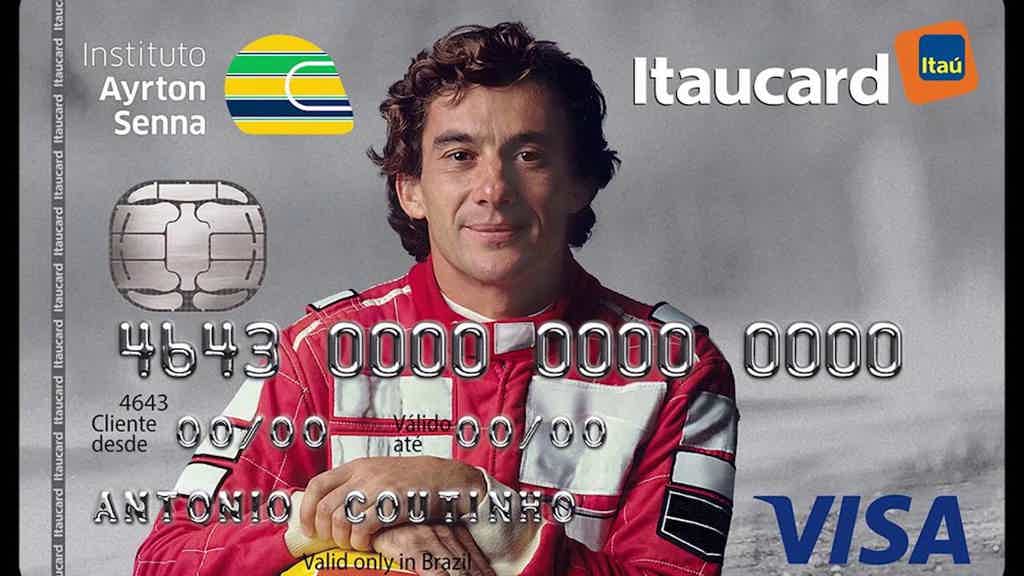

9 benefits of the Ayrton Senna Itaucard Card

Discover the benefits of the Ayrton Senna Itaucard Card.

Keep Reading