loans

How to apply for a Mercado Pago loan

With the Mercado Pago loan, you can pay up to R$ 500 thousand in up to 24 months, depending on the type of credit. See now how to apply for the loan and start changing the future of your business.

Advertisement

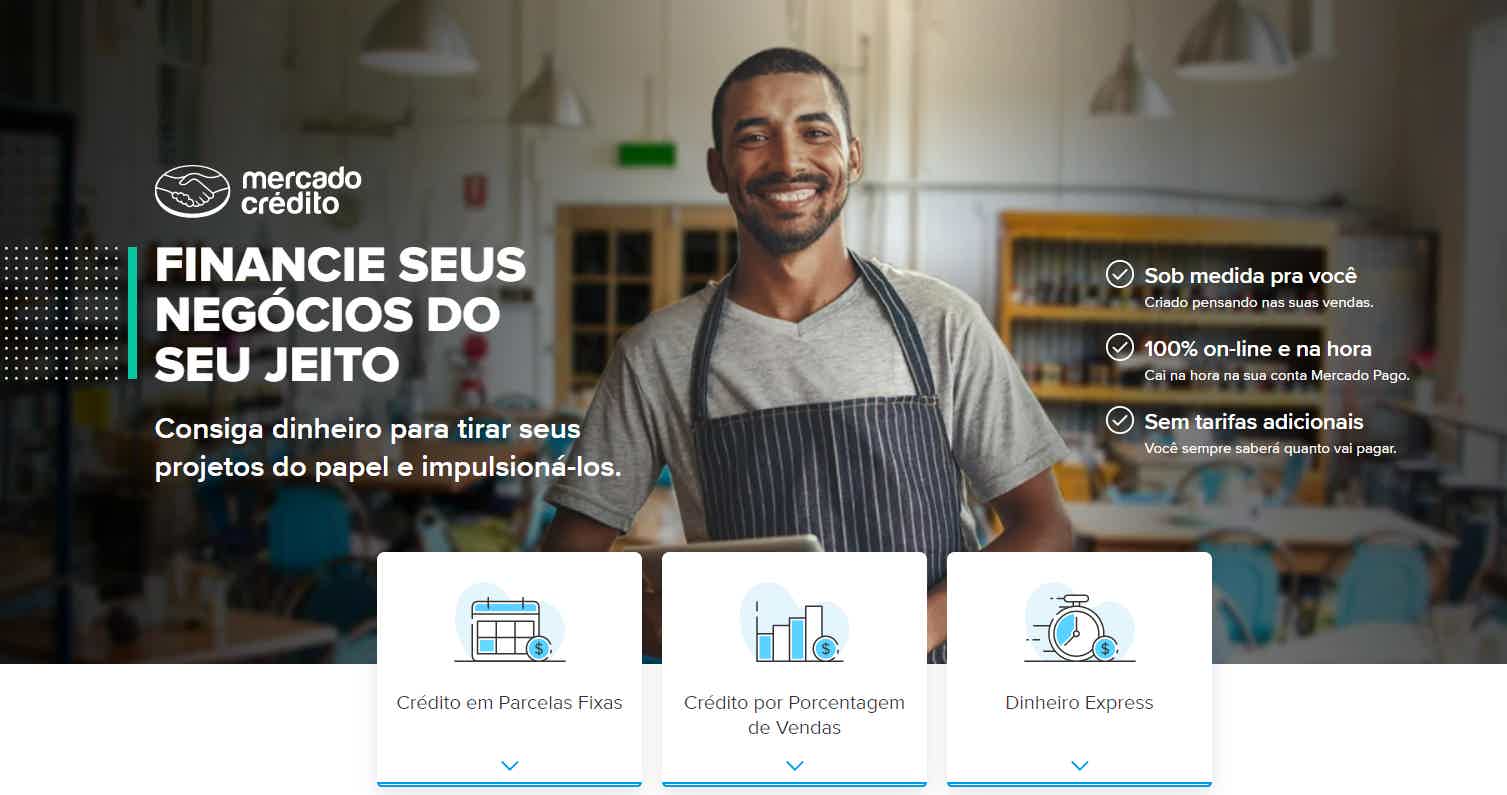

Mercado Pago: apply for the 100% loan online that falls instantly

Moving a new business requires a lot of effort, study and money. That is why, in today's article, we are going to show you the Mercado Pago loan. The platform works with different modalities. They are fixed installments, percentage of sales and express money.

These modalities help you grow and boost your venture more and more. What's more, the loan amount can reach up to R$500,000. Read on to find out how to apply.

Order online

First, applying for the Mercado Pago loan is very simple. However, first it is necessary for the platform itself to make you an offer. After that, just request it directly in the Mercado Pago application.

But for this to happen you need to have a good reputation on Mercado Pago and a good financial history, as well as having sold at least R$ 100.00 in the last two months on Mercado Livre or Mercado Pago.

So, if you meet all these requirements, the pre-approved offer will appear in your app in the “Credit Market” area. Furthermore, after you make the request, the money will be transferred to your Mercado Pago account and then transferred to your bank account.

Request via phone

Unfortunately, it is not possible to apply for the loan over the phone, as the process is done through the application. Also, they do not provide a contact number. So, if you have any questions, just access the help tab on the website or app.

Request by app

As we mentioned, after receiving the offer, all you have to do is apply for the loan through the application itself. Furthermore, the process is very intuitive, as the app informs you step by step as you follow the steps. It is worth mentioning that the money falls instantly and you can transfer it to your bank account in a few minutes.

Credits loan or Mercado Pago loan: which one to choose?

After knowing more about the Mercado Pago loan, let's show you a little about the Creditas loan. Incidentally, both loans have advantages and disadvantages, it's a matter of understanding what works best for your reality. So, compare them and decide which option fits your pocket best.

| Credits | Mercado Pago | |

| Minimum Income | not informed | Not informed, but it is necessary to sell more than R$ 100 in the last two months in Mercado Pago or Livre |

| Interest rate | From 0.99% per month | Depends on each offer |

| Deadline to pay | Up to 240 months, depending on the modality | Up to 24 months, depending on the modality |

| Where to use the credit | Travel, start a business | Invest in your business |

| Benefits | Reduced rates; Three loan options; Long payment term. | Cash release on time; Process 100% online; Three loan options. |

How to apply for the Creditas loan

With the Creditas loan, you have three types of credit to choose the one that best fits your financial life. Check how to apply!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Proteste card, the prepaid one for you

Do you want to know how to apply for the Protest card? If so, read our text and find out how to apply. You will not regret!

Keep Reading

Ponto Frio Card Review 2021

Get to know our Ponto Frio card review and find out what this international credit product can do for your financial life!

Keep Reading

How to apply for the BV More card

With the BV Mais card, you have access to cashback and discounts with partners. In addition, it can be requested through the app or website. Learn more here!

Keep ReadingYou may also like

Millennium BCP Mortgage Credit: what is it?

Get to know the Millennium BCP Mortgage Credit in which you can finance up to 90% of the property, with low interest and up to 40 years to pay. Check out the benefits below.

Keep Reading

Find out how Cashback Ame Digital works

Did you know that with the Ame Digital cashback, part of the amount spent on your purchases comes back to you? That's right! To learn more about the subject, just continue reading.

Keep Reading

Inter Consigned Loan or C6 Consig: which is better?

In today's post we present two loan options, Inter payroll and C6 Consig. Both have their own specificities and advantages. Interested? Come check!

Keep Reading