Cards

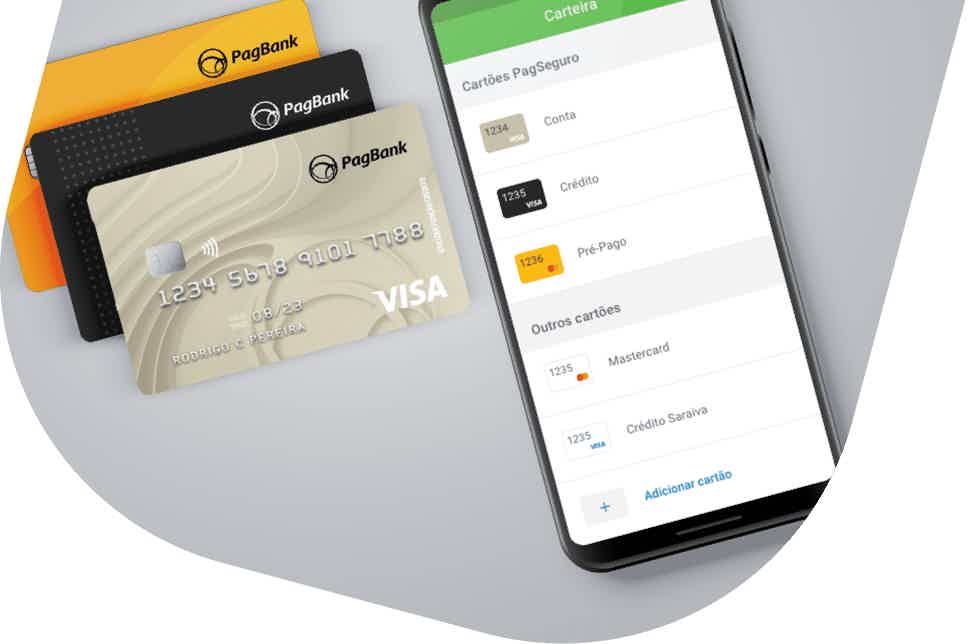

How to apply for PagBank card

Apply for your credit card with no annual fee and with a limit of 100% of your salary or up to R$ 100,000 if you have an application in the CDB. See now how to acquire your PagBank card and have your financial independence.

Advertisement

PagBank: apply for your credit card online

First, applying for the PagBank card is a great option for those starting out in financial life. Being a simple option for you to create your financial autonomy. That's because it is international with a Visa flag. That way, you can do your day-to-day shopping, as well as consume products and services abroad.

Also, do you want to know how to apply for your PagBank card? So, read on and check it out!

Order online

To apply online, just enter the official PagBank website and open an account. After that, you need to wait for the offer made available by the institution to apply. So, it is possible to speed up this process, if you port your salary to the account or make an investment in the CDB. After receiving the offer, just access the app and request the card.

Request via phone

If you prefer, you can also find out about PagBank products by phone at the numbers below, but the request process can only be done via the website or the app.

- 4003 1775 (capitals and metropolitan areas);

- 0800 882 1100 (other locations, except mobile).

Request by app

To purchase your PagBank card through the app, just download the PagBank app and open your account. Then, you must wait for the offer and go through the request process according to the step-by-step instructions given by the application itself.

Santander SX card or PagBank card: which one to choose?

Are you still in doubt if the PagBank card is right for you? So, check now the differences between PagBank and the Santander SX card. Also, compare them and choose the best option!

| Santander SX | PagBank | |

| Annuity | 12x of R$33.25 Exempt if you spend R$ 100 per month or if you join the PIX system | Exempt |

| minimum income | R$ 1,045.00 for non-account holders R$ 500.00 for account holders | not informed |

| Flag | Visa or Mastercard | Visa |

| Roof | International | International |

| Benefits | Benefits of the flag; Discounts with Esfera partners. | Vai de Visa Program; High credit limit. |

How to apply for the Santander SX card

Find out how to apply for your Santander SX card online and enjoy its advantages, such as discounts with partners, exclusive installments and much more!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the free courses Kultivi

See how the free Kultivi courses work and how you can use this platform to prepare for the main exams!

Keep Reading

How to open C6 MEI account

Open your C6 MEI account and enjoy exclusive benefits, such as exemption from the maintenance fee, as well as a credit card with no annual fee and much more!

Keep Reading

Blue Card Review Itaucard 2022

If you are looking for a card in partnership with an airline, in today's article we are going to review the Azul Itaucard card. Check out!

Keep ReadingYou may also like

Discover the Superdigital Loan

Superdigital loan can be an excellent choice for those who need fast and online personal credit. Check out more about him here!

Keep Reading

How to apply for the BB Ourocard Fácil card

Do you want a card with international coverage, which gives you the security and credibility of a consolidated bank? So, find out how to request the Ourocard Fácil.

Keep Reading

How to start investing in fixed income in 2021

If you are thinking about investing in fixed income, then you are in the right place. Here you will find out about the best investment options for 2021, in addition to a brief analysis of the economic scenario for the first half of the year. Check out!

Keep Reading