digital account

How to open an ABC Personal account

Learn the step-by-step process to open your ABC Personal account without leaving home. Thus, you will have the opportunity to make investments in fixed income funds without paying a fee. Follow the post and learn more!

Advertisement

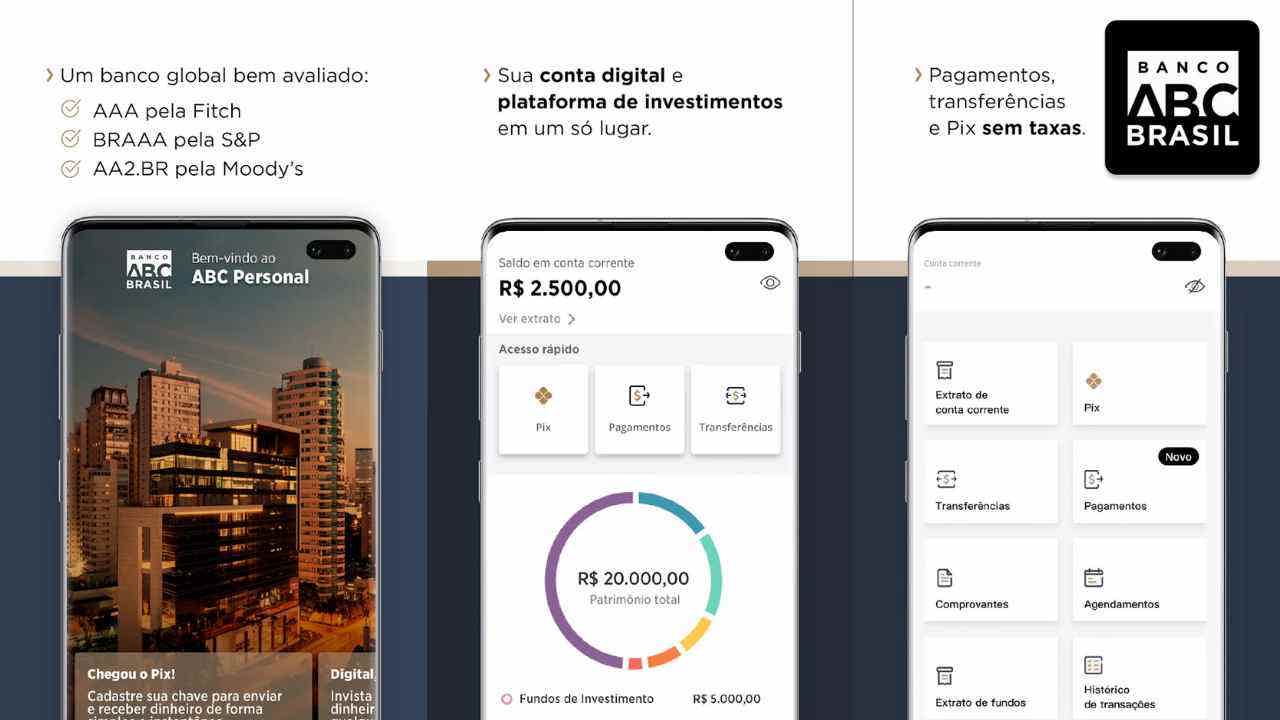

ABC Personal: free digital account that provides opportunities for investments

Learn how to have a free digital account that doesn't charge anything to help you invest in fixed income. So, the ABC Personal account is one of the only ones on the market that works 100% online. In addition, it also provides curatorship for investments.

So follow the post for more details. Let's go!

open account online

First, access the ABC Brasil bank website and locate the ABC Personal account. Then click on the “open your account” field, so you will be directed to a page with information about it. Also, enter your CPF in the right corner. Finally, finish filling out the form.

In conclusion, just wait for approval and start moving. Also, take the opportunity to make transfers, payments and deposits with your digital account.

Open account via phone

It is not possible to open the digital account by phone. However, ABC Brasil offers contact numbers for queries. To do so, you can call 011 3003 4222 or 0800 246 4222.

Open account via app

It is possible to open the account through the application, for this, download the app through the virtual store Google Play or Apple Store. After that, separate the documents to be scanned, as well as access the app and enter your personal data.

Also, validate the cell phone by SMS Token. Finally, take selfies and photos of the documents, to finalize the request. Of course, the process will not take long. If everything is ok, you can start your movements.

Santander Account or ABC Personal Account: which one to choose?

Although the ABC Personal account is interesting, how about getting to know another digital account option? The Santander account has many benefits, such as the possibility of waiving monthly fees, unlimited withdrawals and transfers, and a credit card with waived annual fees under certain conditions.

So, check out the comparison below and have another option to choose the best one.

| Account | Santander | ABC Personal |

| Minimum Income | not informed | not informed |

| Monthly cost | R$ 24.00 | Exempt |

| credit/debit card | Yes | No |

| Account Type | Digital | Digital |

| Benefits | Possibility of exemption from tuition; Unlimited withdrawals and transfers. | Zero maintenance and brokerage fee; Product curation. |

How to open Santander account

Enjoy the Santander account with unlimited transfers and withdrawals, as well as a credit card with no annual fee under conditions. Find out how to open yours here!

Trending Topics

How to apply for the Meu Tudo Consignado loan

Learn all about how to apply for the Meu Tudo Consignado loan and apply for this loan today with interest from 1.70% per month.

Keep Reading

Casas Bahia credit card: what is the store card?

The Casas Bahia card has a Visa flag and can be used in the chain of stores or elsewhere. Take the opportunity to know this card now!

Keep Reading

How to apply for Digi card

There are several ways to apply for the Digio card, it is completely digital, with zero annuity and no minimum income requirement. Look here.

Keep ReadingYou may also like

AliExpress Men's Clothing: purchase with up to 75% OFF

Transform your style with stylish and affordable men's clothing from AliExpress. Discover incredible discounts and renew your wardrobe today! Read until the end to find out how to buy at a discount!

Keep Reading

Is Banco Inter good?

In today's post we will talk about Banco Inter. Since 2014, he has offered a free digital account, attracting thousands of customers across Brazil. Interested? Continue reading and find out if Banco Inter is any good.

Keep Reading

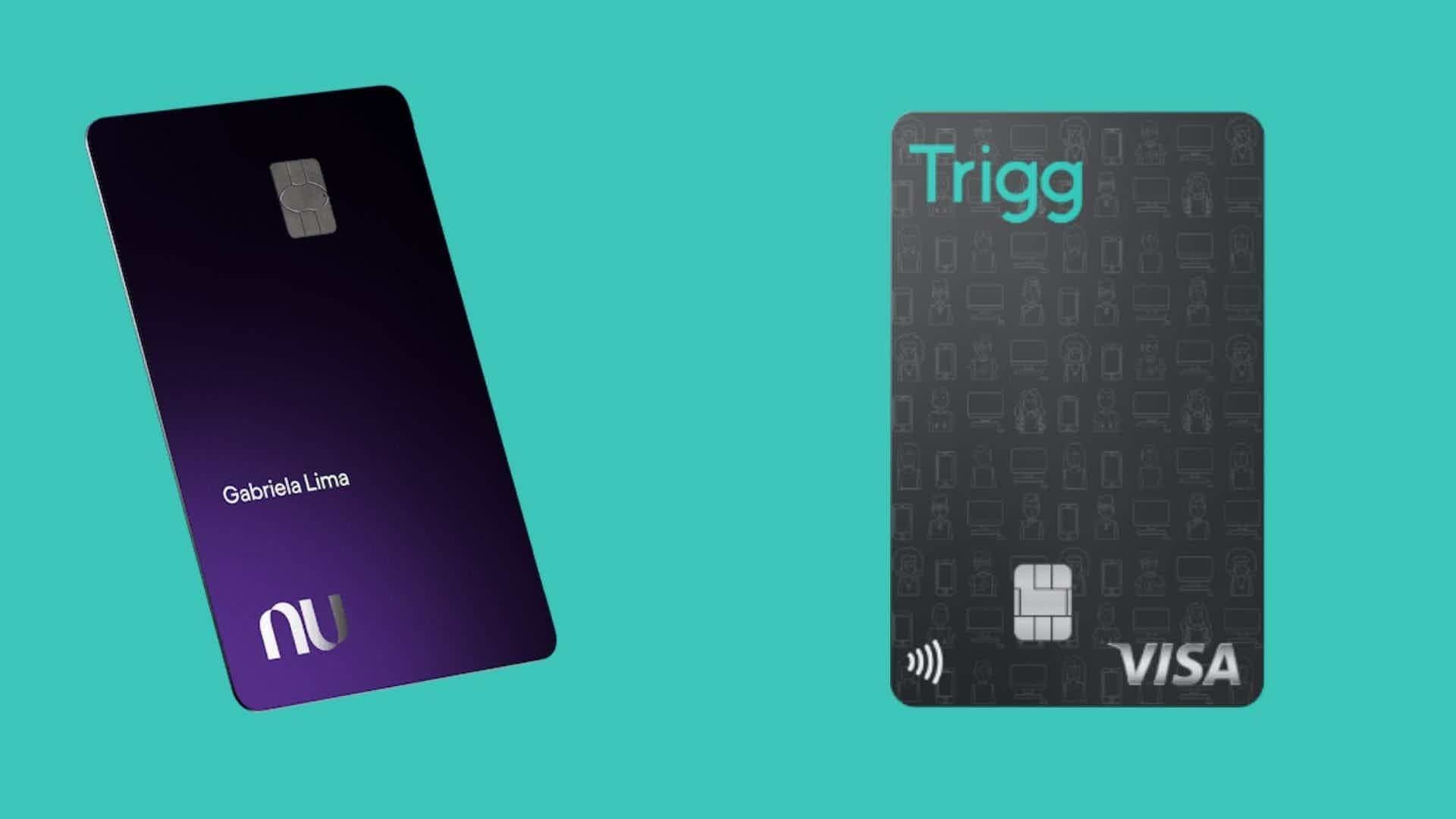

Trigg Card or Nubank Ultraviolet Card: which one to choose?

In addition to perks, many credit cards also offer style. The Trigg card or the Nubank Ultravioleta card may be the choice for those looking for these two things. Check out more about them here and choose yours!

Keep Reading