Cards

Omni credit card: how it works

Find out how the Omni credit card works and have access to exclusive conditions, such as a differentiated annuity, a period of up to 40 days to pay for your purchases and an application to control expenses. Check out!

Advertisement

Omni credit card: learn all about this financial product created for multiple profiles and with a differentiated annual fee

If you are looking for a differentiated credit card with an immediate credit limit, as well as insurance and 24-hour assistance, the Omni card can be a good alternative. Because, in addition to meeting all these requirements, it still has an easy request. So, read on to find out more!

| Annuity | R$ 150.00 |

| minimum income | not informed |

| Flag | Private Label and Visa |

| Roof | National |

| Benefits | Up to 40 days to pay for your purchases; Differentiated annuity; Insurance and 24 hour assistance. |

How to apply for Omni card

Find out how to apply for the Omni card with a differentiated annual fee and win R$500.00 every week on the Premium Invoice. Check out!

Omni Advantages

First of all, among the advantages of the Omni is the differentiated annuity, because you only pay the annuity when you use the card's services, that is, if you don't use it, you don't have to worry about this fee. In addition, you can count on insurance and 24-hour assistance.

In addition, your credit limit will be released immediately after payment of the bill, as well as you have a period of up to 40 days to pay for purchases, up to 6 due dates to choose from and you can also top up your cell phone directly at invoice card.

Among other advantages, you have the option of requesting up to three additional cards free of charge for dependents over 16 years of age, as well as participating in the Fatura Premiada with a prize of R$500.00 per week through the Federal Lottery, as long as the card invoice is up to date. .

Omni's main features

So Omni is an institution that issues personalized credit cards, whether Private Label or Visa.

This means that they are cards issued to establishments with the logo of the retailer with which Omni has a partnership and, through them, you can have access to several advantages, such as 24-hour assistance.

Furthermore, to obtain the Omni card, you will need to go to a company that offers the card, so call the Relationship Center at 4004 3500 (for capitals and metropolitan regions) or 0800 701 3500 (for other regions) and find the partner closer.

Who the card is for

This card is recommended for customers who make frequent purchases at Omni's partner retail stores. Just as it is ideal for anyone who wants to have a credit financial product to make their day-to-day life easier. Furthermore, if you are interested in this card and want to know more about it, then read the recommended content below and check it out!

Discover the Omni credit card

Get to know the Omni credit card and find out how it can help you with everyday purchases, as it offers up to 40 days to pay and exclusive insurance.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

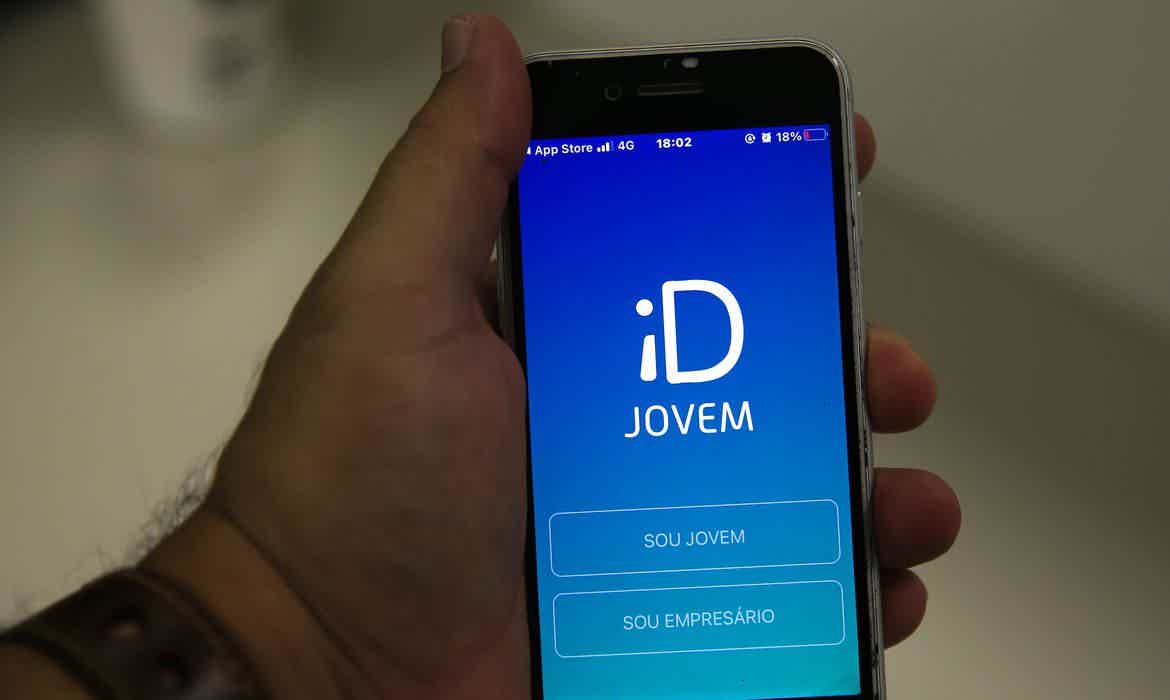

Meet ID Jovem

Find out how ID Jovem works, a Federal Government program for low-income youth between the ages of 15 and 29 registered at CadÚnico. Look!

Keep Reading

Is it worth opening an account at Banco C6?

Are you in doubt whether it is worth opening an account at Banco C6? In today's article we will show you all the details of this account. Check out!

Keep Reading

9 online loan companies for 2022

If you are looking for an online credit, this article is for you. We will show you 9 online loan companies. Check out!

Keep ReadingYou may also like

What are the best sites to earn money?

Use the internet to your advantage and check out our list of the best sites to earn money. So, you start the next year with a guaranteed income and learn a new way to enjoy the benefits of technology!

Keep Reading

Creditas Reforma loan or Bradesco Reforma loan: which is better?

Creditas Reforma or Bradesco Reforma? These two types of renovation loans stand out when it comes to security and practicality. But after all, which one to choose? Find out here.

Keep Reading

Loan via WhatsApp Banco Safra: what are the features and how to apply?

If you want more convenience when taking out the credit you need and have access to lower interest rates, then the loan via WhatsApp Banco Safra may be a great option for you. To find out more, just continue reading.

Keep Reading