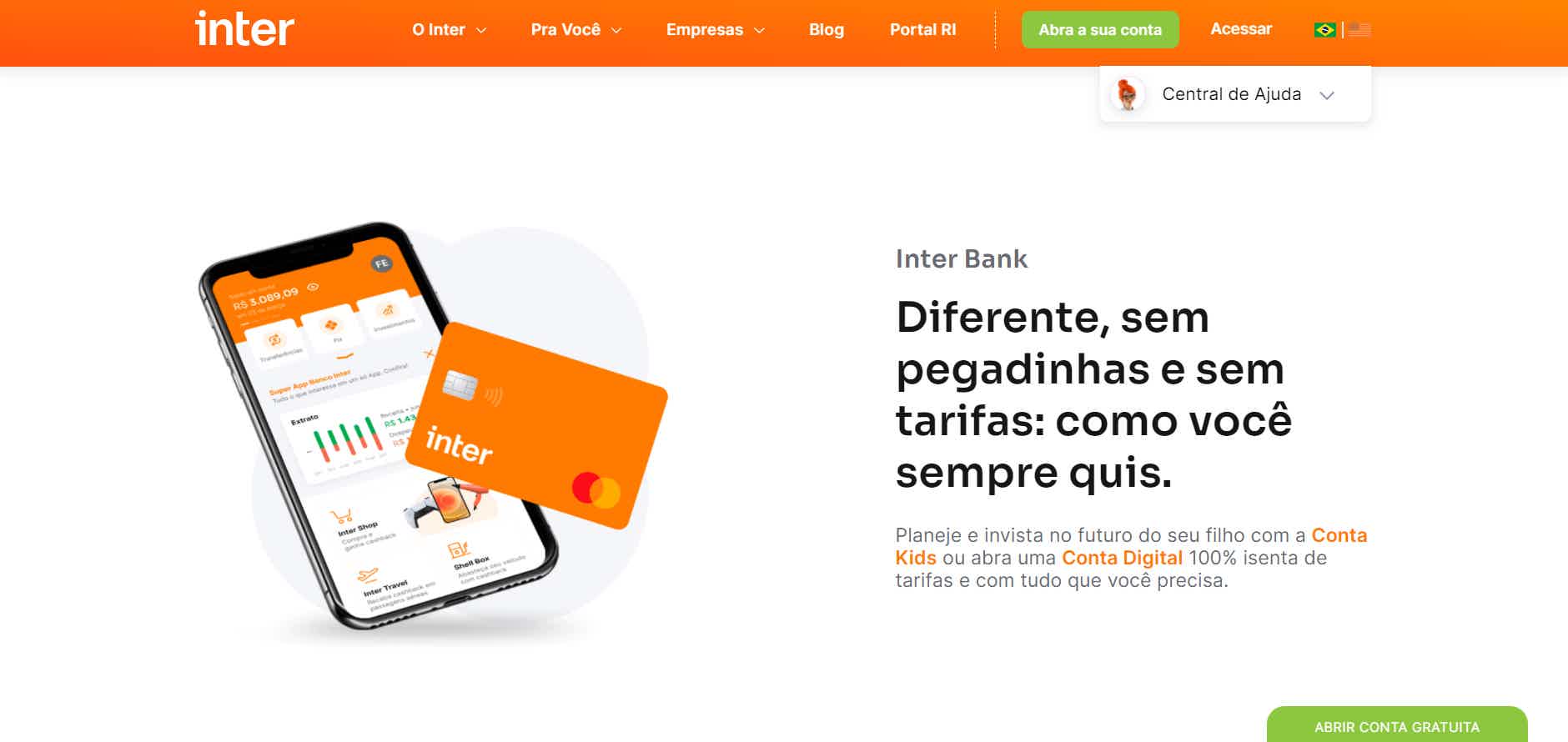

digital account

How to open inter account

Grab the chance to have a free account with free transfers and withdrawals. So, read this post and learn how to open your Inter digital account to enjoy all its advantages.

Advertisement

Inter Account: free account with immediate approval

The Inter account is free and approved immediately. Also, it does not charge for transfers, deposits or payments.

Undoubtedly, the digital account is ideal for those looking for a quick resolution. In addition, through credit analysis, you can obtain a card with a credit function.

Remember that both the debit and credit versions have an international flag and cashback. And you can even pay for Netflix, Spotify and other foreign apps.

Were you curious? So, learn how to open an Inter digital account without leaving home. Likewise, ensure immediate approval without bureaucracy. Let's go!

open online

First, go straight to the top right corner of the site and click on “open your account”. After that, fill in the form with your personal details as well as contact information.

Certainly, the bank will ask for authorization to access information. Then, accept the request and proceed with the procedure for opening the Inter digital account. In the same vein, do the rest of the process, however, through the application.

open via phone

Unfortunately, there is no way to open the account via phone. But you can contact the bank to solve your doubts through the numbers described below:

- 3003 4070 (Capitals and metropolitan areas);

- 0800 940 0007 (Other locations).

open by application

This is the main way to open the account. To do this, download the app from Google Play or the Apple Store. In the same line, enter personal data in the first request screen. After that, take pictures to prove your identity.

So, if you happen to want a credit card, separate proof of income to proceed with the order.

In addition, you will receive an approval notification. So, just unlock the account, without any deposit. Subsequently, the movements will be released.

That is, make transfers, payments and PIX, without any charge. Likewise, withdrawals are guaranteed on the Banco24Horas network or on Saque e Pague.

Digio account or Inter account: which one to choose?

Also, how about one more option to ensure the right choice? Other ideas help in the best choice. Therefore, see the comparison below with another similar digital account that can meet your day-to-day needs.

| digit account | Inter Account | |

| Minimum Income | not informed | not informed |

| Monthly cost | Exempt | Exempt |

| Debit/Credit Card | Yes | Yes |

| digital account type | Digital | Digital |

| Benefits | Free and unlimited transfers; Control 100% digital by app. | Immediate approval; Free transfers and withdrawals. |

How to apply for Digio account

Learn how to open a Digio account and have access to all the advantages, such as free and unlimited transfers and payments. Learn more here!

Trending Topics

How to apply for the Prepaid Banrisul Travel Card

We will show you how you can apply for the Banrisul Travel Card prepaid card and other tips on how this card works. Check out!

Keep Reading

How to apply for the Gamerscard

The Gamerscard card is a non-annuity option with many benefits for gamers. Learn how to order yours and enjoy the benefits!

Keep Reading

Find out how to apply for the BB Ouro card

Read this article and find out how to apply for a BB Ouro card step by step and completely online.

Keep ReadingYou may also like

Card Bradesco Visa University Card the what is the card Bradesco Visa University Card

The Bradesco Visa Universitário card is exclusively for customers with a university bank account. Do you want to know more about him? So, read on and check it out!

Keep Reading

How to apply for Unibanco Personal Credit

Find out how easy it is to apply for Unibanco Personal Credit and take out a loan that has low interest rates and allows up to 84 fixed installments. Check out!

Keep Reading

Meet the NuTap card machine

Are you looking for a card machine with reduced fees, no rent and no membership and maintenance fees? If so, take the opportunity to get to know, in the following post, the NuTap machine, which is 100% by cell phone and has what you need.

Keep Reading