loans

Agreement Right Platform or Good Loan for Credit: which is better?

You need to resolve financial issues and don't know where to start. How about discovering two interesting options? So, read our comparison about the Agreement Certo platform and the Bom Pra Crédito loan and see which one fits your situation.

Advertisement

Right Agreement x Good for Credit: find out which one to choose!

How about deciding between the Agreement Certo platform or Bom Pra Crédito loan? In short, both are released for negatives.

The first option is an ideal platform for trading. To clarify, just enter your CPF and check out several proposals for you to pay off your debts with partner companies.

On the other hand, the second option offers five types of loans through the website. In other words, just choose one of the options and run the simulation.

So let's compare the two options. Likewise, follow advantages, disadvantages and how to access the best solution for negative people.

How to apply for the Right Agreement

Find out how to apply for the Certo Agreement quickly, safely and effectively. And get deals with up to 99% off debt.

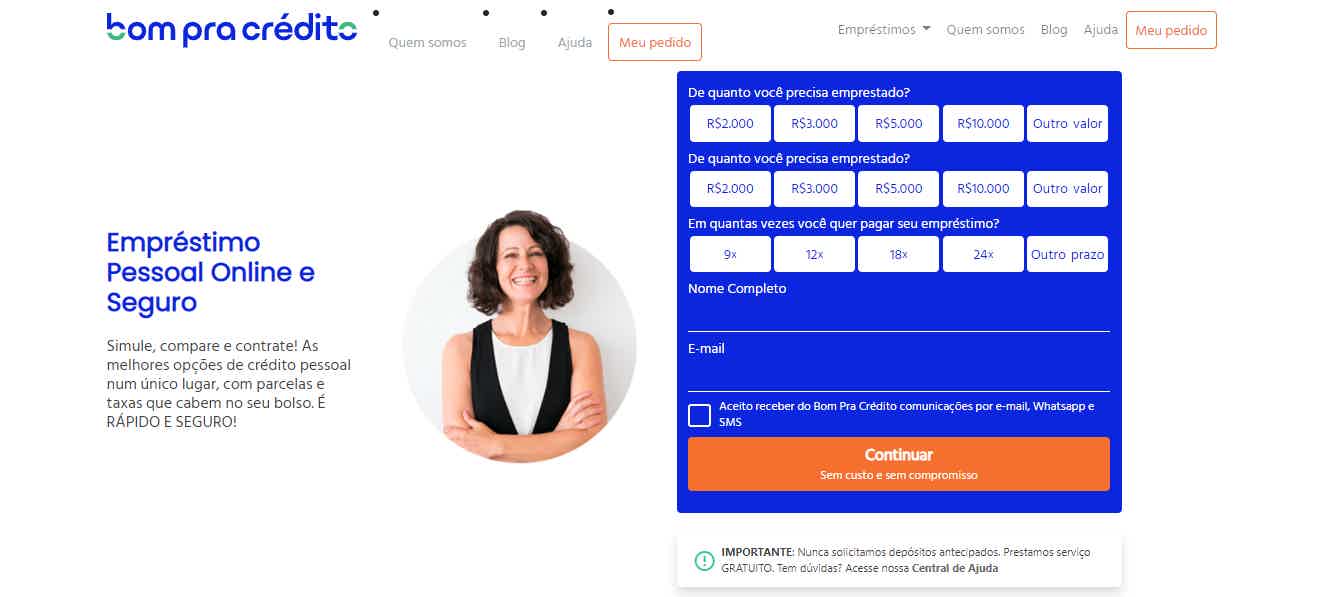

How to apply for a Good Credit Loan

The Bom Pra Crédito personal loan offers economic interest rates and installments that fit your pocket. See how to request yours!

| Right Agreement Platform | Good Loan for Credit | |

| Minimum Income | not informed | not informed |

| Interest rate | depends on the lender | From 0.75% per month |

| Deadline to pay | Varies according to debt | Up to 24 months |

| release period | Same day assessment | Up to 48 hours |

| loan amount | Amount of your renegotiated debt | Uninformed |

| Do you accept negatives? | Yes | Yes |

| Benefits | Opportunity to negotiate debts; Process 100% online. | Have 30 partners providing loans; 100% online simulation. |

Right Agreement Platform

How about negotiating your debts and also having a little push to do so? So, get to know the Agreement Certo platform.

Firstly, the Agreement Certo platform was recently acquired by Boa Vista. Therefore, it is a reliable online debt negotiation company.

Secondly, it is a safe platform that serves 63 million people who may be negative, for example. In other words, register to receive proposals.

To clarify, as soon as you enter the data, the available proposals will appear. As a result, decide the payment method and the installments to be paid.

Good Loan for Credit

This personal credit platform is ideal for those who want proposals to get out of the red. Since it has more than 30 partner companies, it offers offers in five minutes.

In fact, five types of loans are available, with personal credit being the most sought after. To clarify, just do the simulation on the platform's main page.

In this case, it is not even necessary to explain the reason for the loan. So, just request and wait for the analysis of the indicated partner.

With low rates, negative people can try this option and receive ideas within minutes. As a result, more than 8 million people have already requested money from Bom Pra Crédito.

In conclusion, the best offer is recommended by partners who carry out a less rigorous credit analysis, being ideal for those with a dirty name. Also, check out more details!

What are the advantages of the Certo Agreement Platform?

Through the Agreement Certo platform, it is possible to negotiate debts with more than 30 partner establishments. These partners, such as Vivo, Itaú, Santander, Bradesco and others, make the debts available for Agreement Certo. And you just need to enter your CPF to receive proposals in a few minutes.

Additionally, you can get up to 99% discount on your financial outstanding. It is also possible to obtain installments of up to R$ 100.00, that is, that fit in your pocket. Finally, wait ten days or less for your payment to go down and sleep easy.

What are the advantages of the Bom Pra Crédito Loan?

On the other hand, the Bom Pra Crédito platform has the advantage of having low interest rates. In other words, it is possible to obtain loan proposals with an interest rate starting at 0.75% per month.

Furthermore, even self-employed people or informal workers can obtain personal credit. This is because proof of income is not required and the entire process is done online.

What also draws attention is the short waiting period: it takes just two days to receive a response about your documents. The most important thing is that the money also drops in 48 hours, a quick deadline, right?

Finally, another advantage is that personal credit can be requested by anyone over 18 years of age. Unlike other large companies, the platform does not determine the audience for requests.

What are the disadvantages of the Certo Agreement Platform?

Although the advantages attract attention, we highlight that it is not possible to negotiate with so many companies. In other words, only proposals from platform partners are made available.

Furthermore, paid negotiation invoices may take time to be discharged. Especially when the ten business day deadline has passed, it's time to look for support!

Finally, those who are negative may not get good offers, or even negotiations. So, evaluate before registering!

What are the disadvantages of the Bom Pra Crédito Loan?

Since the website provides simulation, it is not fast. First, choose the value and number of installments. As a result, wait for analysis only when entering email and data. In other words, installment simulation is not immediate!

We also highlight that you cannot choose the due date of the installments. This is because it is the partners who decide and the platform has no control over this. In conclusion, know that there is also no way to pay installments other than with bank slips.

Correct Agreement Platform or Good Loan for Credit: which one to choose?

Was it difficult to choose between the Agreement Certo platform or the Bom Pra Crédito loan? It is certainly a difficult decision.

Just to give an example, the Agreement Certo platform is focused on debt negotiation. Most of the time, it offers installment proposals and does not focus on loans.

On the other hand, the second option is ideal for negative borrowers who have already decided on a loan and only need these proposals. In other words, you will not have debt negotiations through this.

This means that trying both is interesting. Mainly because your data is safe and you will have countless options to resolve your financial problem!

So, finally, check the number of restrictions on your CPF before deciding. After that, see what the priority is, whether it is a loan to pay off debt or negotiate pending issues you have.

Likewise, decide! Still, if you don't reach a verdict, don't worry. Below, another detailed comparison to find the best solution to get out of debt, so click!

Good Loan for Credit or Itaú loan

Are you in doubt whether you should choose the Bom Pra Crédito loan or the Itaú loan? See here the content we prepared to help you!

Trending Topics

Get out of debt with this complete step-by-step guide

Learn here the most complete step-by-step that will help you get out of debt even with little money. Check out!

Keep Reading

How to apply for a loan with a car guarantee from Bradesco

Find out how the request for a loan with a Bradesco car guarantee works and check out the documents necessary to carry out the process.

Keep Reading

How to subscribe to Believe Who Want? See the process

Find out in this post how to subscribe to Believe Who Wants and thus be able to tell your impressive story for all of Brazil to hear!

Keep ReadingYou may also like

SuperSim 2022 personal loan review

Are you in need of quick cash? Discover the loan option with the highest acceptance rate in the market through the SuperSim loan review.

Keep Reading

How to get Scholarship Assistance

Understanding how to obtain Scholarship aid is the best way to take advantage of all its benefits. To learn more about this benefit option, just continue reading the article!

Keep Reading

Citibank Ultima Infinite travel with more benefits and security in 2022

If you have a minimum income of US$ 350,000.00 and are always traveling, Citibank Ultima Infinite could be an excellent card for you. Read the post and understand more about this financial product!

Keep Reading