loans

How to apply for the Crefisa loan

Are you negative and need quick cash? In this case, the Crefisa loan can help you, as it offers credit with an interest rate from 1.5% per month with the money released in 24 business hours. So, find out here how to request it without having to leave the comfort of your home.

Advertisement

Crefisa: online request and release of money in 24 hours

The Crefisa loan is a good alternative for people who have a dirty name and need quick cash without having to leave their homes. In addition, with it you can get high loan amounts depending on the credit analysis. So, continue reading to find out how to get this loan step by step.

Order online

Now, let's see how you can apply for the Crefisa loan online. So, for that, you just need to enter the official website, locate the product, fill in the form with all your data and wait for the credit analysis. So, if approved, the amounts may be in the informed account within 24 working hours.

And, in addition, it is worth noting that you can only apply for this loan if you are a public servant, military, retired or pensioner from the INSS and are over 18 years old, as well as being negative.

Request via phone

In addition, it is also possible to apply for the loan via WhatsApp. For this, you need to access the website and fill in the form corresponding to the contact. In this way, you will be redirected to the Crefisa attendant and you will be able to complete the request process.

Request by app

Finally, you can also apply for the loan through the Crefisa app. To do so, just download it from Google Play or the App Store. Then make the request process according to the guidelines of the application itself.

Good Loan for Credit or Crefisa loan: which one to choose?

If after learning about the Crefisa loan, you still have doubts. But do not worry! Because there are other credits available in the market. In addition, among them we can highlight the loan Bom Pra Crédito. Do you want to know more about him? So, check out the comparison table below.

| Good for Credit | Crefisa | |

| Minimum Income | not informed | not informed |

| Interest rate | From 1,59% per month | From 1.5% per month |

| Deadline to pay | Up to 36 months | Up to 12 months |

| Where to use the credit | start a business settle a debt Paying down payment on a house | start a business settle a debt enter a house |

| Benefits | Security Credibility Transparency 100% online | Security Credibility Transparency 100% online |

How to apply for a Good Credit Loan

Are you in doubt about how to apply for the Bom Pra Crédito personal loan? So, see how to apply for your credit in a simple and practical way.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

4 apps for pregnant women you should know about in 2023

3D images of the baby, gestational timeline and list of doubts are just a few functions of apps for pregnant women. Check more here!

Keep Reading

How to advance FGTS through PagBank?

Check out in this post how you can anticipate FGTS through PagBank and receive up to 7 installments of your birthday withdrawal at once!

Keep Reading

All about the OpaPay Mastercard credit card, one of the best for bad debts

Are you negative and can't get a credit card? If yes, then stay tuned, because with OpaPay Mastercard this situation no longer happens.

Keep ReadingYou may also like

7 quick personal credit options

Fast personal credit frees you up to €75,000 with extended repayments and special conditions. See the best options to get your loan in less than 48 hours.

Keep Reading

What is the Hipercard Internacional card?

The Hipercard card is a product that requires a low minimum income and gives you several discounts on purchases at supermarkets and partners. Know more!

Keep Reading

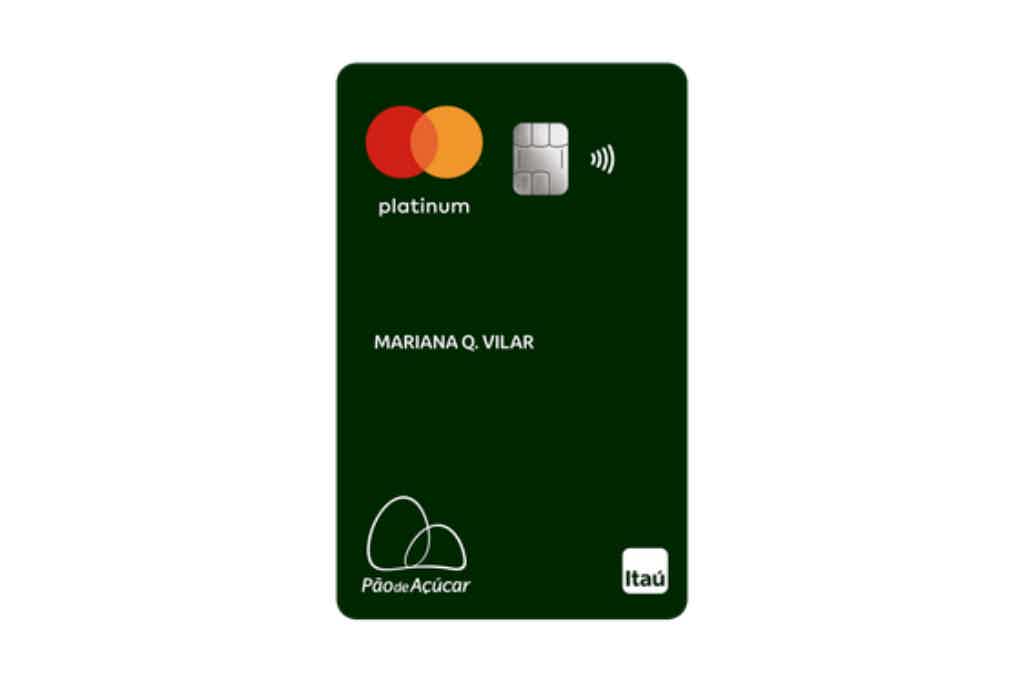

Pão de Açúcar Platinum Card: how to apply?

Do you want to apply for a credit card with many benefits? Here you will find the complete guide on how to order the Pão de Açúcar Platinum card today. Check more information below.

Keep Reading