loans

How to apply for a cash loan

Learn how to apply for the Caixa loan. This process is quick and can be done at any Caixa branch. Thus, you have the money in the account more quickly and with attractive interest.

Advertisement

Caixa: application process without bureaucracy

First, let's learn how to apply for a Caixa loan that can be in your account in a few working days, without any bureaucracy and with all the security you need when applying for a loan. So keep reading to learn the process step by step. So let's go!

Order online

Now, let's see how you can apply for a Caixa loan online. So, unfortunately, although Caixa makes several virtual service channels available, it is currently not possible to request them. But you can apply for the loan by going to one of the Caixa agencies.

And, in addition, you need to bring your personal documents, such as CPF, RG, proof of residence, proof of income, among others that the institution requests. Then, you must wait for the credit analysis. Then, in case of approval, the money is released into your account within a few days.

Request via phone

Furthermore, it is not possible to apply for the loan by phone. But you can get in touch with Caixa to ask questions by number: 0800 726 0101.

Request by app

So, the loan request is made directly at the Caixa branch, so it is not possible to apply through the application.

Lendico loan or Caixa loan: which one to choose?

So, if you've come this far and found that the Caixa loan does not meet your needs at the moment. But do not worry! Because we have other similar financial products to introduce you to. Given this, how about getting to know the Lendico loan? In addition, it also offers excellent credit terms to customers. So, see the comparison table below and compare them:

| legendary | Box | |

| Minimum Income | Minimum wage | not informed |

| Interest rate | From 1,99% per month | not informed |

| Deadline to pay | From 12 to 36 months | Up to 48 months |

| Where to use the credit | pay debts | pay debts |

| Benefits | Credibility Security attractive interest | Credibility Security attractive interest |

How to apply for the Lendico loan

Do you want to learn how to apply for the Lendico loan? It has interest rates starting at 1,99% per month, personalized service and several other unique conditions.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the app for pregnant My Pre-Natal

Follow the stages of pregnancy and calculate the gestation period with the Meu Pré-Natal application. Discover more functions of the app here!

Keep Reading

Bxblue payroll loan: how it works

INSS beneficiaries and public servants who are negative or cannot take advantage of the Bxblue payroll loan. Find out how it works here.

Keep Reading

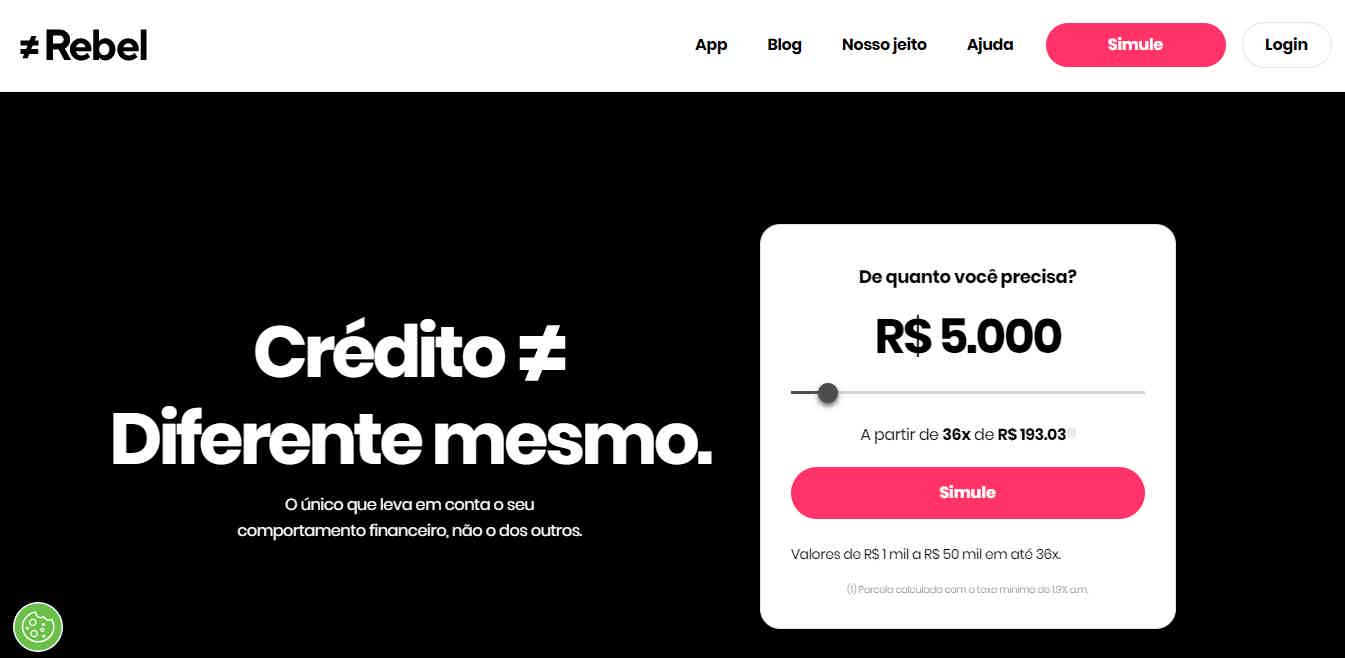

Discover the Rebel loan

See in this post how Rebel's personal loan works, what are its advantages and how you can apply without leaving home.

Keep ReadingYou may also like

Discover the Santander Mundo 123 current account

With the Santander Mundo current account, you have more facilities in your life, after all, you don't pay commission on transfers, you have access to debit cards for the family and you also invest without paying fees. Find out, in the post below, how this service works.

Keep Reading

Caixa Real Estate Credit what is it?

Do you want to fulfill the dream of owning your own home and live more comfortably in your home? Then learn about the advantages of financing Caixa real estate.

Keep Reading

Santander SX Universitário Card or Pan Card: which one to choose?

Santander SX Universitário card or Pan card? Which of these financial products is the best? Read our post right now and find out that answer.

Keep Reading