Cards

How to apply for an Inter Limite Invested card

See how to apply for the Inter Limite Investido card without any bureaucracy in the comfort of your home. Through it, amounts from R$100 can be converted into a credit limit for negative people.

Advertisement

Inter Limite Invested: 100% request online

The Inter Limite Investido card is a very relevant option for people who cannot get immediate approval for the Inter bank financial product. In addition, with it you can create a financial reserve with low values, without having to leave the comfort of your home, that is, doing everything through the bank's website. So, read on to find out how to get this card step by step.

Order online

The first step to apply for the card is to open a digital bank account. To do this, simply access the website or app and place your order. After this process, you receive the debit card from the account at your home.

Next, there are two ways to apply for a credit card with Invested Limit, either through the cards area or Inter Invest.

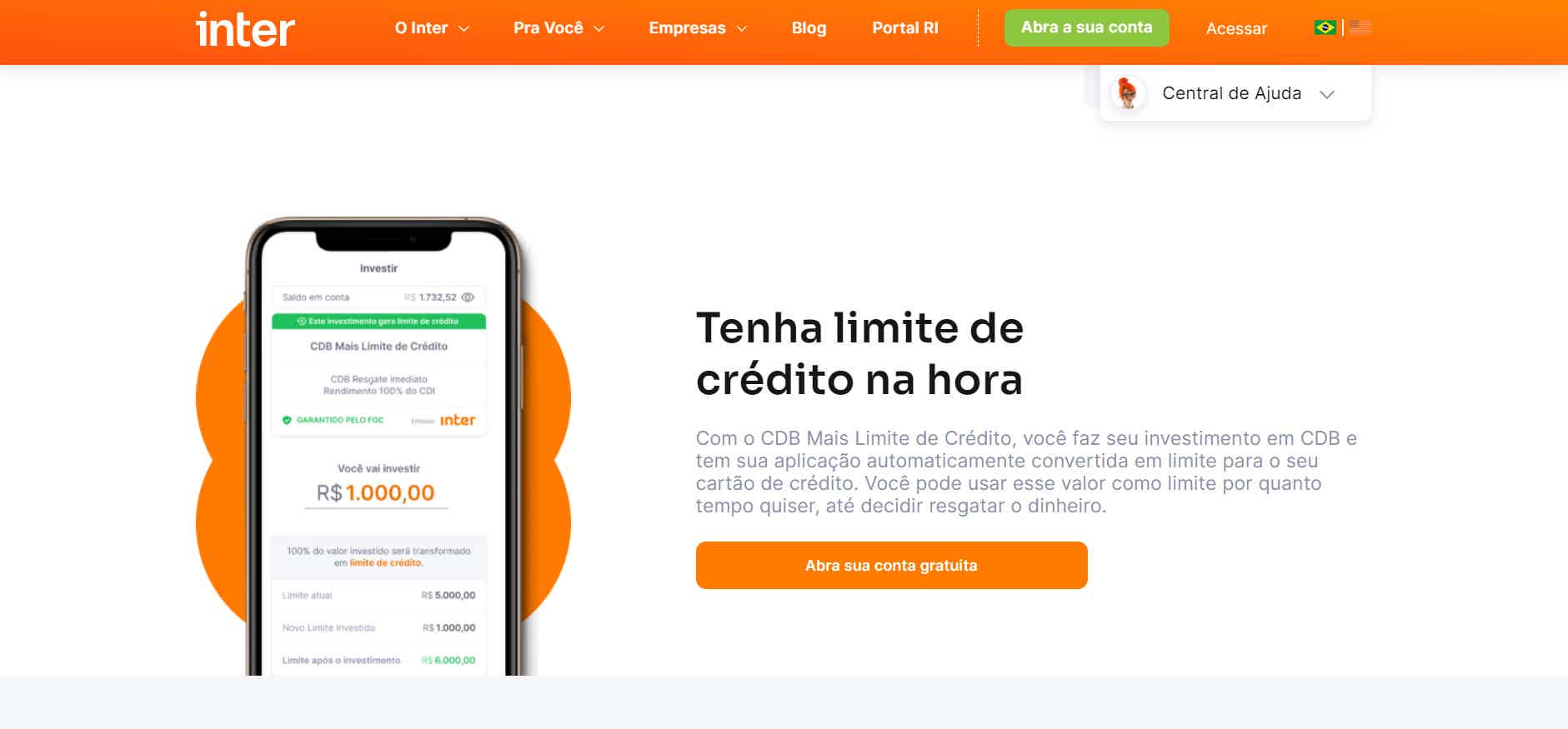

Then, through the cards area, you must access it and click on “See credit options”. Then click on “Invest”. After that, fill in the amounts you want to apply and click on “Invest” again. Ah, the minimum value is R$100.

On the other hand, you can also apply through Inter Invest. So, click on “Investments”. Then click on “Invest” and then on “Fixed Income”. Then, look for the option “CDB Plus Credit Limit” fill in the invested amounts and click on “Invest”.

After this process, the credit function is enabled on your card. Therefore, the online process is very simple, just follow the step by step.

Request via phone

Also, unfortunately, it is not possible to apply for the card over the phone. But you can contact the Inter bank to ask questions through the numbers:

- 3003 4070 (capitals and metropolitan areas);

- 0800 940 0007 (other locations).

Request by app

You can also apply for the Inter Limite Investido card through the app. To do this, just download it from Google Play or the App Store and open your account. Then follow the same steps described above.

Inter Payroll Card or Inter Limite Invested Card: which one to choose?

First, if you got this far and found that the Inter Limite Investido card does not meet your needs at the moment. Rest assured! Because we have other similar financial products to introduce you to. In the face of this, how about getting to know the Inter Consigned card? In addition, it also offers excellent credit terms to customers. So, see the comparison table below and compare them:

| Inter Payroll Card | Invested Inter Limit Card | |

| Minimum Income | Minimum wage | not informed |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Cashback accept negatives flag benefits | Cashback accept negatives flag benefits |

How to apply for the Inter payroll card

Discover the Inter payroll card, with no annual fee and great benefits. And you can easily order online or over the phone! Look here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the PagBank loan

With the PagBank loan, you can have credit from R$300 with rates starting from 2,99% per month. Read this post and learn more!

Keep Reading

Pan Mastercard Platinum Card Review 2021

See the Pan Mastercard Platinum card review that we brought with all the data about this international card with cashback and benefits.

Keep Reading

Atacadão Mastercard International Card Review 2021

Check out the Atacadão Mastercard Internacional card review and see how to use it on purchases to get discounts and special installment conditions.

Keep ReadingYou may also like

How to apply for an Americanas card

You can apply for the Americanas card via the website or the app and also take advantage of the Mais Sorrisos points program, cashback and national coverage with the Mastercard brand. Want to know how? So, check out the post below.

Keep Reading

What are the values of the Bradesco health plan?

Find here all the necessary information about the Bradesco health plan to hire it for you, your family or your company.

Keep Reading

Get to know the Itaú Click credit card

Want zero annuity? So, get to know the Itaú Click credit card, under the Visa or Mastercard Internacional flags and with exclusive rewards programs.

Keep Reading