Cards

Card Review Casas Bahia 2021

If you already frequent Casas Bahia, you will like the Casas Bahia card review that we brought you. This way, you will be able to decide whether or not to apply for this financial product that, in partnership with Banco Bradesco, has come to simplify your life.

Advertisement

Know everything about this financial product

So, the Casas Bahia card is a financial product created by Bradesco bank in partnership with Casas Bahia, and it was created to simplify the lives of customers who frequently shop at the chain's stores. So, check out the Casas Bahia card review and find out if it's the ideal card for you. Let's go!

| Annuity | R$ 189.12 |

| minimum income | Minimum wage |

| Flag | Visa |

| Roof | International |

| Benefits | Exclusive discounts and offers on the network website 50% off at Cinemark Installment payments for selected products in up to 30 interest-free installments |

How to apply for the Casas Bahia card

The Casas Bahia card offers you discounts, offers and exclusive installments in stores and on the website. Want to know how to apply for it? Then read this post.

Casas Bahia card review: everything you need to know

Now, it's time to check out the Casas Bahia card review. Let's go!

annuity and coverage

So, to ensure that you have a different experience when shopping using the Casas Bahia card, this financial product charges an annual fee of R$$189.12.

On the other hand, the card's coverage is international, so you can use it both in Brazil and abroad in physical and online establishments accredited to the brand.

rates to rates

As we mentioned, the Casas Bahia card charges an annual fee of R$189.12.

Furthermore, it also requires proof of a minimum income of one minimum wage, that is, without being able to prove your income, you cannot apply for this card.

In addition, there is a charge for withdrawals both in national and international territory, being R$ 12.00 and R$ 16.00, respectively. The emergency credit assessment also has a cost. In this case, R$ 18.90 is charged. The interest rate for revolving credit is 15.90% per month.

flag and benefits

Still in the Casas Bahia card review, we will talk about the brand and its benefits. So, you have a financial product with the Visa brand.

This way, you have access to the Vai de Visa Program with discounts and differentiated installments on products and services.

In addition, with the Visa brand you also have some additional benefits, such as Original Extended Warranty Insurance, Price Protection Insurance and Purchase Protection Insurance.

So, in relation to the flag, you will be very well served by the Casas Bahia card.

Advantages of the Casas Bahia card

Still on the advantages of having the Casas Bahia card, you also have access to discounts, installments and exclusive offers both in stores and on the brand's website.

And, in addition, you can pay for your purchases of selected products in up to 30 interest-free installments using the Casas Bahia card.

In addition, you also have three protection insurance options to choose from on your card. As well as a 50% discount at Cinemark.

And, you also have access to the Casas Bahia app where you can make purchases and manage everything that happens with your credit card.

Therefore, this card has several advantages if you already regularly shop at Casas Bahia stores.

Discover the Casas Bahia credit card

Have you heard of the Casas Bahia credit card? With it, you can pay for selected products in up to 30 interest-free installments. Check it out!

Disadvantages of the Casas Bahia card

Unfortunately, the Casas Bahia card also has some negative points, for example, the annual fee and the minimum income requirement, which are two criteria analyzed in the credit analysis carried out by the network.

And, in addition, most discounts and installments can only be used within the chain itself, meaning that if you are not a regular customer, it is not the best option.

card application

Still in the Casas Bahia card review, we will talk about the card's application. So, through the application you can request the card, have access to the network's products with differentiated prices, as well as being able to control your financial product.

application process

So, to apply for the Casas Bahia card, you must access the card's website or app. By the way, if you have already decided on this financial product and want to apply for it, click on the recommended content below to see the step-by-step guide to applying for your card and taking advantage of the benefits offered by the brand and Bradescard.

How to apply for the Casas Bahia card

The Casas Bahia card offers you discounts, offers and exclusive installments in stores and on the website. Want to know how to apply for it? Then read this post.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

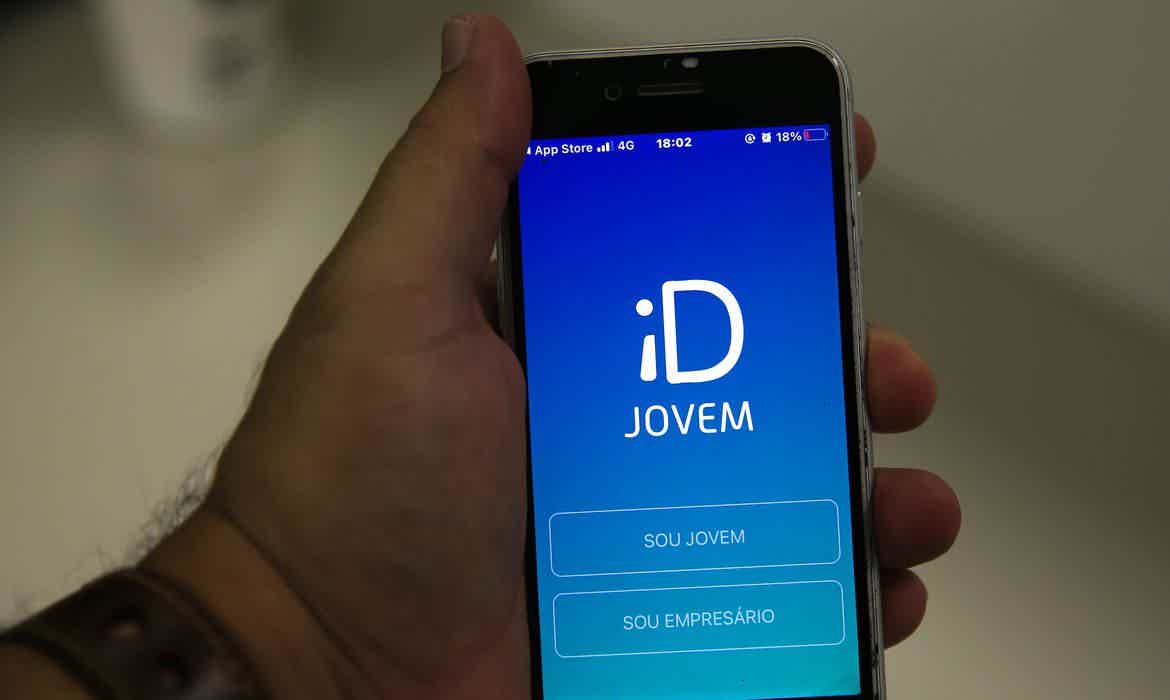

Meet ID Jovem

Find out how ID Jovem works, a Federal Government program for low-income youth between the ages of 15 and 29 registered at CadÚnico. Look!

Keep Reading

How to apply for the Porto Seguro real estate consortium

Hire the Porto Seguro real estate consortium and acquire your property in up to 200 flexible, interest-free installments. Make your own home dream come true!

Keep Reading

Americanas Card or Zencard Card: which is better?

Don't know which one to choose between the Americanas card or the Zencard card? Let's help you! Check this post and find out which of the two is the best!

Keep ReadingYou may also like

How to Apply for a Standard Mastercard

The Standard Mastercard card is ideal for anyone looking for a first credit card. So, see how to make your own and enjoy the benefits of Mastercard Surprise. Find out how to get your first card right now!

Keep Reading

Federal government studies to end unemployment insurance

Seeking alternatives to minimize the impact of benefit payments to public coffers, the Federal Government may end unemployment insurance. See more below!

Keep Reading

What is real estate credit with savings interest?

Financing a home is not always easy. This is because there are several types available in the market. One of them is real estate credit linked to savings, in which interest rates vary. Want to know more? Check it out in this post.

Keep Reading